Hispanolistic

Final month, administration of Medical Properties Belief (NYSE:MPW) offered an investor replace presentation that highlighted the case for the corporate’s inventory worth to be greater. Whereas the corporate made a number of good factors to justify an funding of their inventory, the absence of sure money move info leads me to consider they might want to tackle extra leverage to fulfill their present dividend obligations.

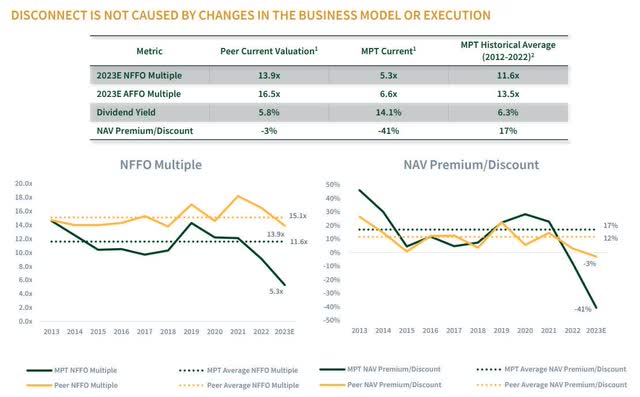

The presentation began by highlighting the low cost in Medical Properties Belief inventory worth in relation to its friends. Traditionally, the corporate traded at a slight worth to earnings and worth to e book reductions in comparison with its friends. Now, the inventory is buying and selling at lower than half of the earnings a number of of its friends and at higher than 40% low cost to e book worth (listed as internet asset worth).

Medical Properties Belief, June Investor Replace

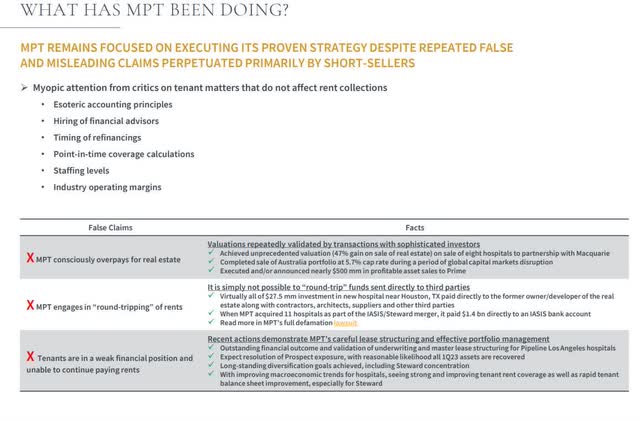

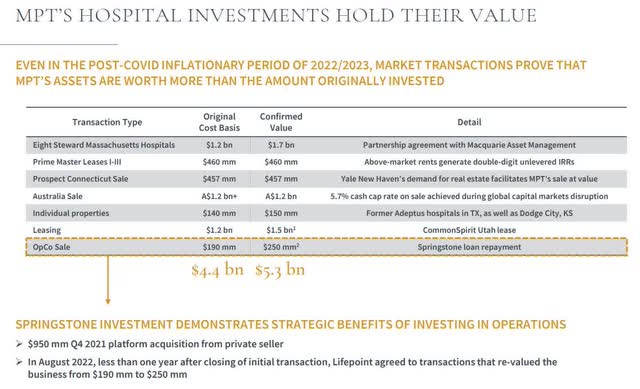

Administration believes the share worth is being pushed down by a sequence of false narratives surrounding how the corporate acquires properties, the way in which it handles rents, and the monetary situation of its tenants. Administration successfully demonstrates how the corporate is unlocking the worth of its belongings by way of above market rents, partnership agreements, leasing agreements, and asset gross sales above their value. Moreover, the corporate’s response to the monetary situations of its tenants does maintain advantage, as even chapter doesn’t imply tenant rents can’t be collected.

