“It ain’t over till it’s over.” is a regularly utilized Yogi Berra stating. The existing semiconductor cycle has that sensation. While for some components it seems over, for various other components it appears like the majority of sectors go to the base, and there are no solid development signs for the sector.

A little bit over a year earlier, in the 2nd quarter of 2022, the memory and cpu firms were tipping swiftly into a slump with the very first tips of either quarter-over-quarter or year-over-year decrease. Firms in the microcontroller and analog area maintenance the automobile sector were still seeing level to favorable development as the automobile area was still experiencing scarcities for some chips. The semiconductor devices sector was still downing along and would certainly not see the first effect of the downturn up until either schedule Q1 or Q2 of 2023.

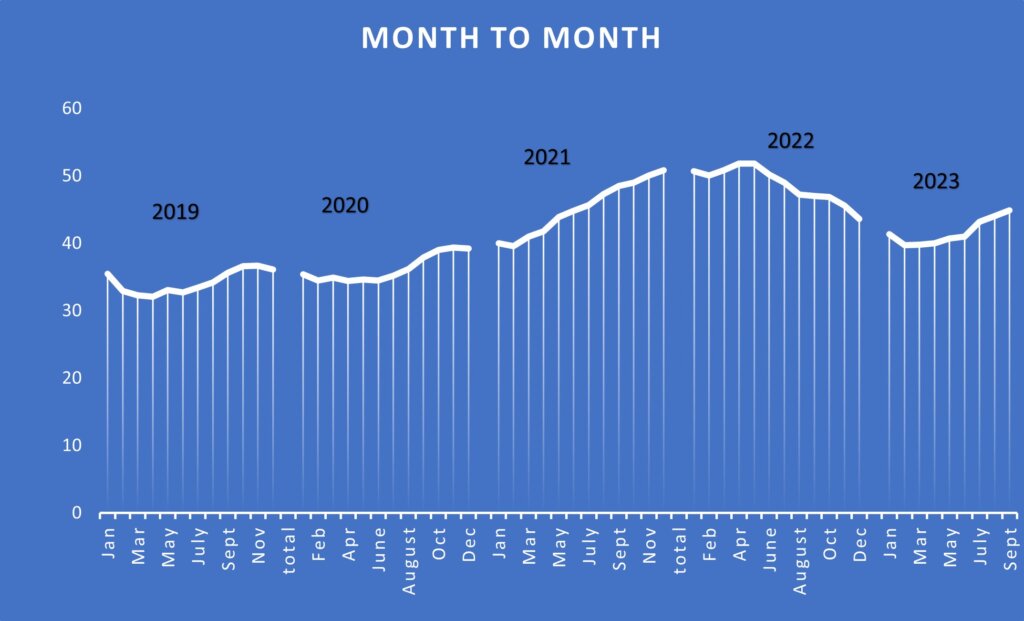

As the semiconductor sector liquidated 2023 and relocated into 2024 the expectation was still over cast. Beginning in the 2nd quarter of 2023 the memory and leading-edge reasoning sectors began to see favorable energy. On the other hand, the microcontroller, analog, and power side of the company checked out a soft Q4 2023. Infineon revealed a 5% development price for its following . The devices side of the company offered combined signals for 2023 of backwards and forwards, relying on which company sector and geographical they are the greatest. The Silicon Market Organization (SIA) information in Number 1 programs the form of the last cycle and the begin of the rebound as the sector relocates into 2024.

Relying on your viewpoint, the existing semiconductor cycle began in late 2019, with a quick respite as a result of the pandemic, and after that kicked into high equipment in the 2nd fifty percent of 2021. At its Market Approach Seminar (ISS), in 2022, SEMI forecasted that $1 Trillion in income for the semiconductor sector was possible by the end of the years. As the graph displays in May 2022, month-to-month semiconductor earnings began to decrease.

In the November 2022 duration, experts were meticulously hopeful regarding the slump. Gartner had a decrease of 3.6% and in the WSTS drop 2022 projection, its experts were forecasting a 4.1% decrease for 2023. On the devices side, SEMI was anticipating a decrease of 16.8% for 2023.

At ISS 2023, the expert panel agreement was that semiconductor income would certainly decrease by around 5%. The one exemption was Malcolm Penn of Future Horizons, that forecasted a 20% decrease in semiconductor income with a rebound in 2024. On the devices side, the agreement was a 15% to 22% decrease with a rebound in 2024. Mark Thirsk of Linx Consulting forecasted a two-year slump for devices with a 13% slump in 2023, and 27% in 2024. For the document, during that time a two-year devices slump was looking most likely.

What Really Occurred

Projecting is an inexact scientific research that depends greatly on your presumptions, in addition to your impulses, as no 2 declines are alike and something from outdoors the box can come and dramatically transform those presumptions. What took place in 2023 and where does it appear like the sector is gone to 2024?

