JHVEPhoto

Investment Thesis

Domino’s Pizza Inc. (NYSE:DPZ) is the worlds largest pizza chain and leader in quick-service restaurant (QSR) pizza. The company operates over 19,500 stores in more than 90 markets, using its leading-edge technology to provide convenience, quality, and competitive prices to customers worldwide.

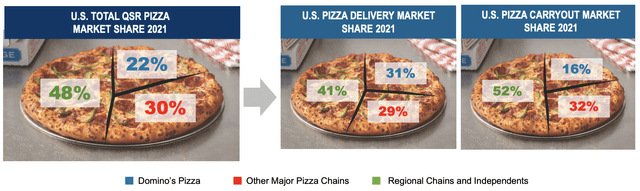

Domino’s estimates that the pizza industry was worth $120 billion in 2022, and that $81 billion of that was QSR. DPZ has the largest market share in the industry and continues to maintain and grow that position through innovation and consistency.

The company competes in a very competitive industry, both against other QSR pizza chains like Pizza Hut and Little Caesars, as well as independent mom-and-pop sit-down pizza joints. However, Domino’s has had no problem carving out its own niche in the market.

DPZ Marketshare Overview (DPZ Investor Relations)

Domino’s Pizza has become the go-to player in the pizza industry due to its commitment to value and convenience. The company has invested in its stores and menus to make it easy and affordable for customers to get a delicious pizza. Management has also done an amazing job utilizing marketing and promotions to build the brand equity. Domino’s is now one of the most well-known and recognized brands in the world, and is easily associated with the pizza industry.

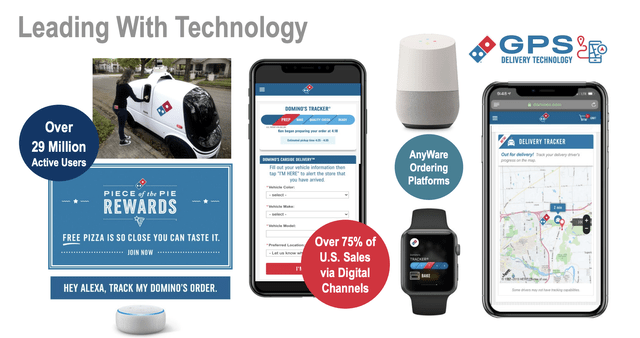

Although the company has been facing headwinds recently as consumers trade down and slow down eating out, the stock has still been resilient. This is due in part to the company’s strong delivery business, which has been strengthened during the COVID-19 pandemic. Domino’s uses advanced technology and GPS tracking systems to have the best and most efficient delivery times. The company tracks each order from the time it comes in, to the pizza entering the oven, to the driver leaving the store. This data allows Domino’s to learn and improve its delivery process, making it more efficient and cost-effective.

DPZ Technology Overview (DPZ Investor Relations)

Domino’s Pizza’s technology gives it an edge over its competitors and makes it the most reliable pizza chain. The company’s real money-making business comes from supplying its franchisee stores with the supplies they need to operate. This includes everything from dough to pizza toppings to its new tater tot option. In Q2, 60% of sales came from the supply chain business, which shows how dominant this side of the business is. Domino’s income diversification from its supply chain, franchisees, and company-owned stores gives it a steady business model and cash flow.

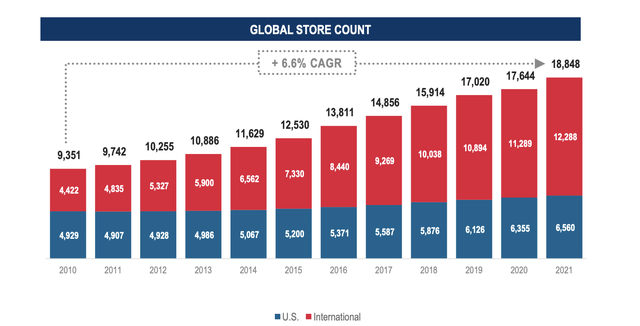

Management has stated that they see room for 8,000 more U.S. stores to be built in the coming years and want to continue to expand globally into more countries and locations. Their brand awareness will allow them to do this, but the balance sheet will be the biggest constraint. In my view, DPZ is a great long-term investment, but it may face some downside volatility in the short term. I rate the stock a hold given the current balance sheet risk and valuation, but I am optimistic about the upside potential for growth in the years to come. Don’t miss out on investing in the world’s largest pizza chain restaurant. Find your price to enter and hold DPZ.