Medical Properties Belief, June Investor Replace

Medical Properties Belief, June Investor Replace

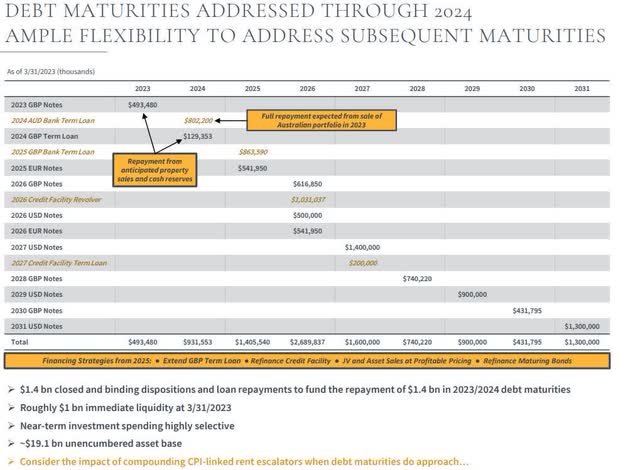

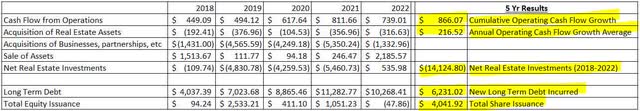

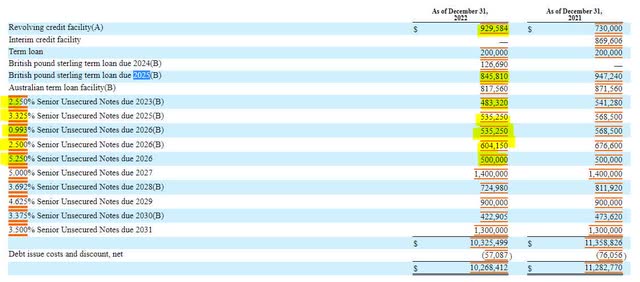

The place I start to get involved with the corporate’s outlook is when the presentation begins outlining the numbers. Whereas Medical Properties Belief has its 2023 and 2024 debt maturities coated, it’s using money available and asset gross sales to fund these maturities. This could lead the corporate to have much less liquidity and a smaller steadiness sheet when it comes time to deal with the $1.4 billion in maturities coming due in 2025. These challenges are available in mild of the corporate having expended practically all of its working money move on dividends, leaving capital expenditures to be financed by asset gross sales.