2 of the lots of presumptions for 2023 were that China would certainly see a solid second-half healing which 5G and China would certainly aid to drive cellphone acquisitions and therefore supply some intense areas throughout the year. These presumptions would certainly aid memory recoup, and drive some reasoning income. Neither of these presumptions became. Because of this, memory costs remained to decrease throughout the majority of the year, just supporting when stocks had actually been overcome or crossed out, leading to a profits decrease of above 30% for the sector reliant upon Q4 23 development. Firms developing computer system and mobile cpus likewise saw above a 10% decrease in earnings for those sectors with 10% being the high side.

Brilliant Areas in High Transmission Capacity Memory

The crucial favorable chauffeurs for memory in 2023 were high-bandwidth memory (HBM) for Expert System (AI), and automobile applications. AI and automobile were sectors that had favorable development throughout the sector. For microcontroller systems( MCU) and power chip producers, automobile and electrification brought about a favorable year for the majority of those producers.

This brought about a little bit of an uncommon year where the MCU and analog producers reported development, while the memory and computer and mobile reasoning producers went to an unfavorable year from a development point of view. Commonly, when there is a slump, earnings are down throughout the board, so the automobile and power semiconductor development is just one of the one-of-a-kind facets of this cycle. As renewables drive the electrification of the grid and the electrical automobile (EV) market remains to expand, it will certainly interest see if the automobile and power semiconductor sectors remain to have a various cycle than the computer and customer sectors.

In the devices sector, there were considerable pushouts at the leading side in 2023. There were likewise hold-ups with the very first TSMC fab in Phoenix metro. The limitations in China likewise had an effect, yet not as considerable as very first been afraid, and some devices firms had excellent years in China. In China and the globe, the power, automobile, interaction, commercial, and IoT sectors continued buying devices.

