Matteo Colombo

Notable Insider Purchases for Q2?

We appeared via 1000’s of S-4 filings in an try to determine companies whose company insiders had been participating in intervals of unusually intense insider shopping for exercise. The sequence continues with this second-quarter piece overlaying mid-cap firms however shall be adopted up shortly with articles overlaying each small-cap and large-cap insider exercise. For the needs of this text, we’ve outlined mid-cap firms as publicly listed companies with a market cap between $2 and $10 billion. Our authentic article with the principle thesis could be learn right here, whereas the final quarter’s article overlaying mid-cap firms could be accessed with this hyperlink.

Beneath is our record of research-worthy mid-caps that, in our view, loved a interval of bizarre and atypical curiosity from company insiders throughout the first quarter of the 12 months and are worthy of a additional dive:

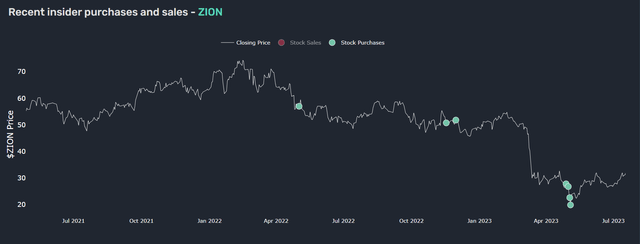

Zions Bancorporation (ZION)

Energetic Company Insiders: 5

12 months-To-Date Efficiency: -25.4%

Whole Purchased Again: $2,730,977

Zions Bancorporation is a Utah Salt Lake Metropolis-based financial institution holding firm offering banking and different bank-related providers via a number of of its financial institution working subsidiaries, most notably together with the likes of Zion Financial institution, Nevada State Financial institution, The Commerce Financial institution, and others. Its enterprise operations are predominantly centered on the Western Coast of the USA, the place the holding company operates a $90 billion stability sheet as one of many extra influential regional banks. The financial institution operator is at present being valued by the market at a comparatively compelling P/E of 8.81x because it trades barely above its tangible e book worth at a P/TBV of 1.41x. ZION had a number of the most centered and diversified insider shopping for exercise we noticed on this most up-to-date quarter. 5 totally different insiders, together with the President, two Vice Presidents, the Chairman and CEO, and a Director purchased somewhat over $2.7 million mixed. This continues the well-established pattern of insider shopping for within the regional banking sector that emerged final quarter and has to this point proved relatively worthwhile for the insiders. It’s price noting right here that the President elevated his place by 35%, one VP elevated his stake by greater than 500%, and the opposite by 96%. In ZION’s case, the identical insiders executing the shopping for spree have been lively sellers for the higher a part of 4 years, making the sign of confidence that rather more essential in our view. Each Looking for Alpha Analysts and Wall Road Analysts appear to have religion within the financial institution and belief that it’s going to navigate towards higher days. Each teams of analysts charge the corporate as a “Purchase”, with a mean rating of 4.33/5.00 and three.63/5.00, respectively. Nonetheless, bears are nonetheless ready for his or her day within the markets, with a roughly 15% of the float at present bought quick. ZION at present trades at $36.10.

Zions Bancorporation Q2 ’23 Insider Exercise (Quiver Quantitative)

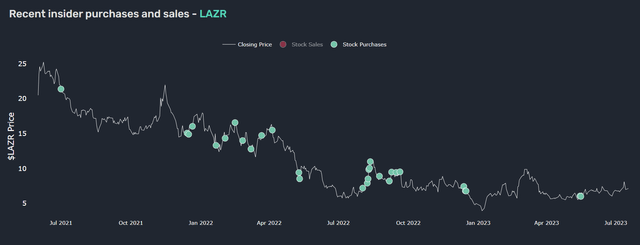

Luminar Applied sciences Inc. (LAZR)

