MasaoTaira

Yesterday, SITE Centers (NYSE:SITC) announced several pieces of good news including:

Strong 3Q results and an increase in full year same store NOI guidance. The divestiture of ~15% of its total asset base at a cap rate of 6.5%. The company is contracted to sell another 6% of assets (at a similar price). Following these divestitures, Site has reduced leverage to a sector low 4x net debt-to-EBITDA. The planned spin-off of its convenience center assets (to be named Curbline). These are very high quality assets with the potential for significant long-term external (acquisitive) growth.

While I view all of this as being quite positive, shares of Site are actually down modestly as I write this. While the market might not like the overhang & complexity of the spin (one year to complete, spin will be externally managed by Site for up to two years), the asset divestures highlight Site’s deeply discounted valuation.

At $11.15 per share, Site trades at an implied cap rate of 9.4% which is a deep discount not only to its recent asset sales but also recent shopping center transactions. I see Site as a fantastic investment here with 60% upside in my base case.

Current Operational Results

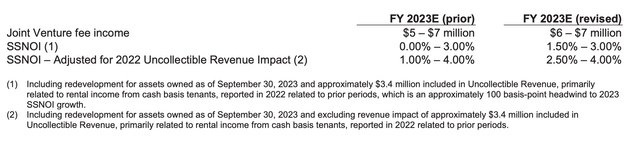

As you can see below, Site increased the low end of its full year NOI guidance on the back of continued strong occupancy and rental increases.

SITE Centers Updated FY Guidance (Quarterly Supplemental Report)

Like all of the shopping center REITs, SITE Centers is benefitting from powerful shopping center sector tailwinds including:

Lack of new supply built over the past 7-8 years Reduced retail bankruptcies Migration to suburbs/ 3 days per week work from home driving increased visitation to suburban shopping centers

These factors have led to multiyear highs in occupancy (hovering around 95%) and solid rental spreads.

Asset Sales

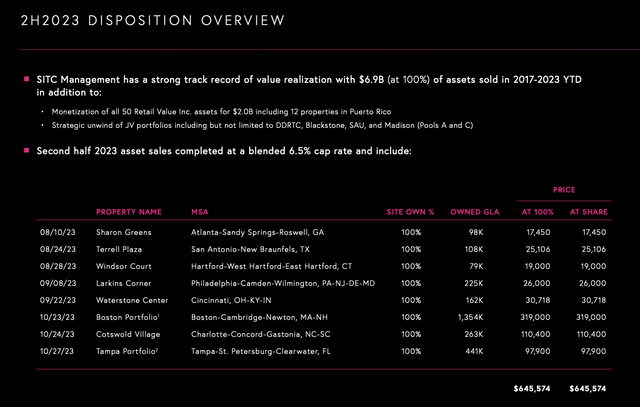

Thus far in the second half, Site has completed the sale of ~15% of its asset base at a 6.5% cap rate.

2H23 Asset Sales (SITE Centers Investor Presentation)

This is a lower cap rate (higher valuation) than the recent sale of Urstadt Biddle to Regency (REG) which was done at a 7.2% cap rate and Kimco’s (KIM) acquisition of RPT Properties (RPT) at an 8.1% cap rate. Given the dislocation in capital markets, it seems larger deals are struggling to attract buyers but smaller deals (bulk of Site’s recent sales are done as single asset sales) are still garnering multiple bids from private buyers leading to better pricing. To be sure, there could also be other asset specific factors here such as below market leases, development opportunities, etc.

Beyond the sale highlighted above, Site has contracted to sell another $242 million worth of assets (said contract price is also mid 6s). Following the completion of these transactions, Site now has the lowest leverage in the shopping center space with net debt of just 4x EBITDA.