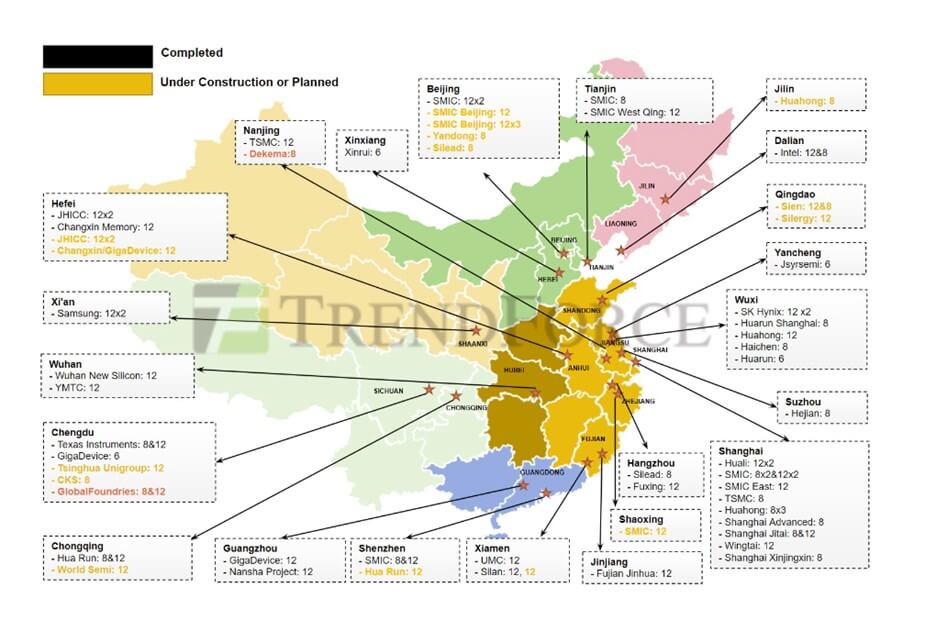

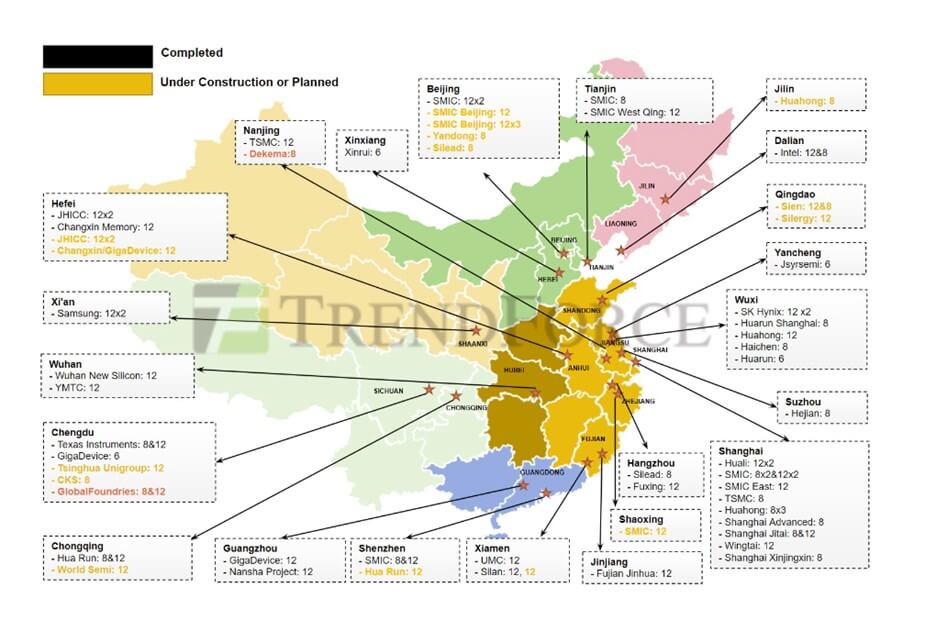

According to Pattern Pressure, in China, there are presently 22 or 23 fabs in various stages of building and 10 even more prepared. The mass of these are predicted to be 28nm and over with fifteen 300mm and 8 200mm (Number 2). This is a substantial quantity of devices as several of these fabs, when finished, will certainly be running 100,000 wafer begins monthly. Relying on the devices assents, China’s production development will certainly remain to be a motorist for devices sales throughout this following cycle. Silicon Carbide (SiC) for electrification and EV will certainly be a crucial development location for 200mm fabs.

Will We See Development in 2024?

Where does it appear like the sector will wind up in 2023 and what are the presumptions for development in 2024? When composing this post, the most recent released SIA numbers went through September of 2023. The chip sector requires to see around 4% development quarter-over-quarter to strike the WSTS projection of a 10% decrease. This would certainly place chip earnings at $515 billion for 2023. Q3 income expanded 10% over Q2 so with any luck it’s secure to claim that there is a possibility for some advantage to those numbers and the year will certainly finish a little far better than presently anticipated.

On the devices front for the leading couple of firms, income development appears like it will certainly vary from favorable 29% development to a 25% decrease, so currently it will certainly be testing to figure out where devices will certainly wind up for 2023 up until the last numbers remain in. The Chinese devices firms are having a banner year, which will certainly likewise aid the year-end number. For the 4th quarter of the 2023 fiscal year, ASML is anticipating a favorable 4% development in Q4 over Q3. Various other devices firms are anticipating level to a little down development for Q4 fiscal year 2023. So, while chip earnings are enhancing, it appears like the devices sector is taking a brief rest as it relocates into 2024.

For 2024 the newest projection on the chip market is by IDC forecasting a 20.2% development. The WSTS springtime projection anticipated 11% development for 2024, which will likely see an upgrade in the autumn 2023 record. Various other records are beginning to arise, and presently, they are dropping in between the over forecasts.

Trick Motorists for Healing

What are the crucial chauffeurs for the healing? According to the newest Gartner projection, IT investing will certainly raise by 8 percent. Information facility systems are the largest chauffeur with 9.5% development year-over-year as cloud and AI information facilities remain to increase. The computer market is anticipated to be at 4.9% development according to Gartner. Smart phone development will certainly remain in the exact same location relying on the success of the lately launched designs.

Boosts at the system degree will drive chip development yet, exactly how does the chip sector reach 20& & development? From a chip point of view, the more powerful asking market price (ASP) for HBM DRAM, and greater efficiency DRAM for systems such as EV, will certainly be the crucial chauffeur for memory development. NAND is anticipated to see development later on in the year as the require for storage space expands.

Before and in the Q3 revenues news, Intel, AMD, QUALCOMM, Samsung, and Nvidia talked about cpus for a brand-new AI-enabled computer and AI mobile applications that would certainly appear in 2024. These brand-new gadgets would certainly utilize a cpu made to allow individual AI efficiency and relocate AI from the cloud to the neighborhood tool. Relying on the need, these brand-new gadgets can be a market chauffeur for higher-end chips with greater ASPs prior to the end of 2024. The concern to ask is whether sectors or customers are tempted to buy these brand-new Computers and mobile phones.

On the devices side, need will certainly be driven by outfitting the brand-new sophisticated fabs coming online in 2024 and 2025. China will likely remain to have solid need for outfitting its fabs. A crucial component of the formula is exactly how quickly will certainly the ability that has actually been taken offline throughout this slump obtain re-adsorbed. Factory use prices are presently in the 70% array and it is most likely that the memory fab use remains in a comparable array. Hence, the devices projection for 2024 depends greatly at a time need and enhancing great use prior to devices acquisitions will certainly see a substantial pick-up.

While chip projections in the 4th quarter will likely appear in the 10-20% array, as a result of what appears a stronger-than-expected 2023 for semiconductor production devices, it’s feasible that devices sales will certainly begin the year sluggish, and after that start to ramp in the 2nd fifty percent of 2024, finishing the year near to the favorable 10% number that has actually been forecasted. Nonetheless, there are a great deal of presumptions that have to form for that to occur. In the 3rd quarter of 2023, customer costs was reducing. Experts will certainly require to figure out if this fad proceeds into 2024 as they compose their projections.

Yogi Berra likewise is reported to have stated it is difficult to make forecasts, specifically regarding the future. I anticipate 2024 to be among those years up until the chauffeurs for development plainly arise.

This post initially showed up in the 2024 3D Prompts Yearbook. Read the problem below.