svetikd

Caesars (CZR) was established in 1937 and manages casinos and resorts under various brands including Harrah’s, Caesars, Planet Hollywood and Horseshoe, which recently hosted the World Series of Poker. The stock has languished in recent years as debt levels have risen amid concerns over the cost of servicing the debt, which has created a valuation overhang. By separating the business components (Las Vegas properties, regional casinos and the high-growth, but loss-leading digital / sport betting division) and valuing each conservatively, the stock appears to offer good value based on a sum-of-the-parts analysis. Moreover, there are tailwinds supporting the gaming business. Las Vegas is becoming a major gaming, resort and entertainment hub buoyed by recent signings of major sports team franchises and events. Caesars is well-placed to benefit from added footfall into its resorts as well as the growth of online gaming and sports betting.

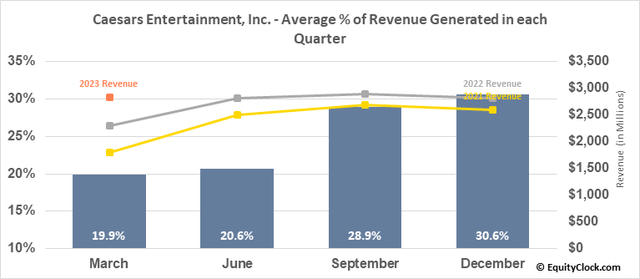

Caesars is the largest casino and entertainment company in the United States. It has a portfolio of 50 properties in 16 American states as well as a presence in Canada and Dubai. These iconic casinos are globally recognized and positioned in irreplaceable locations which offer strong footfall. For instance, across the Las Vegas strip the company operates Caesars Palace, Planet Hollywood and Harrah’s which have cultivated a level of brand recognition matched solely by a handful of peers. Following the closure of the gaming properties during the Covid-19 pandemic in 2020, revenue growth recovered from 2021-22 and 2023 has started positively.

Equity Clock

Source: Equity Clock

Building on its heritage as a gaming, entertainment and convention provider, Las Vegas is attracting a number of marquee sports franchises which should extend its reputation as a global leisure destination. Having transitioned the Golden Knights (hockey) and Oakland Raiders (football) to the city, plans are afoot to expand its professional sports footprint. First, the Oakland Athletics baseball team is close to officially signing a move from its California site to Las Vegas, which prompted Nevada’s state assembly to support the build-out of a $1.5bn stadium on the site of the Tropicana Resort owned by Bally’s. Second, the NBA is pursuing team expansion for the first time since 2004 when the Charlotte Bobcats (now Hornets) were admitted. In conjunction with a new TV rights deal set to be signed in 2025, it is highly possible the NBA could add two new teams to bring the total to 32. Whilst there are a number of candidates, Las Vegas and Seattle have been floated as potential cities. A site on the Strip at the former Wet n’ Wild park is being touted as a possible location for a new $4bn, 23,000 seat arena named the ‘All Net Resort & Arena’. Third, Las Vegas will host the Formula One Grand Prix in November of this year on a 3.8 mile, 50-lap street circuit between Las Vegas Boulevard and Koval Lane. Vegas last hosted an F1 Grand Prix in 1981 and 1982 on a temporary track next to Caesar’s Palace. The event is expected to attract around 150,000 spectators and draw $1.3bn into the local economy. Finally, Vegas will host the Super Bowl in February 2024 and the upcoming launch of the MSG Sphere will provide a cutting-edge 17,00 seat venue for immersive concerts.

In 2018 the US Supreme Court overruled the Sports Protection Act, which had outlawed sports betting across the United States with the exception of Nevada and a few other states. With its liberal sports betting laws, Las Vegas has further cemented its position as a hub for hosting major sports events. Casinos have responded by re-designing their betting parlors termed ‘sports books’ to create immersive viewing and gambling experiences.

Over the course of its illustrious history Caesars has endured two occasions where it became over geared entering into a challenging macroeconomic periods – once during the great financial crisis of 2008 and the other more recently as the COVID-19 pandemic took hold. The plight of Las Vegas is well-known, but the underlying cause was a combination of high unemployment and rampant supply growth. The situation today is the inverse. Unemployment is 3.6% in the US and 5.4% in Nevada. Aside from the Fontainebleau, which will open in the fourth quarter of 2023 with a 67-storey, 3,700 room hotel, gaming, and entertainment complex along with 550,000 square feet of convention and meeting space, there has been negligible supply growth given the dearth of developable land.

Sports Betting Opportunity

Following the acquisition in 2021 of William Hill for $3.7bn, Caesar’s retained the US sports betting franchise and sold its non-US operations to 888. Caesar’s Digital comprises the iGaming platform and online sports betting business, which are both currently loss-leading to the tune of $666m in 2022. Caesars is launching a new standalone i-casino app in the third quarter which will be distinct from its sport betting app which currently houses online casino games. Caesar’s share of online sports betting in the US is 8% but has potential to grow as new content and offerings are rolled out. As more than half of US states begin the process of opening up to sports betting, the addressable market will expand rapidly.

Attractive Valuation with Potential to De-Gear

Whilst the company finished 2022 with $26bn of long-term debt / leases on its balance sheet, following its $8.5bn merger with Eldorado in 2019 which heralded a new management team, the business is on track to de-gear significantly whilst positioned to benefit from an exciting array of digital initiatives. On a sum-of-the-parts basis, assuming the Las Vegas assets are worth 10x normalized EBITDAR of $2.1bn provides for $21bn of value. In addition, CZR’s 45 other gaming properties have been rejuvenated by $2bn investment. Assuming a 25% ROIC, these growth investments could generate an additional $500m of EBITDAR versus the $2bn EBITDA run rate. Applying a 7x multiple to $2.5bn of core prospective EBITDAR values the regional properties at $17.5bn. With the physical portfolio worth c. $38.5bn against a current enterprise value of $34.9bn including $10.4bn of capitalized leases and assuming the value of the managed and branded segment (which generates $100m of EBITDAR roughly offsets the capitalized value of the corporate overhead), the market appears to applying a negative value to the digital assets. The EBITDA potential for the digital business is $500m by 2025 which on a 15x multiple could be worth $7.5bn.

Key Risks

Total debt to EBITDA is elevated at 6.9x (as at 31 March 2023) but has reduced from 8.5x at the end of 2022. EBITDA covers interest expense by 1.6x which leaves some but not a significant margin to withstand a reduction in operating income.

Conclusion

Clearly, the gaming industry is subject to cyclicality, and should US unemployment rise significantly casinos could experience a reduction in visitation and gaming volumes. With a relatively fixed cost base, declines in revenue materially impact the bottom line.

As online gaming and sports betting become a higher proportion of revenue, Caesar’s value should be unlocked. Under the stewardship of a seasoned management team led by CEO Tom Reeg who executed well at Eldorado, Caesar’s offers strong potential upside. As the debt stack is worked down value should accrete to equity holders.