MOAT

In my opinion, Domino’s Pizza has built a large moat around itself, separating itself from its competitors. This is due to its ability to scale efficiently, reach new customers through marketing, and deliver quality pizzas day in and day out. These capabilities are all enabled by its strong management team and the scalability of its technology programs and data. Over the years, Domino’s system has only become stronger and more reliable, helping it to grow substantially around the world.

DPZ Store Count Growth (DPZ Investor Relations)

Domino’s has consistently improved delivery times and grown its carryout business through strategic promotions, such as the $6.99 mix and match deal, and its technology tools that allow for speedy delivery. Carryout now accounts for 40% of sales, as consumers are increasingly feeling pressured to avoid delivery due to the $5 added charge. Carryout is even more profitable for the business, as it does not require paying a driver’s wage and gas mileage. While Domino’s would prefer more carryouts, they are ultimately willing to provide whatever the customer needs.

Domino’s has a 7.79% five-year compound annual growth rate (CAGR), and estimates expect the pizza industry to continue to grow at 5.1% each year through 2030. Domino’s management believes they can continue to grow same-store sales growth between 5% and 7% for the next three to five years. Given their brand equity and store consistency, I believe this is very attainable. When paired with new store expansion and international growth, I believe Domino’s has a long runway to continue to grow. However, it is important for Domino’s to avoid over expansion and growing too fast, in order to maintain the same culture and quality in each store and pizza made.

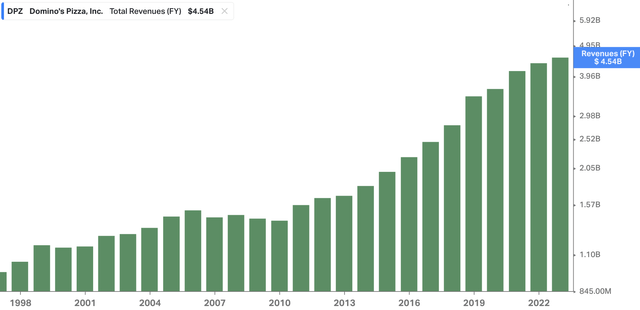

DPZ Annual Total Revenue History (Koyfin)

Domino’s makes money from both store royalties and the supplies it provides to its franchisees. I believe an area they have not yet tapped for growth is selling their technology as a service to other restaurants and pizza joints. I have worked at three pizza places in my life, and one of them was Domino’s. Their system and efficiency are light years ahead of independent pizza joints. I see Domino’s eventually selling their technology as a subscription service to expand their total addressable market (TAM) and bring in more money at extremely high margins.

Overall, Domino’s scale-driven cost advantage and brand equity give the company an advantage that is hard to replicate or compete with. They are not only growing in the United States, but also in nearly 100 different countries. With menu innovation, quality food, and convenience, Domino’s Pizza has plenty of room to grow and is not going anywhere anytime soon. Their current offer of two medium two-topping pizzas for $6.99 with the choice to also mix with any side is an offer that cannot be beat.

Balance Sheet Worries

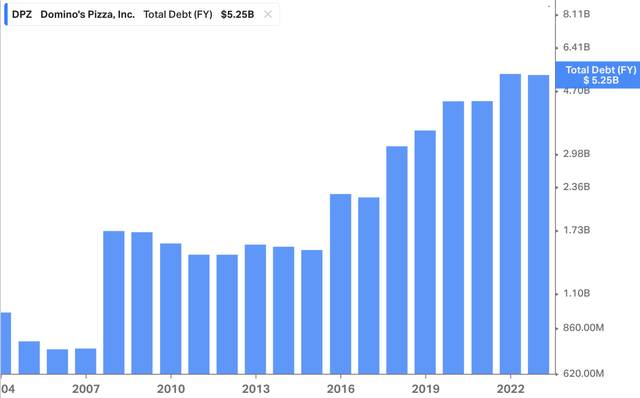

Domino’s Pizza has a long runway for growth ahead of it, but it needs to be careful not to take on too much debt. The company currently has $5.23 billion in debt, but only $77 million in cash on hand. Through the first two fiscal quarters of 2023, DPZ has generated $204 million in free cash flow (FCF), which is on pace to exceed the $388 million in FCF generated last year. However, DPZ’s FCF yield of 3.7% is well below the 6-8% range that many investors look for.

