chameleonseye

Final week’s jobs report confirmed that the U.S. financial system could possibly keep away from a recession altogether in 2023. PayPal (NASDAQ:PYPL) could possibly be one firm that advantages from a robust labor market in addition to resilient shopper spending. Moreover, PayPal has potential to extend its inventory buybacks, which might make sense for the reason that fintech’s share commerce for at a really low P/E ratio. Lastly, I see upside potential for PayPal because the fintech retains reducing bills and restructures its value base and thereby improves its working margin. For these causes, I see PayPal as a severe rebound candidate!

I imagine there are three the explanation why buyers might wish to think about PayPal at this level of time.

1. The US financial system is in a lot better form than buyers suppose

ADP’s Nationwide Employment Report from final week has proven that the U.S. financial system is in a lot better form than buyers have thought: personal employers have generated roughly half 1,000,000 new jobs in June, which was greater than twice nearly as good because the estimate of 220 thousand jobs that the market anticipated.

Employees, in response to the ADP Nationwide Employment Report additionally obtained a 6.4% year-over-year pay enhance, suggesting that shopper spending within the second-quarter stayed resilient. I imagine these favorable developments in job creation, wage development and shopper spending will in the end profit spending-focused fintech corporations like PayPal that take a lower from every on-line transaction.

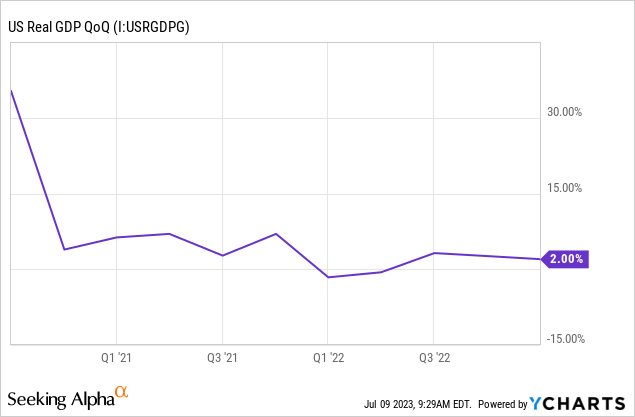

The U.S. financial system retains rising which needs to be a optimistic for shopper spending as effectively: within the first-quarter, U.S. GDP grew 2%, effectively above the estimate of 1.3%. If the U.S. retains including new jobs, the financial system may be capable to keep away from a recession altogether.

2. Working revenue enhancements

PayPal is underneath strain to scale back bills and the corporate has already had some successes in making this occur as a result of effectivity initiatives in addition to job cuts: PayPal introduced a serious discount in its headcount within the first-quarter as the corporate stated that it’s going to lay off 2,000 staff which was roughly 7% of its workforce.

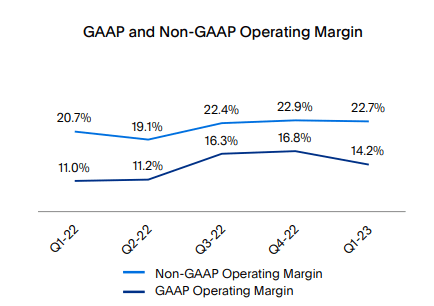

Within the first-quarter, PayPal reported a non-GAAP working margin of twenty-two.7%, which was up 2 PP yr over yr as the corporate has pushed for value cuts. In response to PayPal’s outlook, the fintech seeks to develop its working revenue margin, non-GAAP, by greater than 100 foundation factors in FY 2023, whereas it beforehand anticipated a 125 foundation level enhance.

Supply: PayPal

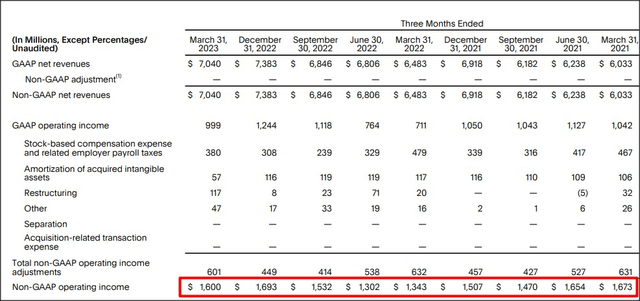

The overall trajectory of PayPal’s working revenue, nevertheless, is optimistic and has basically improved within the final yr as effectively. Within the first-quarter, PayPal’s working revenue was $1,600M, displaying 19% yr over yr development. Within the final 9 quarters, the fintech achieved common quarterly working revenue, non-GAAP, of $1.53B.

