Please note: Any type of viewpoints revealed listed below belong only to the writer. No info released listed below must be dealt with as monetary guidance.

In spite of expanding competitors in the shopping section,Sea Ltd has actually taken care of to attain its first rewarding year because going public in 2017. A rather small US$ 162 million in earnings in 2015 contrasted positively versus the loss of US$ 1.7 billion in 2022.

The securities market responded favorably, leaping as high as 11 percent throughout the other day’s session, prior to shutting the day at 5.6 percent, as some capitalists paid their gains out.

This bump has actually pressed the year-to-date rally forSea Ltd supply past 40 percent over simply 2 months, showing a return of positive outlook concerning its future.

Shopee wards off rivals

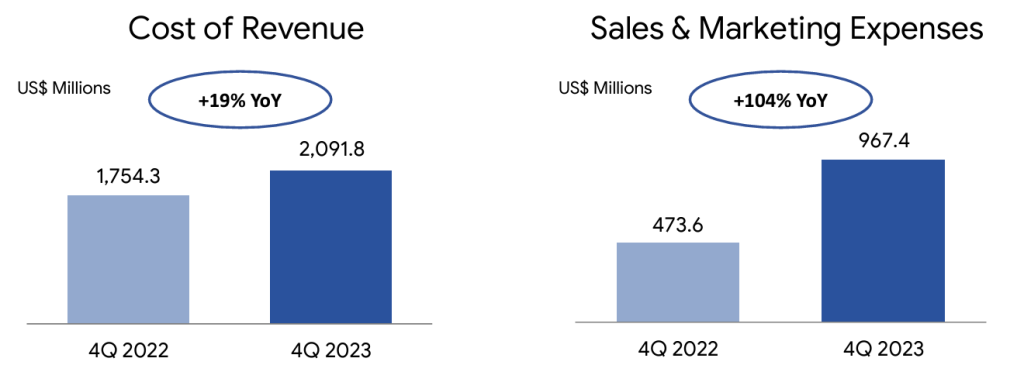

Remarkably, the favorable outcome was attained in spite of a turnaround of cost-cutting plan, which saw sales & & advertising expenditures drop in late 2022.

In the fourth quarter of 2023 the firm invested greater than two times on advertising tasks than it did the year prior to, coming close to US$ 1 billion, driven primarily by the reaction to competitors from Chinese business like Temu.

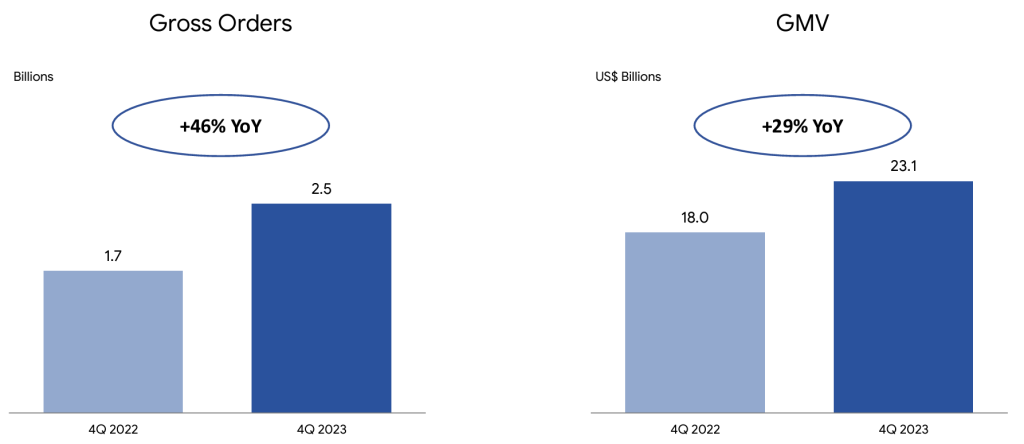

This has actually assisted to increase quarterly orders by 46 percent and the Gross Goods Worth by over US$ 5 billion contrasted to the Q4 of 2022.