Energetic Company Insiders: 2

12 months-To-Date Efficiency: 47.3%

Whole Purchased Again: $21,514,773

Luminar is a inventory with an important monitor file for the 12 months, having generated 47.3% returns year-to-date. The Florida-based gentle detection and ranging know-how agency was based in 2012 by co-founders Austin Russell and Jason Eichenholz, who each nonetheless actively serve within the firm because the CEO and CTO. Despite the fact that it’s simply struggling to get out of the pre-revenue base, LAZR is broadly acknowledged because the chief in LIDAR know-how options, already managing to safe profitable offers with established names reminiscent of Volvo (OTCPK:VLVLY), Nissan (OTCPK:NSANY), and Mercedes-Benz (OTCPK:MBGAF). As of immediately, the corporate nonetheless burns via vital quantities of money, however the bull thesis is that income goes to skyrocket till 2030. That exact sentiment could be seen from the angle of the company insiders, who as soon as once more executed materials insider purchases. That is very true within the case of its CEO, Austin Russel, who in a interval of solely a few days elevated his holdings within the firm by a staggering 346%. He purchased $21.3 million of Luminar inventory between Might fifteenth and sixteenth, within the vary of $5.80 to $6.25 per share. One of many administrators, Heng Jun Hong, joined in on the fifteenth, shopping for about $200K in inventory for $5.91 per share. SA Analysts have failed to ascertain widespread floor on the prospects of the inventory, ranking LAZR as a “Maintain” with a mean rating of three.40/5.00, with protection starting from constructive to outright pessimistic. Wall Road Analysts on the opposite finish are barely extra optimistic on the matter, ranking the corporate as a “Purchase” with a mean of 4.16/5.00. LAZR is at present promoting for $6.90 per share.

Luminar Applied sciences Inc Q2 ’23 Insider Exercise (Quiver Quantitative)

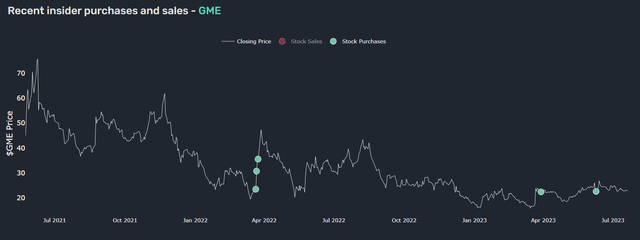

GameStop Company (GME)

Energetic Company Insiders: 3

12 months-To-Date Efficiency: 28.9%

Whole Purchased Again: $10,226,059

The brick-and-mortar sport retailer rose to prominence throughout the 2021 quick squeeze and subsequent meme inventory mania. With the lack of visitors and subsequent gross sales originating from the 2020 lockdowns, in an already troublesome monetary place, Gamestop turned one of the standard quick targets on the Road. Because the shorts bought grasping, reportedly extending their shorts to extra shares than the agency even had excellent, a retail investor motion rose to interrupt the shorts. GME’s inventory value skyrocketed from lower than $5 a share to greater than $325 because of the quick sellers getting squeezed out. Administration used this unprecedented curiosity to lift capital by diluting the brand new shareholder base, getting their fingers on some much-needed money. The turnaround story for the in-distress inventory has been nowhere close to the one projected by even probably the most optimistic bulls. Whereas GME trades at solely x1.19 NTM P/S, aside from a one-off freakishly sturdy March earnings report, it’s nonetheless burning via money, posting quarter over 1 / 4 of detrimental EBITDA and FCF with seemingly no finish in sight. SA Analysts joined the ranks of Road Analysts in unanimously ranking the meme inventory as an easy “Promote”, with a mean rating of two.12/5.00 and a pair of.00/5.00, respectively. The inventory additionally fell out of prominence among the many meme inventory crowd, having been ranked as solely the nineteenth hottest meme inventory in keeping with our information. This has not stopped company insiders from as soon as once more signaling confidence to the investor base by executing one other spherical of insider purchases. This quarter noticed three lively company insiders, Govt Chairman Ryan Cohen and Administrators Alain Attal and Lawrence Cheng. All of them purchased shares on June ninth for a mixed whole of about $10.3 million, with the bulk being purchased by Mr. Cohen, who’s already well-known for executing materials purchases within the first quarter of 2022, throughout the GME’s spectacular 150% surge. Insiders had been shopping for the shares whereas GameStop traded between $21 and $23, and the inventory can at present be bought for roughly the identical quantity immediately, being traded for $22.10 per share.

GameStop Company Q2 ’23 Insider Exercise (Quiver Quantitative)

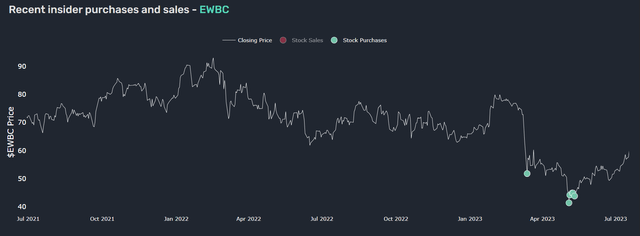

East West Bancorp, Inc. (EWBC)

