tdub303

A few days ago, Range Resources (NYSE:RRC) released its Q3-2023 earnings report with figures quite in line with analyst expectations. Indeed, the stock price was not affected by strong movements and there were no significant increases in trading volumes. In this article, I will provide an overview of Range Resources’ financial and operational results and I will explain the reasons behind my BUY recommendation. Indeed, I believe that Range Resources is well positioned to get the most out of the long-term improving natural gas fundamentals such as demand and price growth.

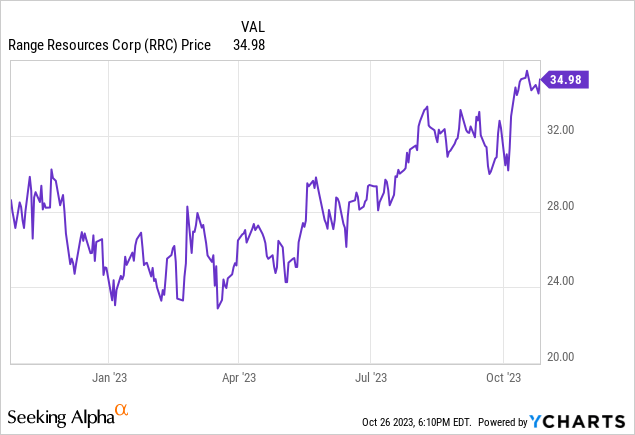

Stock performance

Range Resources is currently trading at $34.7/share, equivalent to a market cap of $8.3 bn. Since the beginning of the year, the stock is up 40% while the increase over the last 52 weeks is 47%. When I wrote my last article about Range Resources, the stock was trading at $26.8/share and has appreciated by 30%. The 52-week minimum is $22.8/share and was recorded on March 17th, 2023, while the 52-week maximum was $35.4/share, recorded a couple of weeks ago (October 17th, 2023).

Q3-2023 production volumes, sales, and costs

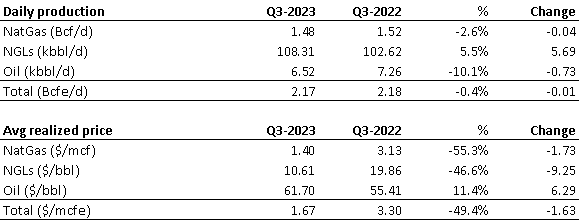

Total sales for Q3-2023 were $607 M, down 45% year-on-year (from $1.1 bn) mostly due to declining commodity prices and, only partially, to changes in production volumes. Revenues from natural gas, oil and NGLs were down 63% y-o-y to $526 M: as one can see from the table below, the overall daily production declined only 0.4% y-o-y with the drop in natural gas and oil that was counterbalanced by the increase in NGLs production. However, the decline in prices was quite strong with the average realized price for natural gas down 55% y-o-y to $1.40/mcf and NGLs down 46% to $10.6/barrel.

Range Resources

Even revenues from brokered natural gas declined by 67%, from $132 M to $43 M. Looking at the hedging impact, in Q3-2022 the impact was quite negative (-$457 M) while in Q3-2023 the impact was positive at +$38 M. If we exclude the impact of hedging, revenues pre-hedging in Q3-2023 were $569 M compared to $1.5 bn one year before.

Total operating expenses declined 20% y-o-y, from $677 M to $544 M. The main cost items were transportation, processing and compression cost, down 14% to $277 M and D&A, down 3% to $87M.The cost for brokered natural gas significantly declined as well by 64% y-o-y to $46 M while interest expenses declined by 21% to $30 M due to a lower amount of outstanding debt.

Net income was positive at $49 M, and, as one would expect, it was down 87% year-on-year for the aforementioned dynamics.

Cash flows and debt

Cash flow from operation was positive at $751 M while cash flow from investing activities was negative at -$443 M, mostly due to additions of new acres (-$421 M). Cash flow from financing was negative as well at -$145 M and was the result of several events, among which the most important are:

Repayment of senior notes for $61 M Dividends paid for $58 M Taxes paid for withheld shares for $39 M.

Overall, net cash flow was positive at $162 M, bringing the cash and cash equivalent position to $162 M (at the beginning of 2023, cash was very close to zero). The total outstanding debt is about $1.7 bn, leading to a net debt of $1.6 bn equivalent to 19% of the current market capitalization. As declared by Range Resources’ top management, the target net-debt to be reached in the next years is less than $1.5 bn. Considering the deleverage trend that the company has followed over the past years, with net debt almost halved from $3.1 bn in 2020, I believe that the $11.5 bn target is realistic and could be already reached either in Q4-2023 or Q1-2024

Stock repurchase program

In 2019, Range Resources’ board of directors approved a stock repurchase program that allowed the company to buy back shares in the open market. During FY2022, the company repurchased almost $400 M worth of shares and, at the beginning of 2023, it had an authorization for a potential buyback up to $1.1 bn. However, as of Q3-2023, only about $10 M worth of shares were repurchased. From my point of view, Range Resources will not exercise any buy-ack in Q4-2023 since the favorable market dynamics are likely to be sufficient to sustain the current stock price and even offer the possibility for further growth. I believe that the same approach will be followed even in the first quarters of 2024, with cash being used to reduce debt and carry out new capital investments rather than buy back shares.