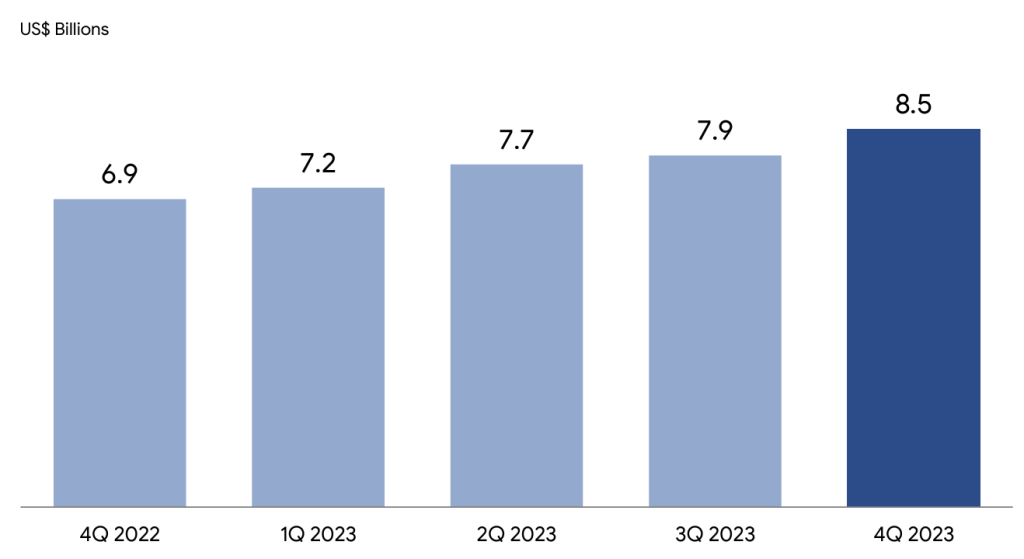

Many thanks to solid quarterly efficiency Shopee handled prevent analytical stagnancy for the whole 2023, as without the added 800 million orders in Q4 it would certainly have battled to reveal annual development.

This is most likely to end up being a reoccuring motif for Sea for the near future, as it attempts to stabilize the requirement to invest sufficient to drive acquisitions and remaining rewarding in a time of limited accessibility to low-cost resources.

In this context, possibly the very best information to find out of the firm is that it has actually taken care of to expand its cash money gets by an additional US$ 1.6 billion this year, revealing that liquidity must not be an issue (although it still can not invest virtually as high as it did prior to the beginning of worldwide rising cost of living in 2022).

Garena diminishes in fifty percent …

Every One Of the above is specifically excellent information considered that Sea’s golden goose, the electronic home entertainment arm Garena, has actually endured a depression in the post-pandemic globe, where individuals are no more stuck at home playing computer game.

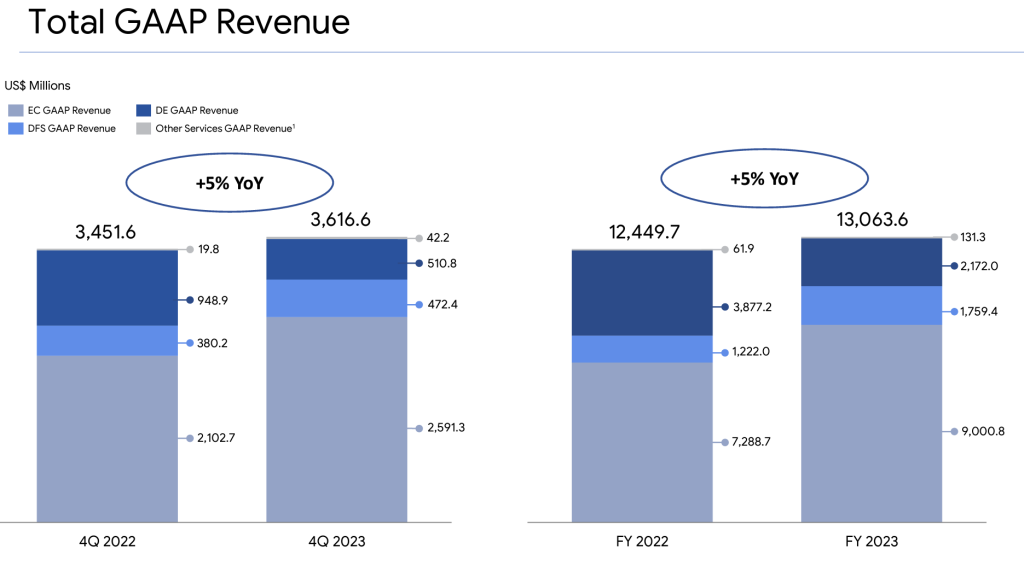

Earnings in the section dropped by over 46 percent, from US$ 948 million to simply US$ 510 million for the last quarter, and by 44 percent, from US$ 3.87 to simply US$ 2.1 billion for the whole year.

Every one of these numbers are listed below 50 percent of what the firm drew in from video gaming in 2021, when annual earnings covered US$ 4.3 billion, at the elevation of COVID-19 lockdowns.

… however SeaMoney fills up the void

Sea Ltd is in a continuous state of change in between its 3 basic companies. When one has a hard time others get.

Everything began with video gaming, which developed right into shopping– that currently gives the mass of the earnings and is most likely seen by capitalists as one of the most important component– and electronic financing, expanding at a suitable rate, having actually given US$ 1.8 billion in earnings, a rise of 44 percent over 2022.

This indicates that also as the structure of Sea’s earnings streams modifications, the overall number maintains climbing up.

In 2022 Garena brought in 3 times as much cash as SeaMoney did, however a plain year later on they were nearly head-to-head.

If the pattern proceeds (as it could offered the stagnancy in mobile video gaming) business that Sea was established on might be the tiniest of all by the end of 2024.

Nonetheless, Sea is seen primarily as an ecommerce firm and the lot of money of Shopee are most likely to determine exactly how it prices in the following couple of years, prior to electronic financial can develop itself as a powerful cash manufacturer. Already, electronic home entertainment could end up being a side note in its publications.