On March 11, Malaysian mini mart chain 99 Speedmart submitted an IPO prospectus draft on the Stocks Payment (SC) Malaysia.

A prospectus is a paper that supplies information regarding a financial investment offering that’s up for sale to the general public. In Malaysia, the SC is the single governing authority for authorizing and signing up syllabus.

According to the declaring, the business intends to have a going public (IPO) of approximately 1.428 billion common shares in 99 Holdings, the mini mart’s financial investment holdings business.

This novice share sale will certainly make up a sell of approximately 1.028 billion existing shares and a public concern of 400 million brand-new shares.

Of these numbers, the institutional offering composes 1.218 billion shares, standing for 14.5% of the team’s bigger released share funding. It will certainly make up 1.028 billion existing shares and 190 million brand-new shares.

On the other hand, the retail offering includes the remaining 210 million brand-new shares (2.5% of the team’s bigger share funding). 42 million shares are scheduled for qualified personnel while 168 million shares will certainly be provided to the Malaysian public.

With this IPO on Bursa Malaysia’s major market, creator Lee Thiam Wah and his family members will be releasing a 17% risk.

A little bit regarding 99 Speedmart

For those that do not understand, 99 Speedmart is a preferred mini mart chain that retails everyday requirements, mostly consisting of fast-moving durable goods (FMCG).

The mini mart is run with 2 of 99 Holdings’ entirely possessed subsidiaries. The holdings business likewise possesses 2 various other entirely possessed subsidiaries– Yiwu J-Jade Trading, and Yiwu SM Import and Export.

These 2 subsidiaries were lately included in individuals’s Republic of China for the objective of financial investment holding and obtaining product up for sale in the business’s electrical outlets.

According to the prospectus, the business considers itself the “largest Malaysian homegrown mini market chain retailer to capitalise on the strong growth potential of the grocery retail segment”.

The prospectus clarifies, “With a history spanning 36 years since the inception of ‘Pasar Raya Hiap Hoe’ by our founder, Lee Thiam Wah, and having operated ‘99 Speedmart’ outlets for over 20 years, we have established our presence as a leading retailer of daily necessities comprising mainly FMCG across Malaysia.”

Pasar Raya Hiap Hoe was established by Lee at 23 years of ages, with a funding of RM17,000, which he later on offered to go after the 99 Speedmart chain.

Lee is called a motivating number in Malaysia’s business scene, having actually continued and prospered in the area in spite of his impairment, which compelled him to leave college after his main education and learning.

He’s recognized for his suggestions to “strive for perfection (99 marks), knowing there is always room for improvement”.

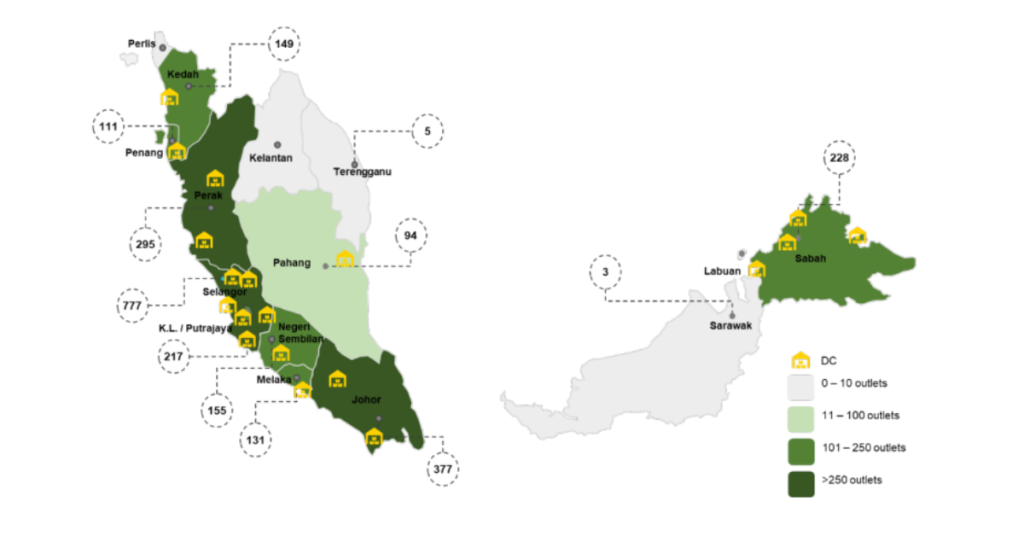

Various other toughness the business highlighted include its affordable rate factors and curated offerings, in addition to an effective across the country network of circulation centres (DCs). The prospectus likewise stresses on the truth that it is a scalable service system and has an extremely seasoned group.

When it comes to the business’s previous efficiency, for the fiscal year finishing in 2023, 99 Holdings had an earnings of RM8,075,262,000, with a revenue after tax obligation of RM326,665,000.

Speeding up in the direction of 3,000 electrical outlets across the country

When it comes to future strategies, the prospectus asserts that the business plans to get to a target total amount of regarding 3,000 electrical outlets running across the country by the end of 2025. Presently, it has 2,542 electrical outlets.

Yet, it intends to proceed opening up approximately 250 electrical outlets yearly.

Their main goal is to additional increase their impact in areas with reduced electrical outlet infiltration prices such as the north and eastern shore areas of Peninsular Malaysia, in addition to the entire of East Malaysia.

In addition to that, the business likewise intends to increase its network of DCs and logistical capacities throughout Malaysia, while likewise taking a look at chances for growth right into global markets to boost the business’s sourcing capacities or electrical outlet network.

Finally, the business wishes to boost their mass sales capacities with an ecommerce-driven service version, promoting mass sales throughout Malaysia.

According to the prospectus, making use of profits from the general public concern will certainly be made use of for:

Electrical outlet and DC expense (consisting of opening of brand-new electrical outlets, facility of brand-new DCs, updating of existing electrical outlets, and acquisition of delivery van).

Payment of existing financial institution loanings.

Settle costs and costs for their public problems.

In the meantime, the draft prospectus has actually not given an IPO rate or timeline.

Even more info on the prospectus can be located online, but also for currently, it’s exclusively for the objective of looking for remarks from the general public, as it has actually not been signed up with the SC under Area 232 of the Funding Markets and Solutions Act 2007.

That suggests the prospectus need to not be made use of for making any kind of financial investment choices.

Discover more regarding 99 Speedmart right here.

Review various other short articles we have actually blogged about Malaysian start-ups right here.

Included Picture Debt: 99 Speedmart