While DPZ is generating more cash, its debt has also been steadily increasing. The company’s total debt is up 20% since 2019, while its FCF has only increased by 14.6%. In addition, DPZ’s total liabilities are greater than its total assets, which puts the company at risk of insolvency. This could be a sign that DPZ is growing too fast.

However, I don’t think Domino’s will instantly stop seeing orders come in. The company has a strong brand and a loyal customer base. As long as it can continue to generate positive FCF, it should be able to manage its debt. Additionally, DPZ’s current assets are greater than its current liabilities, which gives it some breathing room in the short term.

Overall, I think DPZ is a good company with a bright future. However, I would be cautious about investing in the stock at its current price. The company’s debt levels are a concern, and I would like to see FCF yield increase before I become more bullish.

DPZ Total Debt (Koyfin)

You would think that, given their amount of debt and low cash flow relative to their sales and size, Domino’s Pizza would be struggling to pay off debt, diluting shareholders, and having a declining stock price. However, the opposite has been the case. This is simply because of the consistency and steadiness of their business and customers. Sales have consistently grown, stores have continued to be built, and the amount of money coming in continues to grow.

In the last 10 years, DPZ has shrunk its share count from 55.56 million shares to 35.09 million, a 36.8% decrease. They currently have a $1 Billion share repurchase program with $289 million left that they hope to finish by 2024. Although at first glance it may seem like they have over leveraged themselves, I believe Domino’s management is doing a great job using leverage to expand and grow the business while returning capital to shareholders.

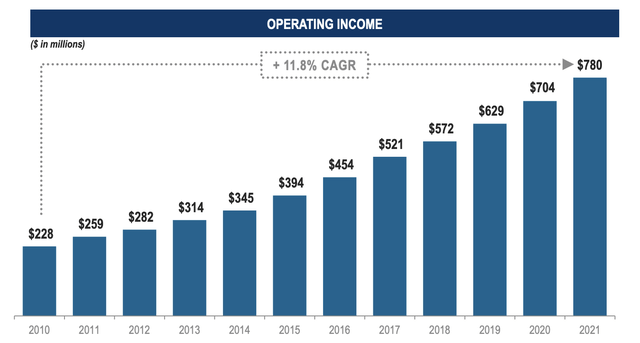

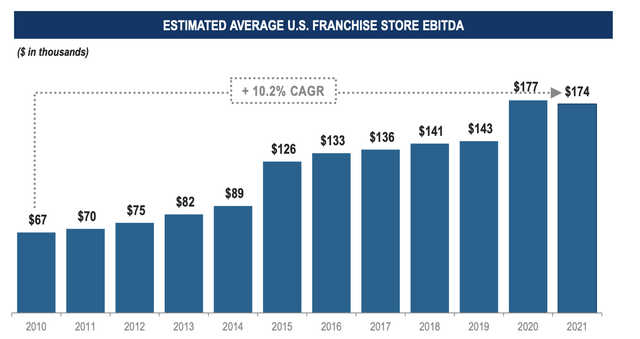

In fact, the company has increased its dividend for 11 straight years. They only have a payout ratio of 34%, so the other 66% of net income is going into share repurchases, research and development, and marketing. Domino’s has increased its dividend at an 18% growth rate for the past 5 years and increased its dividend 10% earlier this year. In my opinion, as DPZ continues to grow stores and stabilize FCF, the dividend will continue to grow at an above-average rate. DPZ is one of my favorite dividend growth stocks for the next 20 years. Profitability has continued to grow both as a company and per unit.

DPZ Operating Income History (DPZ Investor Relations)

DPZ Industry-Leading Unit Economics (DPZ Investor Relations)

Domino’s has put itself in great shape to benefit from the world’s love of pizza. They are the #1 quick-service restaurant pizza chain and have continued to leverage their brand to bring in more money. As they continue to strategically leverage their debt to grow store count and market share, I believe the excessive debt will be worth it.

