primeimages

Fund Traits

P/V Ratio

Mid-60s %

Money

1.3%

# of Holdings

26

Click on to enlarge

Annualized Complete Return

2Q (%)

YTD (%)

1 Yr (%)

3 Yr (%)

5 Yr (%)

10 Yr (%)

Since Inception (%)*

Worldwide Fund

1.35

13.82

18.26

4.62

0.22

2.93

6.12

FTSE Developed ex-North America

3.10

11.39

17.97

8.65

4.15

5.43

5.47

Click on to enlarge

*Inception date 10/26/1998

Returns replicate reinvested capital good points and dividends however not the deduction of taxes an investor would pay on distributions or share redemptions. Efficiency information quoted represents previous efficiency. Previous efficiency doesn’t assure future outcomes. The funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when redeemed, could also be price kind of than their unique value. Present efficiency of the fund could also be decrease or increased than the efficiency quoted. Efficiency information present to the newest month finish could also be obtained by visiting southeasternasset.com. The prospectus expense ratio earlier than waivers is 1.26%. The expense ratio is topic to a contractual payment waiver to the extent the Fund’s regular working bills (excluding curiosity, taxes, brokerage commissions and extraordinary bills) exceed 1.15% of common internet property per yr.

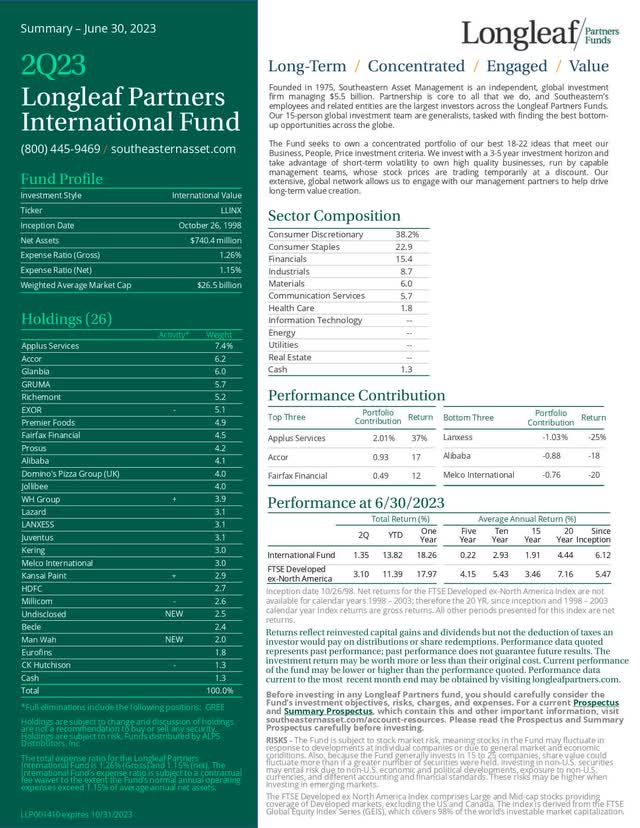

Longleaf Companions Worldwide Fund added 1.35% within the second quarter, taking year-to-date (YTD) returns to 13.82% for the primary half. Whereas the portfolio’s lack of publicity to Info Know-how and obese to Asian Client Discretionary weighed on outcomes, the Fund outperformed the FTSE Developed-ex-North America Index within the first half. The second quarter noticed a continuation of our European companies driving optimistic returns because the market rewarded optimistic bottom-up operational and monetary progress, whereas geopolitics and the slower consumption restoration in China remained a drag on the remainder of the portfolio.

In Europe, most of our companies delivered robust monetary efficiency on the again of a difficult yr in 2022, and our administration groups continued to take steps to create worth via clever capital allocation and strategic motion to crystallize the worth of entire companies and/or underlying property. Our companies which have publicity to China (together with German-listed enterprise LANXESS (OTCPK:LNXSF) (OTCPK:LNXSY)) had been challenged within the quarter amid ongoing unfavorable geopolitical sentiment and a slower-than-anticipated Covid reopening restoration, leading to disappointing client spending. 70% of Chinese language family property are uncovered to the property sector, which faces a continued downturn with property gross sales at 60% of pre-Covid ranges. The re-opening increase is unlikely to be sufficient to achieve the 5% development goal for the yr. Beijing is taking discover and is anticipated to move via coverage responses. Within the meantime, near-term share worth weak point has created a chance for our administration groups to go on offense. Alibaba (BABA) purchased again $14 billion price of shares within the final 14 months (with one other $17 billion to go) and introduced plans to interrupt itself up into six totally different companies to get the worth acknowledged. Prosus (OTCPK:PROSY) (OTCPK:PROSF) equally introduced a transaction to simplify the enterprise by eradicating the cross-holding construction with Naspers (OTCPK:NPSNY) (OTCPK:NAPRF) and has additionally purchased again roughly one-quarter of its free float shares within the final 12 months since saying its open-ended buyback program.

