syahrir maulana

US small caps are experiencing an autumn stock market rally, but they continue to be heavily impacted by interest rate sentiment.

Year to date, the Russell 2000 index has increased by 2.07%. Over the past week, however, the index has grown by 5.41% and over the past month by 7.92%.

Despite this impressive performance, the index is currently trailing its large-cap counterpart by one of the widest margins since 1998. Small-cap stocks are heavily impacted by moves in interest rates and since the start of the latest interest rate hiking cycle, US small-cap stocks have been on a roller-coaster journey.

Recent economic data indicating slowing inflation and the growing likelihood of a soft landing for the US economy has been leading market participants to believe that the Fed has now reached peak rates and may even start cutting next year. This sentiment has been pushing small-cap stocks higher over the last few weeks.

Small-cap stocks tend to feel the impact of changes in interest rates more than their large-cap equivalents. Not only do small-cap companies have a greater dependency on shorter-term financing to help them survive, but they tend to rely more heavily upon floating rate debt, strengthening the immediate impact of any increases in interest rates upon their profits.

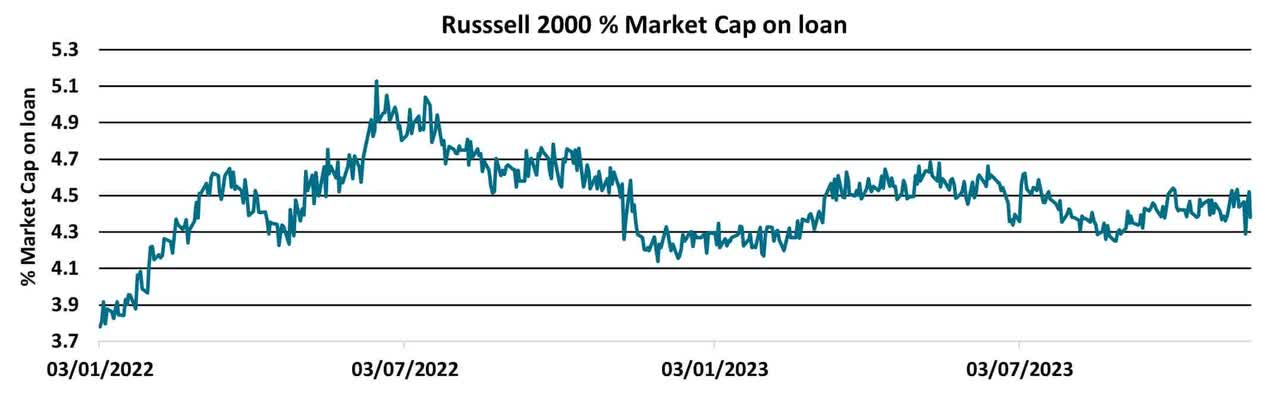

As can be seen in the graph above, the percentage of market capitalization on loan, which is often used as a proxy for short selling, across the Russell 2000, has been volatile since interest rates started to rise at the beginning of 2022.

More recently, the percentage of market cap on loan has started to decrease as economic data points towards a slowdown in inflation and market participants look towards future interest rate cuts of as much as 100bps during 2024.