Energetic Company Insiders: 9

One-12 months Efficiency: -10.9%

Whole Purchased Again: $1,638,336

East West Bancorp is the corporate with probably the most lively company insiders we had an opportunity to cowl immediately. We tracked 9 lively company insiders for the retail and business financial institution within the quarter. Whereas broadly falling below the class of a regional financial institution, EWBC is considerably particular within the context of providing monetary providers in China as properly. The distinctive story behind this financial institution is that it was actually based with a view to predominantly serve the wants of Chinese language American immigrants in Los Angeles. Since its beginnings within the Seventies, East West Financial institution has turn out to be one of many largest impartial banks headquartered in Southern California, with somewhat greater than 120 areas all through the USA and Asia. Much like the opposite banks we’ve lined immediately, it trades at a comparatively honest valuation of x7.32 NTM P/E and a P/TBV of x1.39. It has adopted the same value pattern as the opposite regional banks we mentioned, bottoming out in early Might, maybe considerably supported by appreciable insider quantity. It is misplaced about 11% of its worth year-to-date, becoming a member of the record of a number of the much less impacted regional banks. The financial institution holding firm is properly revered by SA Analysts in addition to Wall Road analysts, with each teams of analysts assigning it a “Purchase” ranking on common. Purchases got here between Might 4th and Might eleventh within the vary of $41 to $45 per share. In whole, they purchased round $1.6 million in firm inventory. Price noting right here, the COO opened a brand new place of 4780 shares, the EVP grew his stake by 23%, and two administrators grew their stakes by 77% and 28% respectively. Shares of East West Bancorp can at present be bought for $58.86.

East West Bancorp Q2 ’23 Insider Exercise (Quiver Quantitative)

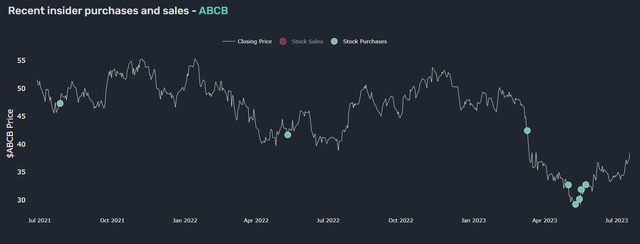

Ameris Bancorp (ABCB)

Energetic Company Insiders: 5

12 months-To-Date Efficiency: -14.1%

Whole Purchased Again: $1,228,549

ABCB is a financial institution holding firm that owns and operates Ameris Financial institution, a regional financial institution that’s engaged in retail banking, business banking, bank card lending, and the mortgage mortgage enterprise throughout greater than 200 areas within the Southeast and Mid-Atlantic of the U.S. The corporate represents one of many “youthful” regional banks based in Georgia again in 1971. Not like a number of the different regional banks, it has solely been reasonably impacted by the disaster earlier within the 12 months. Total, shares of the financial institution operator are down solely 14.1% year-to-date, nonetheless considerably underperforming the S&P 500 (SPY), however removed from a number of the different extra distressed shares. Even and not using a main sell-off, Ameris Bancorp will not be sitting at some closely stretched valuations; it’s traded within the open marketplace for an NTM P/E of 9.25x and a P/TBV of 1.29x, which means it trades solely at a small premium. This features a token 1.6% dividend yield at present costs. The Chief Technique and Threat Officers, in addition to the CFO and CEO, all purchased shares. Two administrators additionally made notable purchases themselves. Equally to ZION, the shopping for spree occurred from early to mid-Might, a time that now seems to have been a backside for a lot of regional financial institution shares. Each Road and SA Analysts stay pretty optimistic concerning the financial institution’s future potential, assigning it a “Purchase” ranking with a 4.00/5.00 and three.85/5.00 rating, respectively. Ameris Bancorp shares can at present be purchased for $39.70.

Ameris Bancorp Q2 ’23 Insider Exercise (Quiver Quantitative)

Different notable mid-cap purchases consists of Invoice Ackman’s Pershing Sq. doubling down on their Howard Hughes Corp. (HHC) place, shopping for shares on 3 dozen or so totally different events all through the second quarter, finally increase his stake to round 33% of the agency. Extra regional banks, Simmons First Nationwide (SFNC) and Texas Capital Bancshares (TCBI) loved intervals of notable insider purchases from April twenty eighth to Might sixteenth. Robust insider exercise was famous for MoonLake Immunotherapeutics (MLTX), Dish Community Corp (DISH), RenaissanceRe Holdings (RNR), Agree Realty Corp (ADC), Callon Petroleum (CPE), CNX Sources (CNX), and Cleveland-Cliffs (CLF), amongst others.

Closing Ideas

Considerably just like our insider exercise protection from final quarter, the well-established pattern of insider shopping for within the regional banking sector continues and has to this point proved relatively worthwhile for the insiders. It seems that financial institution insiders are nonetheless prepared to sign to the broader market that the banking disaster was, a minimum of so far as they’re involved, to a bigger extent overblown. It stays an open-ended query as to how lengthy traders are prepared to cope with depressed smaller-scale financial institution shares and whether or not this chance will stay open on the time once we write the third-quarter replace on the sequence.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.