Lemon_tm

Introduction

Wheaton Precious Metals Corporation (NYSE:WPM) is a long-time favorite of mine, so be warned I am a tad bias towards it. In September 2009, we paid the princely sum of $28.80 which I thought was fair value at the time.

Today, we will have a quick look at WPM’s position in this sector of the market along with the highlights of their recently published Q2 Financial Results.

Fundamentals

Formerly known as Silver Wheaton Corp when it focused solely on streaming silver, however time moves on, and they have added gold to their portfolio of the ‘streaming’ activities and have grown to become one of the biggest companies in this sector, second to Franco-Nevada Corp (FNV).

Wheaton derives its income from streaming contracts for 19 operating mines, with an additional 13 projects in the development stage.

Financials

We start with a quote from the President and Chief Executive Officer, Randy Smallwood: “Despite operations at Peñasquito being suspended in early June, we achieved quarter-over-quarter gold equivalent production growth. As such, we are reiterating our 2023 production guidance, which we now expect to have a slightly higher weighting toward gold, highlighting the resilience of our high-quality, diversified portfolio.“

Now to the Q2 results and news that will please stockholders is that the third quarterly cash dividend for 2023 of US$0.15 will be paid to holders of record of Wheaton common shares as of the close of business on August 25, 2023.

Revenue of $265 million, operating cash flow of $202 million, net earnings of $141 million and $143 million in adjusted net earnings. The cash balance stands at $829 million and no debt as at June 30, 2023. This amount of cash puts Wheaton in an extraordinary position when negotiating new deals. They have the financial clout that others can only dream about. Wheaton also has a revolving credit facility of $2 billion should it be needed for acquisition purposes.

This company has a market capitalization of $20.04B, an EPS of $1.16 and a P/E ratio of 38.11. The average volume of shares traded on a daily basis is 2,777,766, so the liquidity is good for those who wish to enter and exit this stock on a frequent basis. The 52-week trading range has been from a low of $28.62 to a high of $52.76, so oscillations in both directions should be expected.

The attraction for me is that they have fixed price agreements for the delivery of gold and silver and as I am expecting both of these metals to rally so higher prices of the metals will boost turnover, increase profits, dividends, and capital value.

The price of gold has a myriad of influences. The two major ones are the US Dollar and the S&P 500. Given that inflation has raised its ugly head, the central bankers have reacted by implementing a series of interest rate hikes which have been supportive of the US dollar and other currencies. However, this practice looks to come to an end as inflation flattens out. Gold has an inverse relationship with the US dollar and so when the dollar turns and heads south gold will rally to much higher price levels. Now, given that the streaming business model has fixed the price for the supply of both and silver, as their prices rise, the profitability of Wheaton should increase significantly.

The S&P 500 also presents a headwind as it rallied over the past year from a low of around 3,600 to today’s level of 4,459.38. This move could be viewed as the unfolding of a major rally and attract investors’ capital away from the precious metals sector. Both need to be observed closely through the second half of 2023 and throughout 2024.

A Quick Look At The Chart Of Wheaton Precious Metals

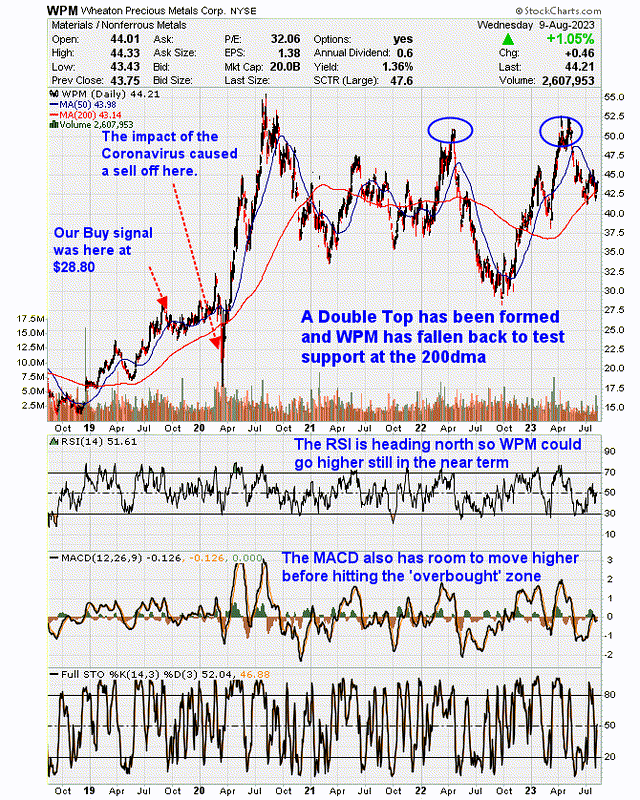

As we can see from the chart below, it has been a volatile few years for Wheaton as gold and silver, their underlying commodity, has also been experiencing turbulent times.

Chart of Wheaton Precious Metals Corp (Stock Charts)

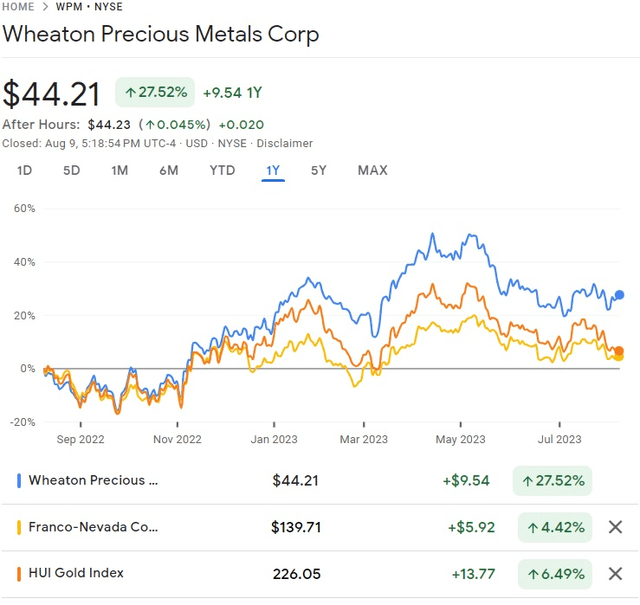

A quick look at the Chart Of Wheaton Precious Metals compared with Franco-Nevada Corp. and the Gold Bugs Index (HUI).

Comparison of WPM, FNV and the HUI (Google Finance)

We can glean from the chart above that over the last year Wheaton Precious Metals has outperformed Franco-Nevada Corp and the Gold Bugs Index which bodes well for the future of this company

Conclusion

As a Gold Bug at heart, I am totally focused on this tiny sector of the market, a sector where the streaming companies should do very well and Wheaton is one of the best to invest in.

The streamers in this sector will offer many opportunities to trade in and out of them but only if you are nimble and devote a fair amount of time to trading.

Otherwise, buy and hold and prepare yourself for a white-knuckle ride as we have a bumpy few years ahead of us.

For the record, I have been long physical gold and silver for a number of years and also own a portfolio of stocks in the precious metals sector including Sandstorm Gold Ltd (SAND), Wheaton Precious Metals Corp, Agnico Eagle Mines Limited (AEM) and SSR Mining Inc (SSRM).

You must have a comment, so please add it to the commentary and I will do my best to address each and every one of them as the discussion is such a benefit for all concerned in these endeavors.