The Fund’s means to provide robust relative outcomes just isn’t predicated on a China market restoration. Our companies have robust steadiness sheets and pricing energy enabling them to navigate difficult exterior environments and persistently generate rising free money stream coupons. This has translated into stable inventory efficiency for many of our portfolio holdings. In circumstances the place there’s a persistent hole between worth and intrinsic worth, our administration companions proceed to make use of all of the instruments inside their energy to develop and acknowledge worth through buybacks, spin-offs, and divestitures.

We encourage you to look at our video with Portfolio Managers John Woodman and Manish Sharma for a extra detailed evaluate of the quarter.

Contribution To Return

2Q Prime 5

Firm Title Complete Return (%) Contribution to Return (%) Portfolio Weight (%) (6/30/23) Applus Providers 37 2.01 7.4 Accor 17 0.93 6.2 Fairfax Monetary 12 0.49 4.5 EXOR 8 0.47 5.1 GRUMA 9 0.45 5.7

Click on to enlarge

2Q Backside 5

Firm Title Complete Return (%) Contribution to Return (%) Portfolio Weight (%) (6/30/23) LANXESS -25 -1.03 3.1 Alibaba -18 -0.88 4.1 Melco Worldwide -20 -0.76 3 Millicom -20 -0.7 2.6 Kering -14 -0.5 3

Click on to enlarge Applus Providers (OTCPK:APLUF) – Diversified Spanish testing inspection and certification (TIC) enterprise Applus was the highest contributor within the quarter and for the primary half. In June, non-public fairness agency Apollo World made a $1.33 billion bid for the whole enterprise, and there may be rumored curiosity from extra non-public fairness patrons for the corporate. All through our possession interval, we’ve got been engaged with administration and the board to encourage getting the worth acknowledged, and the corporate purchased again 10% of the market cap prior to now yr. Though we imagine the Apollo bid undervalues Applus, the non-public fairness curiosity highlights the strategic nature of this high-quality enterprise inside a structural development {industry}. We stay carefully engaged on this dynamic scenario. Accor (OTCPK:ACRFF) (OTCPK:ACCYY) – French hospitality enterprise Accor was one other high performer within the quarter and YTD. Accor is a number one international lodge operator in Europe, Asia, and Latin America. The enterprise lagged its North American friends given a slower post-Covid restoration in its key markets however in the present day is reporting revenue-per-average-room (REVPAR) above pre-Covid ranges, with robust pricing energy and excessive occupancy charges. Throughout Covid, administration internally restructured the enterprise, taking out €200 million in structural value financial savings and reorganizing the enterprise into luxurious and life-style (trophy property with well-established manufacturers and a robust pipeline) and mid-scale and financial system (a cash-generative franchise enterprise). Within the quarter, Accor launched separate financials for every of those companies, permitting the market to correctly weigh the worth of the 2 underlying companies. LANXESS – German-listed specialty chemical firm LANXESS was the highest absolute and relative detractor after saying a higher-than-expected revenue warning within the quarter. The corporate has confronted a triple whammy of industry-wide destocking, publicity to delayed demand restoration in China, and elevated power costs final yr, resulting in a inventory of high-cost stock that wanted to be cleared. We imagine the size of the warning displays administration taking all of the ache upfront to make sure it was a “one and completed” warning, with the potential for the corporate to shock on the upside within the second half. We aren’t relying upon a restoration within the second half, as there are indicators of returning to a extra normalized demand setting by the primary half of 2024.

Portfolio Exercise

Within the second quarter, we initiated two new positions, added to Kansai Paint (OTCPK:KSANF) (OTCPK:KPTCY) (a brand new buy within the first quarter), exited Gree, and trimmed a handful of positions. We initiated a purchase order in a European-listed enterprise that may be a international {industry} chief and derives nearly all of its worth from its dominant market place in Asia. The corporate stays undisclosed whereas we construct the place. We additionally purchased Man Wah (OTCPK:MAWHF) (OTCPK:MAWHY), one of many main purposeful couch producers in China, an organization that we all know properly and personal in our Asia Pacific technique. Man Wah is the most important recliner couch maker in China with greater than 50% market share in a extremely fragmented market. Its share worth has been punished amid Chinese language actual property weak point, however underneath the management of owner-operator Man Li Wong (who owns >60% of the enterprise), the corporate has continued to take share and construct scale that additional strengthens its low-cost benefit over friends. Man Wah has a 6% dividend yield and has been shopping for again its shares at an 8x worth to earnings (P/E). We funded the acquisition by promoting Gree, the most important air con producer in China, on the again of optimistic YTD efficiency pushed by robust gross sales attributable to a warmth wave in China.

