cagkansayin/iStock via Getty Images

Thesis

The Global X Variable Rate Preferred ETF (NYSEARCA:PFFV) is a fixed income exchange traded fund. The vehicle focuses on financial services preferred equity with a variable rate coupon. This feature has helped the fund maintain a low duration profile and reduce the negative drag from higher rates in the past year.

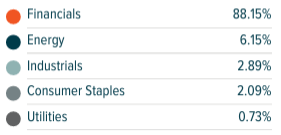

The fund is extremely financials heavy, the sector making up over 88% of the ETF collateral. Banks are generally heavy issuers of preferred securities due to their advantageous capital treatment on a bank’s balance sheet. The 2008-2009 financial crisis brought about a plethora of regulatory changes, with regulatory capital being a main magnet for new legislative initiatives.

Going through the collateral tape, the vast majority of the names in this ETF are large, well-capitalized financial institutions. Default risk is not a concern in this fund for us, however credit spreads are.

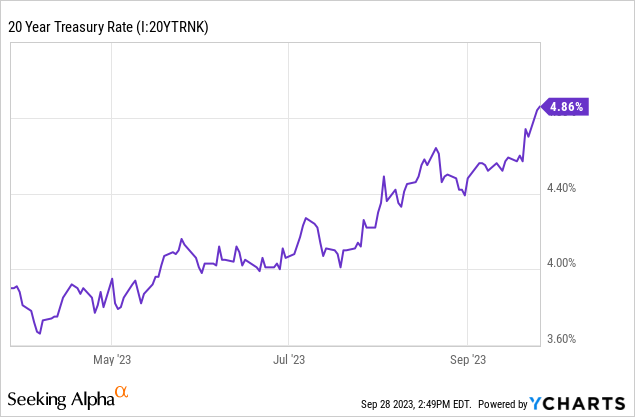

What we are currently witnessing is an unprecedented rally in long term yields, on the back of the ‘higher for longer’ Fed mantra. To that end, 20-year yields have moved over 120 bps in the past 6 months:

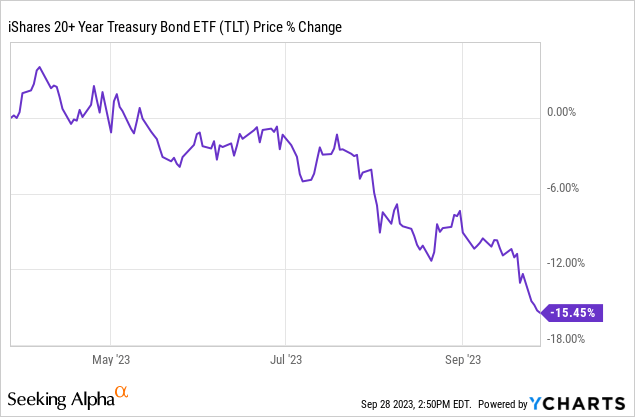

The duration implications for long end bonds are dire, with the iShares 20+ Year Treasury Bond ETF (TLT) being a prime example:

The fund is down -15% during the past six months on the back of the move higher in yields.

Higher interest rates produced a regional banking crisis in March this year, when issues around ‘held to maturity’ and ‘available for sale’ bonds came to fore. While none of the large systemically important institutions defaulted, we did see a forced marriage between UBS and Credit Suisse, while several U.S. regional banks went into receivership. The relentless move higher in yields in the past months will not be without consequences, especially since the move has accelerated in September.

Violent and sudden moves in long yields like the one we are experiencing now take time to make their way to bank’s quarter end reports and capital ratios, but they will have a negative effect.

We are of the opinion that we will yet again experience trepidations in financials later this year, as a direct result of the current violent swing higher in yields. While none of the names in the collateral pool here are at risk of default, they will experience however wider credit spreads:

GS 6.29 PERP (ChartMill)

The above is the graph of one of the securities present in the fund, namely the Goldman GS 6.29 Perp bond. If we have a look at the price graph for the name, we can see a rough -10% price decline in March, which was followed by a slow recovery. As a reminder, we actually experienced lower long rates in March on the back of the banking shock, but wider credit spreads. PFFV experienced a similar drawdown in March:

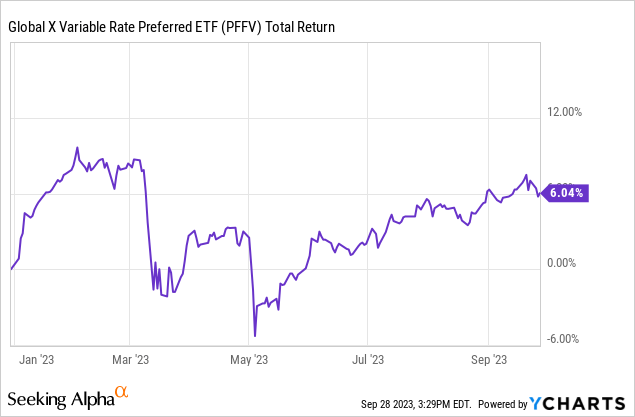

YTD Fund Performance (Seeking Alpha)

We can see the fund’s price chart move from +6% to -3%, a rough -9% drawdown, quite similar to the GS perpetual performance.