Range Resources’ strengths

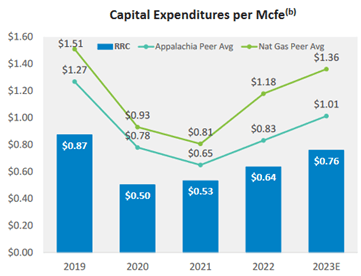

Being one of the top 10 US producers of natural gas and NGLs, Range Resource is well positioned to deliver value through the commodity cycles. The company has a large acreage with 70k net acres in Northeast Pennsylvania and 450k net acres in Southwest Pennsylvania. In addition, Range Resources had been able to develop a cost advantage versus its peers thanks to the large contiguous acreages to the point that the capital expenditure per Mcfe is well below the one of its peers. Moreover, during the Q&A call with analysts, there was a technical topic that was discussed that I believe is of relevance. For 2023, Range Resources was planning to drill 51 wells but so far it has drilled only 19 long lateral wells and 12 are expected to be drilled in the remaining part of 2023. Considering that the company still expects to turn 650k acres to sales in 2023, then I believe it means that the 19 lateral wells drilled (plus those still to be drilled) were extremely efficient. In addition, from the Q&A I also understood that Range Resources is going to build an uncompleted well (DUC) backlog of about 10-15 wells: my guess is that the reason behind this choice is to allow for flexibility and to make the company ready to complete wells to potentially exploit higher natural gas prices in 2024 or 2025.

Range Resources

Another strength of Range Resources is represented by its flexible market outlets, with the company being able to market its natural gas and NGLs either to the US domestic market or to international markets. In particular, about 25% of produced natural gas is destined to LNG plants allowing Range Resources to potentially export LNG volumes to Europe if prices in that market are higher.

Commodity outlook

Focusing on natural gas, the EIA (US Energy Information Administration) forecast a constant supply throughout 2024 mostly due to reduction in gas rigs. On the other hand, US natural gas demand is forecast to increase by up to 20 Bcf/d in 2027 driven by pipe exports to Mexico and industrial consumption. In this context, Range Resources could benefit from its large acreage position to increases its production volumes.

For what concerns NGLs, the IEA (International Energy Agency) forecast LPG and ethane demand to be among the highest growing energy products over the medium term. Once again, Range Resources, with its large NGLs production, is well positioned to take advantage of the increase in demand.

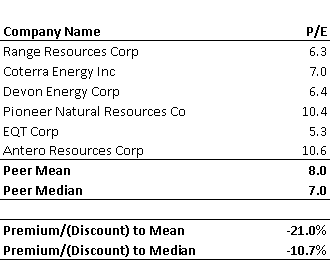

Peer multiple comparison

In order to have a better understanding of how Range Resources is trading versus peers, I selected a panel of similar US based oil and gas companies, and I compared their price-to-earnings multiple. As one can see from the table below, Range Resources P/E is 6.3x and it is roughly at 21% discount to the mean ratio, 8.0x, and at 11% discount to the median value, 7.0x. From my point of view, the reason why Range Resources is trading at a lower multiple than peers is due to its production being mostly gas, with only a minor production of oil. After the past months with gas prices at incredibly high prices, the NBP, TTF and other gas reference prices are now back to more standard levels while Brent and WTI are still trading at higher levels. Consequently, O&G investors are probably more attracted to invest in companies with more oil production since are likely to generate higher FCFs, thus increasing their P/E ratio. However, I firmly believe that Range Resources also offers many upsides and, therefore, it represents a cheap opportunity to add an O&G company to the portfolio.

Thomson Reuters

Wall Street consensus overview

Range Resources is currently covered by 27 equity research analysts from Wall Street investment banks. 14 of them have a Buy or Strong Buy position while 10 analysts have a Hold rating, even though these valuations are not recent. The average target price is $36.4/share, which would represent a 4% upside on the current target price.

Risks

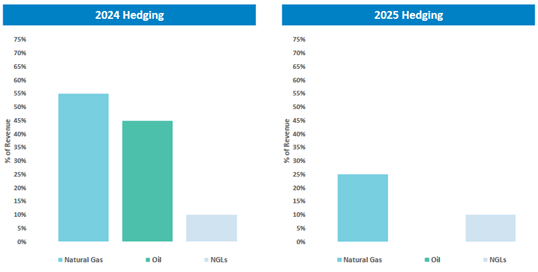

The main risk to which Range Resources is exposed is represented by the volatility of commodity prices such as natural gas and oil prices. To mitigate this risk, the company uses some derivatives instruments to hedge production volumes at certain pre-determined price levels. On one side, this allows Range Resources to have a minimum selling price that is not too low, however, on the other side, hedging could also set a maximum cap to revenue generation.

As it is possible to see from the charts below, 55% of 2024natural gas production is hedged at prices between ($3.40/mcf and $3.94 mcf) while 45% of oil volumes is hedged at $71.3/barrel. For 2025, oil is not hedged at all while 25% of natural gas volumes are hedged at $4.12/mcf.

Range Resources

Conclusion

Overall, Range Resources is a solid company with a sound balance sheet and a clear path to deleverage. The company has low CapEx costs, particularly if compared to peers, allowing it to be profitable even with lower commodity prices. Moreover, the increase in natural gas and NGLs demand will benefit large producers such as Range Resources, therefore, I recommend buying shares of Range Resources.