Supply: PayPal

3. Free money stream and buyback potential

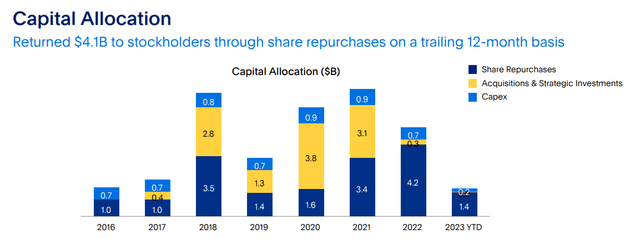

On a trailing 12-month foundation, ending with the first-quarter of 2023, PayPal generated $5.1B in free money stream which calculates to a quarterly common of roughly$1.27B. I imagine PayPal’s free money stream is in the end the explanation why buyers would wish to purchase PayPal’s shares: PayPal invested $9B of its free money stream since FY 2021 into inventory buybacks.

Supply: PayPal

Because the cost platform permits PayPal to generate constantly excessive ranges of free money stream, I imagine PayPal continues to have lots of potential so as to add to its buyback program: PayPal presently expects to spend $4.0B of its anticipated $5.0B in free money stream in FY 2023 on buybacks which calculates to an 80% free money stream return ratio.

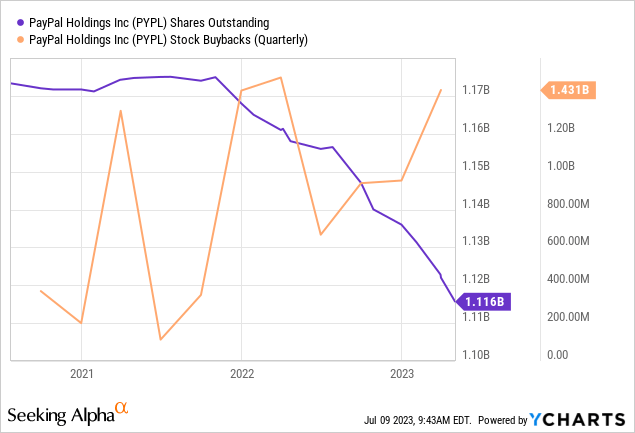

PayPal has comparatively low capital expenditures which implies it could use its free money stream freely and will enhance its buyback to $5B yearly. Within the final three years, PayPal diminished the variety of its excellent shares by roughly 5%.

PayPal has a massively discounted valuation

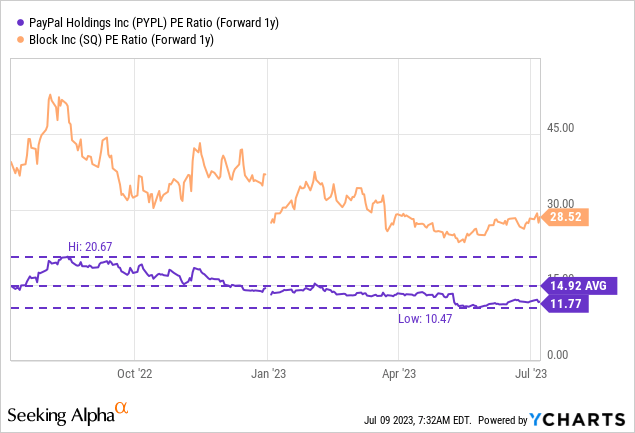

With $5B in free money stream anticipated in FY 2023 and a market capitalization of roughly $74B, shares of PayPal are valued at 14.8X FY 2023 FCF. The fintech can also be valued at a P/E ratio (FY 2024) of 11.8X which is roughly 21% beneath its 1-year common P/E ratio.

Block (SQ), a fintech competitor which owns the favored Money App, is buying and selling at a a lot larger P/E ratio than PayPal, but additionally has stronger development potential as a result of firm’s Money App momentum. Whereas I favor PayPal over Block from a valuation perspective, I additionally imagine that Block, regardless of its a lot larger valuation relative to PayPal, has a robust alternative for development within the worldwide market in addition to in its core product, the Money App.

Dangers with PayPal

The most important threat for PayPal is a possible slowdown in internet new energetic account development which has slowed to simply 1% within the first-quarter. A decline in PayPal’s whole account measurement would seemingly additional issues a few contracting enterprise. What would change my thoughts about PayPal is that if the corporate noticed a cloth decline in its free money stream as this may instantly affect the corporate’s buyback potential.

Closing ideas

The most important benefit of PayPal proper now could be that the corporate is extraordinarily lowly valued primarily based on P/E whereas producing constantly a ton of free money stream. PayPal additionally adequate free money stream to repurchase at the least a billion {dollars}’ value of its personal shares every quarter, so I undoubtedly see a pathway for the fintech to speed up its inventory buybacks. Moreover, the employment report means that the U.S. financial system in addition to the labor market are in nice form which may enhance PayPal’s development as a cyclical fintech. If the U.S. financial system avoids a recession, I’d count on analysts to improve PayPal’s earnings estimates which then would end in a decrease P/E ratio. Working revenue enhancements are additionally sensible as the corporate has launched into a sequence of cost-cutting efforts that are supposed to enhance profitability.