tum3123

Rising markets have been adopting new applied sciences, which clear up present challenges, increase productiveness and mirror altering consumption patterns. Study extra from Franklin Templeton Rising Markets Fairness.

Three issues we’re excited about right this moment

1. Broadening market breadth. Through the first half of 2023, 72% of the beneficial properties and 6 out of the ten largest contributors to the beneficial properties within the MSCI Rising Markets Index had been technology-related.1

It is a development repeated in world fairness indexes, as 53% of the beneficial properties and 9 of the ten largest contributors to beneficial properties within the MSCI All Nation World Index got here from technology-related firms.2

Looking forward to the second half of the 12 months, buyers are questioning whether or not this development will likely be repeated or if beneficial properties will likely be extra broad-based. Know-how firms are long-duration property – extra of their income are within the distant future versus the close to time period.

This makes their efficiency delicate to interest-rate expectations, with falling expectations supporting their efficiency within the first half-period. We consider this suggests interest-rate expectations, in addition to different basic components, may drive extra broad-based beneficial properties in fairness indexes within the second half of this 12 months.

2. Oil provide and demand. The Worldwide Vitality Company (IEA) lately up to date its forecasts for world oil provide and demand, highlighting that rising markets (EMs) are anticipated to overhaul the Organisation for Financial Cooperation and Growth (OECD) because the main oil client by 2028.

EMs’ share of whole demand is forecast to rise from 45% this 12 months to 48% by 2028.3 The OECD’s share of whole demand is forecast to say no to 42% over the identical interval.

World demand for oil utilized in transportation is forecast to start out declining after 2026, reflecting a pivot towards renewable vitality and progress in electrical automobile (EV) gross sales.

The OECD is seen as main the way in which, however it’s anticipated to start out impacting EM demand towards the top of the last decade as EV gross sales develop and emission guidelines are tightened.

3. El Niño impacts. The US Nationwide Oceanic and Atmospheric Administration has confirmed the formation of an “El Niño,” a local weather phenomenon that ends in tropical cyclones within the Pacific, wetter circumstances in South America and drier circumstances in India.

Through the prior El Nino in 2016, which was the strongest on file, drought circumstances lowered crop yields and hotter oceans lowered fish shares. This creates upside dangers to inflation in 2024 in EMs, contemplating the highweight of meals within the client worth basket and the lagged impact of decrease agriculture provides on meals costs.

Outlook

EMs have been adopting new applied sciences within the pursuit of improvement. These new applied sciences clear up present challenges, increase productiveness and mirror altering consumption patterns.

Examples embrace e-commerce, which will increase gross sales whereas offering comfort to prospects; digitalization methods inside monetary establishments to attain value and operational efficiencies; and the Web of Issues (IoT), which incorporates digital applied sciences in client and industrial merchandise from smartwatches to sensible manufacturing.

In our view, know-how is embedded in most, if not all, sectors to maximise output and seize progress alternatives. Inside the financials sector, the position of know-how has caused cellular banking, e-wallets and robo-advisors, which permit monetary establishments to increase their attain to a bigger pool of consumers, particularly these in rural areas.

In India alone, the cellular wallets market is estimated to surpass US$5 trillion in 2027, whereas Brazil’s main banks have elevated their technologicalinvestments in 2022. Inside the client discretionary sector, we see the rising recognition of on-demand meals and grocery supply.

Lengthy-term drivers of the knowledge know-how sector embrace rising demand for semiconductors – also called chips – that are ubiquitous in computer systems, smartphones and client items together with cars.

The emergence and growing recognition of improvements together with electrical automobiles, 5G (or the fifth era of wi-fi know-how) and synthetic intelligence will help demand for semiconductors over the long run.