Medical Properties Belief, June Investor Replace

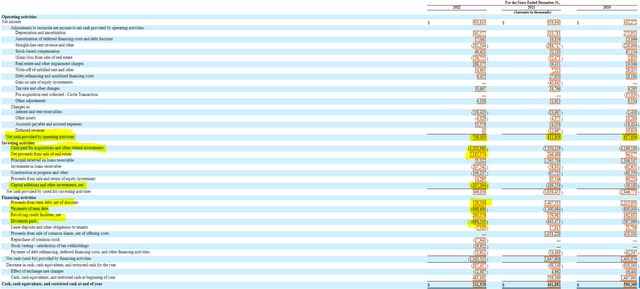

SEC 10-Okay for 2022

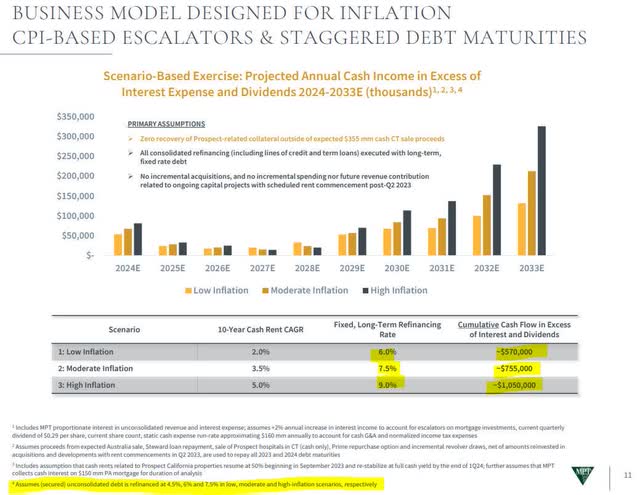

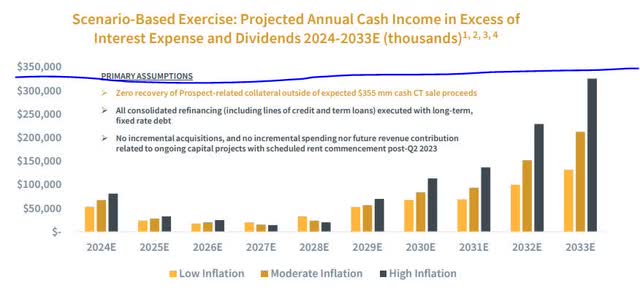

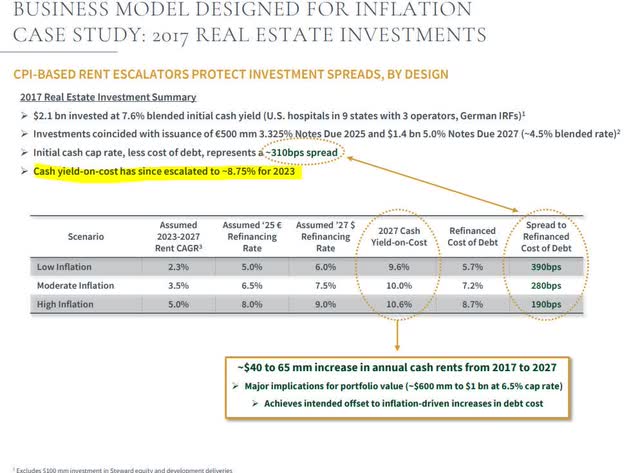

My issues over the enterprise enlarge when inspecting the annual money projections that administration introduced for the subsequent 10 years. These projections had been designed to guarantee buyers that the group was protected by excessive inflation, and consequently, greater rates of interest. Medical Properties’ administration is projecting earnings to say no notably from 2025 by way of 2028 and rebound into the subsequent decade. My greatest downside with this projection is that whereas it contains dividend funds, it excludes capital expenditures.

Medical Properties Belief, June Investor Replace

Based mostly on the final two years of monetary information, Medical Properties Belief has spent roughly $300 to $350 million per 12 months in the direction of capital expenditures. When that quantity is included within the administration projections, a completely totally different image seems. Based mostly on the looks of the amended chart, Medical Properties goes to conservatively want $250 million per 12 months from 2024 to 2030 ($1.75 billion whole) in funding to cowl capital expenditures. Even beneath the excessive inflation assumption, 2033 outcomes nonetheless are available in just below capital expenditure want.

Medical Properties Belief, June Investor Replace with CapEx Line Added

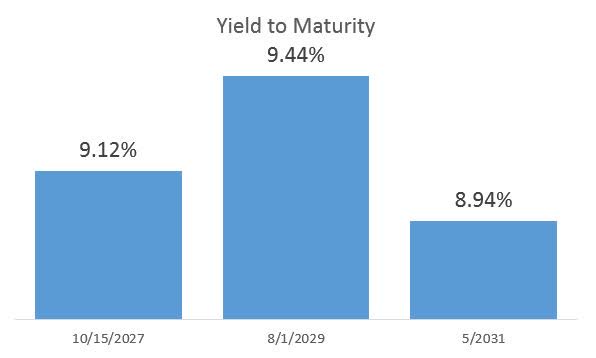

One other concern I’ve with the mannequin is the debt refinancing assumptions. Administration states that of their three eventualities, rates of interest on refinanced debt are assumed to be 4.5%, 6%, and seven.5%, on secured debt and 6%, 7.5%, and 9% on unsecured debt. Sadly, we’re in an surroundings of declining inflation and Medical Properties Belief debt is simply now buying and selling at round 9% after a latest rally. Whereas it’s doable for brand new debt to be financed at these ranges, I’d think about administration projections to be barely optimistic and in potential hassle if the corporate had been to obtain a credit score downgrade.

FINRA information in Spreadsheet

One other concern I’ve is concerning the return on invested capital or returns primarily based on funding. In direction of the tip of their presentation, administration presents the case that their capital investments have outperformed debt financing prices. They use belongings acquired in 2017 to indicate how the returns outpaced projected refinancing prices by 190 to 390 foundation factors.

Medical Properties Belief, June Investor Replace

The issue I’ve right here is the examine doesn’t incorporate past one time limit. By wanting on the money move statements courting again to 2018, I discovered that Medical Properties Belief has invested $14 billion (internet of asset gross sales) into capital expenditures during the last 5 years. To attain this, they borrowed $6.2 billion in long run debt and issued roughly $4 billion in shares. The result’s an estimated $216 million improve in annual working money move or 152 foundation factors of actual property investments.

TIKR

The issue is that Medical Properties has not generated sufficient money to cowl its dividends and capital expenditures mixed. It will change into problematic when low rate of interest debt matures over the subsequent 4 years, and be refinanced with greater rates of interest that may erode money move technology. Administration may subject new shares, however not with a value of capital over 11.5% (present dividend yield). Lowering the dividend would improve the corporate’s choices for elevating money whereas concurrently reducing the necessity for money.

SEC 10-Okay for 2022

I’m nonetheless bullish on holding Medical Properties Belief debt as an excellent earnings funding. I consider that administration will ultimately discover faith and alter the dividend to extra precisely replicate the present state of the enterprise and the headwinds they’re projecting for the second half of this decade.

![It was all going well until… | Squid Game 2 | Netflix [ENG SUB] It was all going well until… | Squid Game 2 | Netflix [ENG SUB]](https://thehollywoodpremiere.com/wp-content/uploads/2025/01/It-was-all-going-well-until-Squid-Game-2-120x86.jpg)