We additionally elevated our place in Kansai Paint, a worldwide paint and coating producer with market-leading positions in Japan and India. This can be a high-quality {industry} staple enterprise with no substitutes and robust pricing energy in an oligopolistic market. Our administration workforce, underneath the ready management of Mori Kunishi-san, has been targeted for the final three years on unwinding the complexity of the enterprise by divesting sub-scale operations at worth accretive costs, promoting cross-holdings and owned actual property, and utilizing the proceeds to purchase again discounted Kansai Paint shares. We’re excited to see the group shift from a hierarchy to a meritocracy, and deal with margins, return on fairness, and free money stream technology.

Outlook

The Fund delivered a robust first half, regardless of relative macro headwinds, and with materially totally different return drivers than the index. We imagine this places the Fund in a robust place to ship differentiated future returns. The analysis workforce has been busy evaluating present holdings and figuring out new alternatives, leading to upgrades to the portfolio. Our administration groups have been equally busy, taking steps to get the underlying worth of their companies acknowledged. Following a interval of mid-teens returns, the portfolio ended the quarter with a compelling price-to-value (P/V) ratio within the mid-60s%, indicating vital future potential upside.

See the next web page for necessary disclosures.

Earlier than investing in any Longleaf Companions Fund, it is best to fastidiously contemplate the Fund’s funding goals, dangers, costs, and bills. For a present Prospectus and Abstract Prospectus, which include this and different necessary info, go to https://southeasternasset.com/account-resources. Please learn the Prospectus and Abstract Prospectus fastidiously earlier than investing.

RISKS

The Longleaf Companions Worldwide Fund is topic to inventory market danger, which means shares within the Fund might fluctuate in response to developments at particular person corporations or attributable to normal market and financial situations. Additionally, as a result of the Fund usually invests in 15 to 25 corporations, share worth might fluctuate greater than if a larger variety of securities had been held. Investing in non-U.S. securities might entail danger attributable to non-US financial and political developments, publicity to non-US currencies, and totally different accounting and monetary requirements. These dangers could also be increased when investing in rising markets.

The FTSE Developed ex-North America Index includes Giant and Mid cap shares offering protection of Developed markets, excluding the US and Canada. The index is derived from the FTSE World Fairness Index Sequence (GEIS), which covers 98% of the world’s investable market capitalization.

P/V (“worth to worth”) is a calculation that compares the costs of the shares in a portfolio to Southeastern’s appraisal of their intrinsic values. The ratio represents a single information level a couple of Fund and shouldn’t be construed as one thing extra. P/V doesn’t assure future outcomes, and we warning buyers to not give this calculation undue weight.

Free Money Move (FCF) is a measure of an organization’s means to generate the money stream needed to keep up operations. Usually, it’s calculated as working money stream minus capital expenditures.

Value / Earnings (P/E) is the ratio of an organization’s share worth in comparison with its earnings per share.

Return on fairness (ROE) is a measure of profitability that calculates what number of {dollars} of revenue an organization generates with every greenback of shareholders’ fairness.

As of June 30, 2023, the highest ten holdings for the Longleaf Companions Worldwide Fund: Applus Providers, 7.4%;

Accor, 6.2%; Glanbia, 6%; GRUMA, 5.7%; Richemont, 5.2%; EXOR, 5.1%; Premier Meals, 4.9%; Fairfax Monetary, 4.5%; Prosus, 4.2%, and Alibaba, 4.1%. Fund holdings are topic to vary and holdings discussions should not suggestions to purchase or promote any safety. Present and future holdings are topic to danger.

Funds distributed by ALPS Distributors, Inc.

LLP001445

Expires 10/31/2023

Unique Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

![Iyanya, Mayorkun & Tekno – ‘One Side’ (Remix) [Official Music Video] Iyanya, Mayorkun & Tekno – ‘One Side’ (Remix) [Official Music Video]](https://thehollywoodpremiere.com/wp-content/uploads/2024/11/Iyanya-Mayorkun-Tekno-One-Side-Remix-Official-Music-120x86.jpg)