McDonald’s Corporation (MCD) has a similar balance sheet with a lot of long-term debt ($35.7 B) and total liabilities ($55.4 B) are greater than total assets ($50.4 B). In order to continue to grow and build stores across the world, the company has to utilize its access to capital through debt.

DPZ is in great shape and I believe that they can hit their goal of opening 8,000 more stores and maintain steady international growth. The stock will be a lot higher in three years if the company continues to use the balance sheet to execute.

Price Targets and Valuations

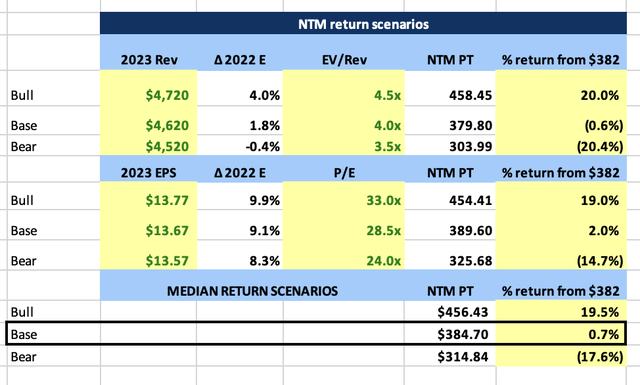

Domino’s has typically traded at a premium compared to its peers due to its industry-leading margins and sales. DPZ is currently trading at $382 per share with a 27.9x price-to-earnings (P/E) ratio for 2023. This is down slightly from its five-year average of 30.3x, but still well above the sector median of 15.6x. Historically, the stock’s P/E has topped out around 38-39x and bottomed in the low 20s (20-22x).

Looking at the chart after today’s drop, it looks like DPZ is testing a significant level. I believe that if the stock drops on Friday, August 18th, it could head back down to the $350s. However, if it can finish above $380, it could be consolidating before its next run.

DPZ Chart as of 8/17/2023 (Trading View)

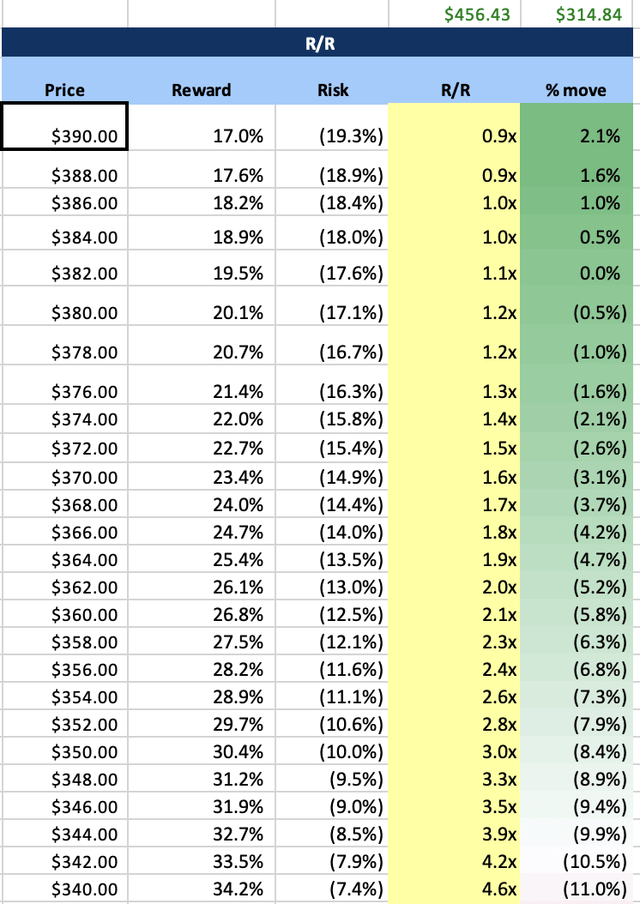

After looking at the chart and price-to-earnings (P/E) valuation history, I created a price target scenario table. The stock is trading very close to my next 12-month fair value, with a 19% discount from my bull case scenario if the stock market rallies into the end of the year.

At $382, the stock has a 1.1x risk-to-reward ratio by my calculations. This means that for every $1 invested, I expect to make a profit of $1.10. A move down in the stock price would make it more appealing to purchase. Specifically, at $350, the risk-to-reward ratio becomes 3x, which is where I usually look to start building a position.

