JLGutierrez

Market pundits are fond of fairy tales, and perhaps none more so than the story of Goldilocks and the Three Bears. Goldilocks, of course, finds Papa Bear’s porridge too hot and Mama Bear’s too cold, before settling on Baby Bear’s as just right.

As for porridge, so for the economy. We don’t want it running too hot (too much inflation) or too cold (recession). The Goldilocks Economy so beloved of financial news anchors is in that happy medium of growth that is moderate, but still positive.

In another metaphor overused by the chattering class, it is the soft landing pulled off by the Fed as it tries to thread the needle of a monetary tightening without driving the economy into the ground.

Approaching the Runway

The Fed has not yet stuck the landing, but the numbers are looking pretty good as the plane approaches.

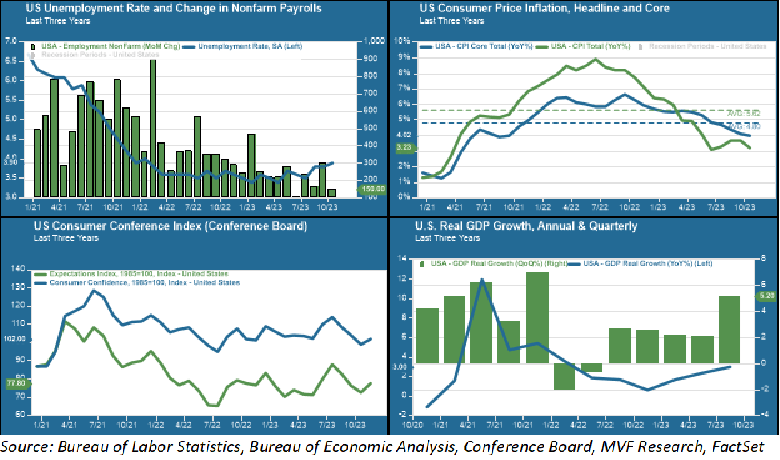

This week saw an upward revision of third quarter GDP real growth to 5.2 percent, while the latest inflation data in the form of the PCE report validated the continuing downward trend in consumer prices seen in the most recent Consumer Price Index release a couple of weeks ago.

Meanwhile, the labor market is still growing, with a more moderate pace of monthly nonfarm payroll growth, and consumer confidence levels are reasonably stable from month to month. All this would seem to be about as Goldilocks as it gets.

Investors have taken notice. The S&P 500 closed out November with a gain of nearly nine percent, its best monthly performance since the summer of 2022. The Nasdaq Composite did even better, coming in at 10.7 percent for the month on the back of yet another rally in the Magnificent Seven and its posse of tech/growth stock darlings.

The Fed eased up on its hawkish-leading commentary from earlier in the fall, producing another outsize run-up in bond prices as yields plummeted. This sets the stage for (wait for it) yet another metaphor that Wall Street will never get tired of: a Santa Claus rally in December.

Though maybe not starting today, if S&P futures are any indication of how the first day of the new month will play out (always subject to change throughout the day).

Some Caveats

We think overall conditions seem fairy supportive for a positive end to the year. As always, though, there are plenty of ways for things to turn pear-shaped. Let’s start with the bond market, which is never too far away center stage in our analysis.

The pattern of volatility that has been a constant theme of this year is still with us. In the most recent rally, the 10-year Treasury yield fell from five percent on October 19 to 4.27 percent earlier this week, a percentage change of 17 percent.

This is the third big rally for bonds this year, following the misplaced enthusiasm about inflation at the beginning of the year and then the mini-crisis in the banking sector in March.

It’s worth noting that on both previous occasions, yields snapped back after the initial exuberance. Bond traders are once again pricing in rate cuts that the Fed insists are not up for discussion any time soon, so the happy vibes of the moment could face a reality check.

Then there is the persisting fact of the narrowness of gains in the equity market this year, dominated (as we discussed in some detail last week) by the small number of names able to tap into the general enthusiasm for artificial intelligence. That theme will get more scrutiny next year, leaving an open question as to where the big growth drivers will come from.

As for the economy, it mostly comes down to the US consumer. Strength in consumer spending has been the most important factor keeping the economy performing ahead of expectations this year, even in the face of all those interest rate hikes making credit more expensive.

Will that strength carry into next year? Assuming that inflation continues its downward trend and the Fed really is done with its tightening, one could make a fairly good argument for yes. But it’s not a given. Nothing lasts forever, not even the prodigious might of the world’s consumer of last resort.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

![Iyanya, Mayorkun & Tekno – ‘One Side’ (Remix) [Official Music Video] Iyanya, Mayorkun & Tekno – ‘One Side’ (Remix) [Official Music Video]](https://thehollywoodpremiere.com/wp-content/uploads/2024/11/Iyanya-Mayorkun-Tekno-One-Side-Remix-Official-Music-120x86.jpg)

![David Koepp Talks About The 25th Anniversary 4K Release, His Friendship With Kevin Bacon, and Coming Back to ‘Jurassic Park’ [The Discourse Podcast] David Koepp Talks About The 25th Anniversary 4K Release, His Friendship With Kevin Bacon, and Coming Back to ‘Jurassic Park’ [The Discourse Podcast]](https://thehollywoodpremiere.com/wp-content/uploads/2024/12/David-Koepp-Talks-About-The-25th-Anniversary-4K-Release-His-120x86.jpeg)