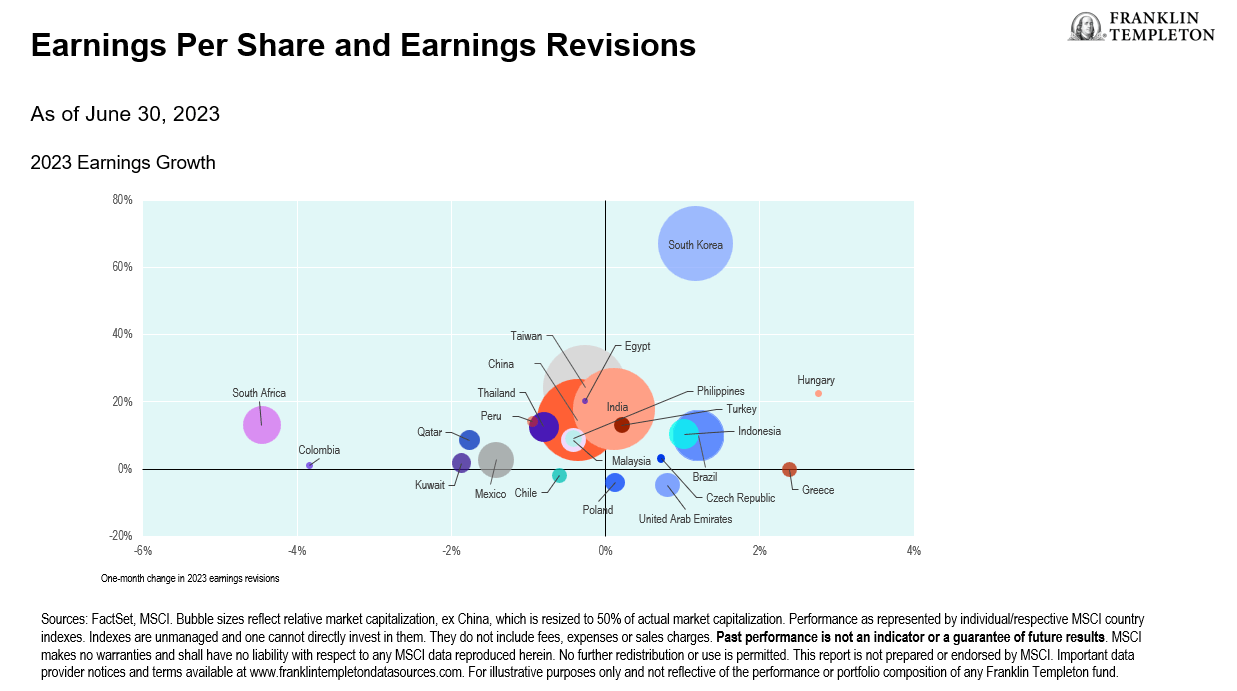

The dominant market share of semiconductor producers in Taiwan and South Korea and chip packaging firms in China and Malaysia creates thrilling funding alternatives to leverage this demand, in our view.

Rising markets are flourishing – pushed by advances in know-how and growing private wealth. Know-how has built-in itself inside different sectors and industries, and we consider that it is going to be a key driver of world progress.

As buyers, we favor technology-led progress alternatives, starting from semiconductors to banks. We consider that our funding crew’s detailed native information and experience to uncover EM funding alternatives, coupled with entry to the dynamic progress potential of firms from among the world’s fastest-advancing economies, enable us to uncover among the most fun alternatives throughout EMs.

What are the dangers?

All investments contain dangers, together with doable lack of principal.

Fairness securities are topic to cost fluctuation and doable lack of principal.

Fastened earnings securities contain rate of interest, credit score, inflation and reinvestment dangers, and doable lack of principal. As rates of interest rise, the worth of fastened earnings securities falls.

Worldwide investments are topic to particular dangers, together with forex fluctuations and social, financial and political uncertainties, which may enhance volatility. These dangers are magnified in rising markets.

The federal government’s participation within the financial system remains to be excessive and, subsequently, investments in China will likely be topic to bigger regulatory threat ranges in comparison with many different international locations.

There are particular dangers related to investments in China, Hong Kong and Taiwan, together with much less liquidity, expropriation, confiscatory taxation, worldwide commerce tensions, nationalization, and change management laws and speedy inflation, all of which may negatively impression the fund. Investments in Taiwan may very well be adversely affected by its political and financial relationship with China.

1. FactSet, as of June 30, 2023.

2. Ibid.

3. Supply: Worldwide Vitality Company, World Vitality Funding 2023.

Unique Put up

Editor’s Word: The abstract bullets for this text had been chosen by Looking for Alpha editors.