Expect another similar drawdown in the next few months for this fund, followed by a similar recovery. While the ETF has managed duration very well, it cannot eliminate its sensitivity to credit spreads.

Holdings

The fund has a very high concentration to securities coming from financial services institutions:

Sectors (Fund Fact Sheet)

Its top holdings represent issuances from systemically important institutions:

Top Holdings (Fund Website)

To note that the fund is fairly concentrated, with all its top holdings above 1% of the fund holdings, and in aggregate representing over 30% of the ETF. The fund only has 60 names overall in its composition.

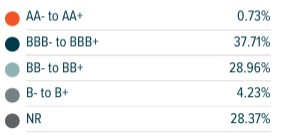

From a ratings’ standpoint, the collateral pool is evenly split among investment grade securities, junk ones and not rated:

Ratings (Fund Fact Sheet)

In our mind there is less of a scope in terms of ratings here since financial services preferred issuances tend to be below investment grade due to their subordination, but also due to the binary nature of the institutions. One does not get a slightly degrading situation over years of lower profitability here. Banking troubles happen very fast due to the funding profile of the institutions, and the usual demise happens in months, not years. Therefore, the rating profile for this asset class / industry should always be taken with a grain of salt.

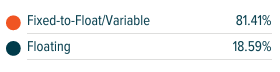

The vast majority of the collateral pool here is fixed-to-floating, which has helped the fund navigate the duration trepidations of 2022 very well:

Coupon Type (Fund Fact Sheet)

The primary issuance market usually works with a 5-year non-call period, after which the bonds switch to a floating rate plus a spread if they are not called. In today’s environment where risk-free rates are above 5%, variable rate bonds are suddenly extremely attractive since they can generate all-in yields in excess of 10% if not called. Let us have a look at one of the bonds in the collateral pool as an example:

Individual Bond Example (Prospectus)

This is the 6.35% Athene security, which is the 5th largest fund holding. As per its prospectus, the security will switch to a floating rate if not called in 2029:

Beginning on June 30, 2029, any such dividends will be payable on a non-cumulative basis, only when, as and if declared by our Board of Directors or a duly authorized committee thereof, at a floating annual rate, which is reset quarterly, equal to three-month LIBOR (as defined herein) plus 4.253% of the liquidation preference per annum

Performance

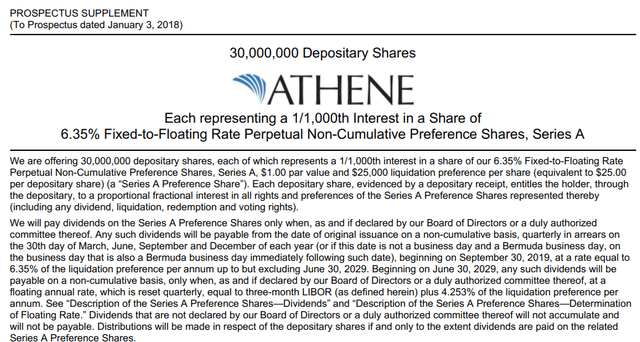

Due to its overweight positioning in variable rate collateral, the fund has been able to outperform long term the much better known iShares Preferred and Income Securities ETF (PFF):

The two vehicles have very similar total return profiles until the Fed started raising rates in 2022, after which PFFV outperformed. Expect a mirror situation when the Fed eventually starts lowering rates, with PFF better set-up to take advantage of lower Fed Funds via a higher duration profile.

The fund is back up after its credit spread shock in March:

Its total return as of now has been mainly driven by its 6.5% dividend yield, after credit spreads returned to their start of the year levels.

Conclusion

PFFV is a fixed income ETF. The fund focuses on financial services preferred securities, in particular fixed to floating ones. This feature has reduced the fund duration and helped it outperform the much better known PFF ETF.

While the fund has dealt very well with duration and default risk, it cannot eliminate its sensitivity to credit spreads. We saw the name experience a -9% drawdown in March, on the back of a blow-up in credit spreads during the regional banks’ crisis.

With long rates higher by over 120 bps since, and an extremely aggressive move higher in September, do expect another flare-up of banking capital issues stemming from unrealized losses from held-to-maturity portfolios. Such an occurrence would widen credit spreads again here and cause a drawdown.

We like PFFV for its nice exposure to rock-solid large financial institutions preferred securities, but we would not add any exposure here. Hold for now, clipping the yield, looking to add only on the back of another banking meltdown.

![It was all going well until… | Squid Game 2 | Netflix [ENG SUB] It was all going well until… | Squid Game 2 | Netflix [ENG SUB]](https://thehollywoodpremiere.com/wp-content/uploads/2025/01/It-was-all-going-well-until-Squid-Game-2-120x86.jpg)