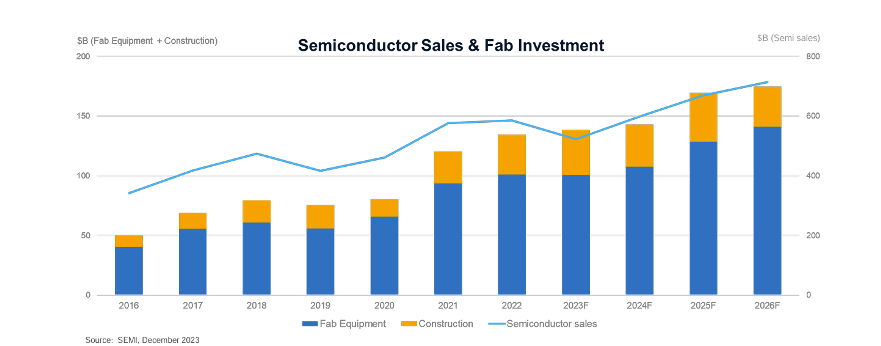

At ISS 2024, SEMI reported that fab devices sales seem level in 2024– best around $100 billion. We will not understand for certain till the last numbers are in for the year, yet presently, it’s a respectable price quote. TechInsights has wafer fabulous devices (WFE) coming in a little favorable for 2023 and near $100 billion.

The WFE number is a little a shock when chip sales are anticipated to be down around 10%. Generally, when chip sales are adverse, devices sales are a lot more adverse. Nonetheless, you would certainly need to go back to the 2012, and 2013 recessions to locate years where devices growth was less than chip growth. Chip growth came in at -3% and +5 specifically and WFE growth was -12% and -2%. In 2019 chip sales were down 12% and WFE was down just 8% a flip flop from historic standards.

The concern is what has been driving the more powerful devices growth over these previous couple of cycles?

From paying attention to semiconductor devices firm incomes phone calls in 2023, 2 brilliant places have actually shown up. One is in the power, analog, and auto fields, as business in this room are investing to raise capability to match need in the commercial and auto room. EVs and sustainable power have actually expanded significantly. Applied Products mentioned a document 200mm sales in their 2nd financial quarter.

The various other brilliant place has actually been the devices rampin China On January 25, 2024, Digitimes released that China had actually imported over 400 lithography devices from ASML over the previous 5 years. In 2022 and 2023, 78 and 176 lithography systems were imported specifically. The post took place to point out that according to information from the General Management of Traditions of China, China imported $27.4 billion of IC production devices in 2023. This mores than a quarter of WFE investing in 2023. It is additionally a rise of 46.48 % according to the Digitimes post.

In 2023 ASML reported that roughly 29% of its income originated from China, the Digitimes post makes a large offer concerning that number; nonetheless, in examining various other leading devices producers’ China income over the previous 4 quarters it varies from a reduced of 27% for Applied Products, to a high of 36% for Dia Nippon Display. Lam Research Study, TEL, and KLA all aim to have actually obtained over 30% of their income from China in 2023. So, utilizing the old stating, an increasing trend raises all watercrafts, China aided to make the year for semiconductor devices business beyondChina As I explained in a current blog site, Chinese devices business done also much better in China throughout 2023.

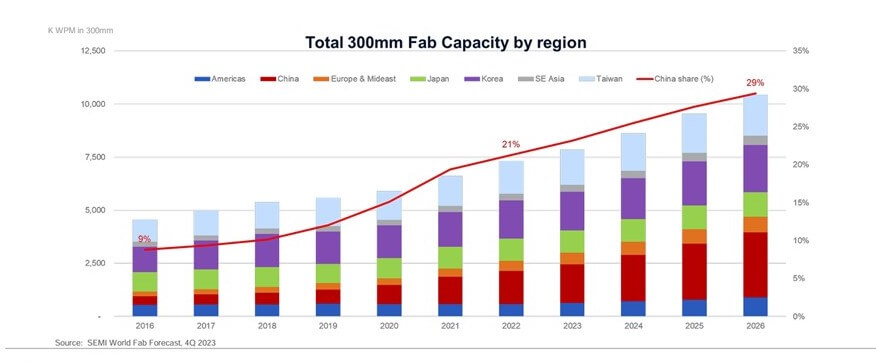

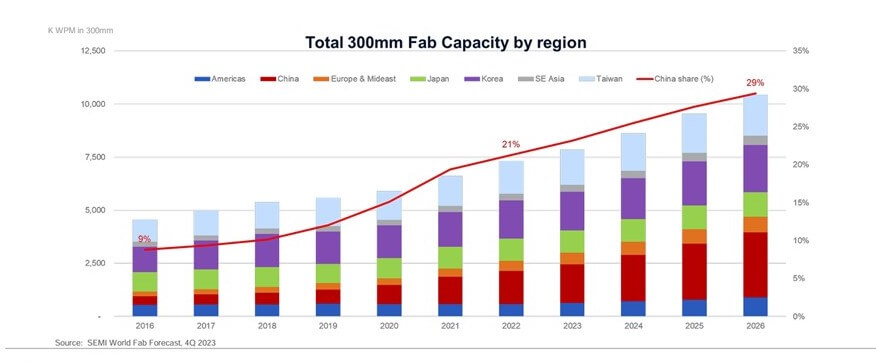

According to SEMI’s marketing research team, China isn’t reducing. SEMI is projecting China’s capability to maintain expanding at a considerable price over the following couple of years. For 300mm, SEMI anticipates China to have 29% of the around the world capability in 2026, boosting from 21% in 2022 (Number 2). The 200mm capability is anticipated to expand from 16% to 24%. And shop capability is anticipated to get to 42% in 2026 up from 27% in 2022, exceeding the Taiwan shop capability developments.

China has its objective established on being much more chip-independent and investing much less than $300 billion a year on importing semiconductors. To complete these objectives, they are investing a great deal of cash on fabs and devices, and in some situations developing JVs to obtain the best chips for their markets. So, will the European and United States CHIPS Acts aid to raise Europe’s and the United States’s capability? A little, yet as Peter Wennink just recently commented, the EU chip objective is impractical. I’ll include in as is the CHIPS Act in the United States. China has a considerable running start and it will certainly take substantial financial investment by the EU and United States to capture up, and it is not likely political leaders and investors will certainly remain to money the workout to get to the wanted objective of 20%.