Spin off of Convenience Asset (Curbline)

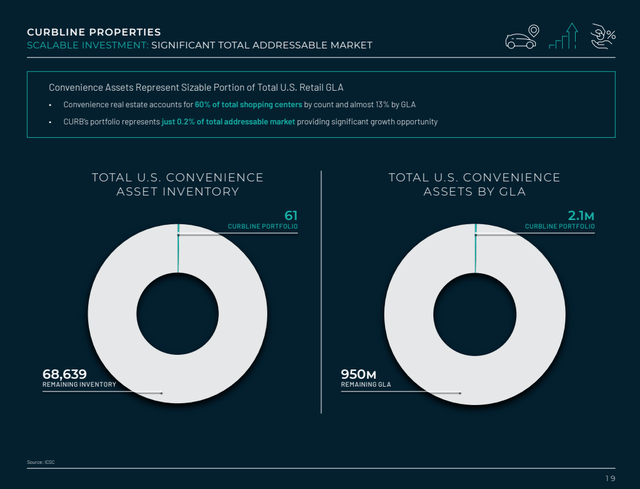

Convenience Assets (Site Investor Presentation)

Over the past three years, Site has acquired a portfolio of 61 convenience retail assets. Convenience assets differ from shopping centers in being smaller size (typically sub 30k square), much higher visitation/sales per square foot (3.5x level of shopping centers), and significantly lower ongoing capital expenditure requirements (sub 10% NOI vs. 20-25% for shopping centers).

Curbline will be the only REIT focused on convenience assets with a long potential runway for acquisitions.

Valuation

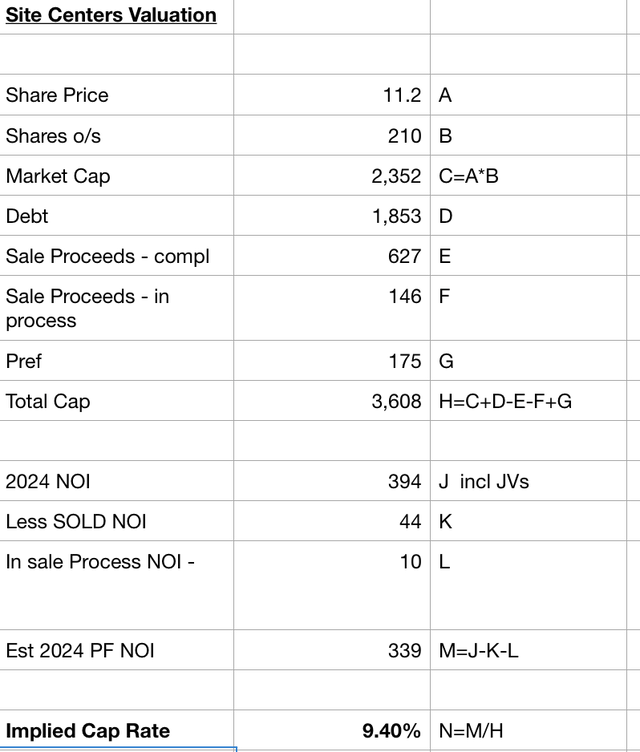

Below I show SITE Center’s valuation adjusted for the asset divestitures:

SITE Centers Valuation (Company Filings; Author Estimates)

Despite having just sold nearly $900 million worth of assets at a 6.5% cap rate, SITE Centers trades at a deep discount to recent sales. On the call, management noted that the quality of the remaining shopping center assets is similar to the recently sold assets. This makes sense given that SITE Centers divested its lower quality shopping centers (via the spin of RVI in 2018) and kept only its best assets.

Assuming a 6% cap rate for the convenience assets (higher value due to lower capital expenditure requirements) and a 7% cap rate for the remaining shopping center portfolio (conservatively pricing in a 7% discount to recent sales), I get a value of $17.50 per share, implying nearly 60% upside from today’s price.

Conclusion

Frankly I’m surprised that SITE Centers shares did not soar on this news. I have significantly increased my position in the shares following this announcement given the large discount to a private market value which is being actively realized. Further, I am excited to be a long-term owner of Curbline Properties given the high quality assets and long runway for consolidation.