I have attached the price target scenario table and my risk-to-reward chart below.

DPZ NTM Price Target Scenario (Author Calculations Based on Analyst estimates From Data on Koyfin)

DPZ Risk to Reward Table (Author Calculations)

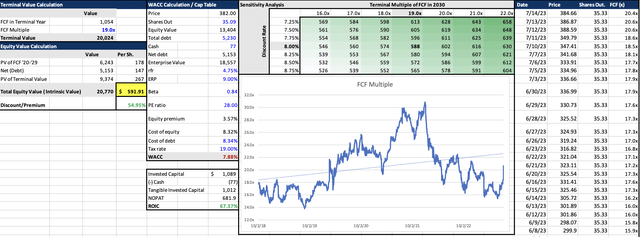

Although DPZ may be trading at fair value currently, I believe that in the long term, it won’t matter if you buy the stock today or tomorrow. Of course, we would all love to have a lower cost basis or buy at the bottom, but we have to be realistic with ourselves when investing and be disciplined. That’s why I also run a discounted cash flow (DCF) analysis on Domino’s to get a price target over a longer time horizon. I use a DCF to calculate a price target 3-5 years out, based on the company’s projected cash flow and weighted average cost of capital (WACC). I believe DPZ is trading at a 55% discount from its 5-year price target of $591 per share. The stock hit an all-time high (ATH) of $567 in December 2021, and I think it’s only a matter of time before Domino’s Pizza sets new highs.

DPZ DCF Analysis (Author Calculations)

Risk

Whenever we think about risk when entering a position I want you to ask yourself:

“Why would this position fail?”

When I think about the risks associated with Domino’s, two main ones come to mind. First, consumer preferences are always changing and evolving, and the quick-service restaurant industry has very low switching costs for consumers. This means that it is easy for customers to switch from one restaurant to another, which puts pressure on companies to keep their prices low and their products innovative.

Domino’s industry is also very competitive, with many different chains and independent restaurants vying for customers. This competition can also lead to lower margins, as companies try to undercut each other on price.

To combat these challenges, Domino’s needs to invest heavily in marketing and promotions to reach new customers and keep existing ones coming back. They also need to be constantly innovating and adding new menu items to keep their products fresh and appealing.

The second big risk for Domino’s is its exposure to input cost inflation. As a major supplier of pizza supplies to its franchisees, Domino’s is directly affected by rising prices for ingredients such as chicken, dairy, and vegetables. This can lead to lower margins and lower profits.

However, I believe that Domino’s is well-positioned to weather these challenges. The company has a strong brand reputation and a loyal customer base. They have also been successful in raising prices in recent years, which has helped to offset some of the impact of inflation. The what was mix or match $5.99 deal is now $6.99, but customers have shown no sign of slowdown.

I believe that Domino’s will continue to grow and expand its free cash flow (FCF) in the long term. The company has a strong track record of innovation and they are well-positioned to take advantage of the growing demand for delivery and carryout food.

Conclusion

Domino’s Pizza is not going anywhere, simply because people love pizza. DPZ has capitalized on our love of pizza with quality food, convenient stores, and genius promotions. Their leading-edge technology in stores and for drivers gives them an advantage over any pizza joint or delivery app. They continue to have a long runway ahead of them through opening new stores. Management has ambitious goals both in the U.S. and internationally, but they have a proven track record of success. Strategic marketing and promotions will continue to be a driver for Domino’s to bring in customers, and I have no doubt their team will execute.

The bigger Domino’s gets, the more dominant I believe they will be. Domino’s is only a $13 billion dollar company right now, compared to other dominant fast food restaurants like McDonald’s ($207 billion) and Chipotle (CMG) ($51 billion). I believe Domino’s has room to grow. A stock price of $591 would give DPZ a $20.7 billion market cap with the amount of current shares outstanding right now. DPZ may be headed lower to end the summer, but I believe that on a long-term scale, we are getting a highly discounted stock. I have seen inside a Domino’s on Super Bowl Sunday, Christmas Eve, and a normal Taco Tuesday, and I can tell you one thing: the phone never stops ringing for them. Domino’s brand name and reputation is worldwide, and they will only continue to get bigger.