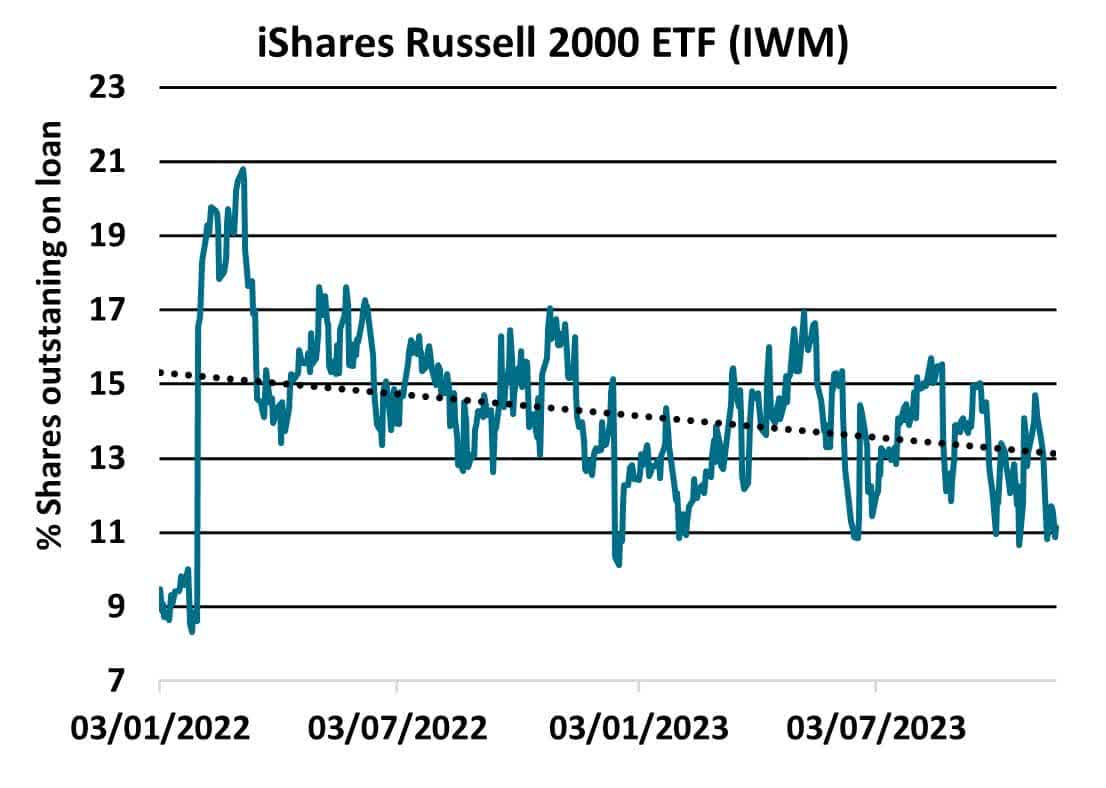

When looking at proxies for the index, such as the iShares Russell 2000 ETF (IWM), a similar story can be seen. As the narrative surrounding a hard landing, to no landing, to soft landing, to interest rates cuts has taken place, the overall percentage of shares outstanding on loan, which is also used as a proxy for short selling activity, has also decreased.

S&P Global Market Intelligence ETF data shows that over the past month, IWM has seen the fourth-highest inflows of any ETF during the period. Over $4.3B has been invested into the exchange traded fund over the last 30 days.

When reviewing retail flows for individual equities that are part of the large cap and small-cap indices however, data shows a move towards large-cap equities, by retail investors, over the last three months.

This may suggest a preference by retail investors to track the small-cap index through a fund or wrapper rather than invest in individual companies within the sector.

Institutional investor flows show that holdings in small-cap stocks have moved from a 70% median to an 80% median over the last few months, suggesting an increase in positive sentiment.

This is a big departure from the trends seen during the preceding 12 months and shows that institutional investors are holding on to more of their recent purchases of small-cap equities.

When considering the potential dividends that US small caps may offer, at the current time, any improvement in earnings outlook does not appear to be substantial enough to result in a meaningful increase in dividends.

In addition to the negative full year dividend growth expectation, there haven’t been any recent announcements or updated forecasts in Russell 2000 equities with dividend increases.

The recent rally appears to therefore be driven more by positive market sentiment than by any fundamental changes to the yield on offer.

Finally, when looking at fixed income assets issued by US small-cap companies, the median level of risk has declined when compared to levels seen during the summer.

A significant improvement has been noted during the last quarter and risk levels have moved back to where they were earlier on in the year. This suggests that the asset class is increasingly considered as a safer investment.

The recent decline in bearish sentiment, led by the expectation that the Fed may achieve a soft landing without sparking a recession, may mark a significant turning point for the future investment prospects of US small-cap equities.

If the Fed were to start cutting rates next year, however, then the main motivation for this is likely to be a slowing economy. In this scenario, investors may want to be careful what they wish for, as small-cap companies generate the majority of their sales in their domestic markets, and their performance therefore remains heavily aligned to the health of their local economies.

Data Sets used: Securities Finance, ETF and Benchmarking Services, Alpha Signals and Dividend Forecasting.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.