The S&P 500 has skilled its second-best begin to a 12 months prior to now 25 years, fueling a way of optimism amongst buyers. Nevertheless, this achievement has not been the principle story of the 12 months. In reality, the bellwether index’s year-to-date beneficial properties of 16% have been utterly overshadowed by the tech sector’s domination. With AI hype driving the surge, it has develop into the best-performing sector in 2023, up by 31.5%.

That could be a vital quantity and truly represents the best opening half of a 12 months ever recorded by the sector because it has pulled away from the S&P 500 by the largest hole over a six-month interval since 1999.

Is tech set for additional beneficial properties within the second half of the 12 months? That is still to be seen though the section is under no circumstances the one recreation on the town. There are different corners of the market that would present alternatives for buyers, and the analysts at Raymond James are eager to level them out. They’ve been searching for out the equities set to push forward for the remainder of the 12 months and have tagged some non-tech names as Sturdy Buys.

We ran a pair of their selections via the TipRanks database for a wider view of the prospects and it appears to be like like the remainder of the Road agrees with the Raymond James consultants – each are rated as ‘Sturdy Buys’ by the analyst consensus, too. Let’s take a more in-depth look.

Everest Group (EG)

Let’s admit that insurance coverage doesn’t have the identical attract as tech and AI however as investing legend George Soros mentioned, “good investing is boring,” and that brings us to Everest Group, a number one world supplier of reinsurance and insurance coverage options.

Based in 1973, the corporate is a longtime insurance coverage identify, its world presence permitting it to serve shoppers in over 100 international locations throughout 6 continents. Offering tailor-made options to fulfill clients’ distinctive wants, Everest operates via its subsidiaries and provides a various portfolio of merchandise, together with property, casualty, specialty, and life reinsurance, in addition to insurance coverage protection.

Story continues

Everest has managed to put up sequential enhancements to the top-line over the previous a number of quarters and that was the case once more within the first quarter of 2023. Income reached $3.29 billion, climbing from the $3.25 billion delivered in This fall and amounting to a 13.8% year-over-year enhance. The determine additionally beat the consensus estimate by $190 million.

On the different finish of the dimensions, boosted by ongoing underwriting margin enchancment, web working earnings reached $443 million, translating to EPS of $11.31 and enhancing on the $10.31 delivered in the identical interval final 12 months. Nevertheless, the bottom-line determine missed the analysts’ forecast by $1.23.

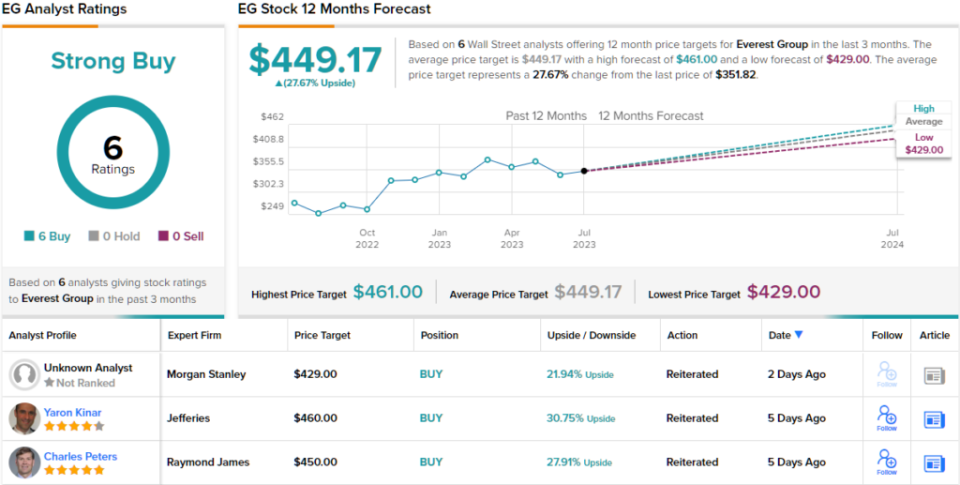

Assessing this agency’s prospects, Raymond James analyst Charles Peters maintains his Sturdy Purchase ranking, citing a “constructive outlook for Everest to report accelerating income and earnings progress.”

Expounding on this, the 5-star analyst mentioned, “Our ranking displays enhancing reinsurance market situations with robust traits in pricing and phrases/situations persevering with via mid-year renewals. Whereas we acknowledge hurricane/disaster associated issues in 2H23, we imagine the risk-reward favors [Everest] as a result of exhausting market and our outlook for working ROBEs of 19%+ over the following two years.”

“We proceed to imagine there may very well be upside to our estimates ought to the corporate obtain the lower-end of administration’s 2023 u/w targets with additional enhancements in 2024,” Peters summed up.

Together with the Sturdy Purchase ranking, Peters’ $450 worth goal on EG makes room for 12-month returns of ~28%. (To look at Peters’ monitor report, click on right here)

Trying on the consensus breakdown, the remainder of the Road agrees with Peters’ evaluation. With 6 Buys and no Holds or Sells, the phrase on the Road is that EG is a Sturdy Purchase. The $449.17 common worth goal is virtually the identical as Peters’ goal. (See EG inventory forecast)

Copa Holdings (CPA)

Let’s now pivot from insurance coverage to the airline trade. Copa Holdings is a Panama-based agency that operates as a holding firm for Copa Airways and Copa Colombia (Wingo). The corporate has positioned itself as a significant participant within the Latin American area, providing connectivity between cities in South America, Central America, North America, and the Caribbean, with a large community of 79 locations throughout 31 international locations. Copa operates a contemporary fleet of plane (a complete of 99 on the finish of Q1) and has gained a status for its high-quality service, punctuality, and environment friendly operations.

Journey demand has been on the rise following the Covid-driven lull and Copa has been benefitting from this improvement. In Q1, income elevated by 51.7% from the identical interval a 12 months in the past to achieve $867.3 million, whereas beating the Road’s forecast by $27.94 million. The determine additionally represented a 29% enhance vs. pre-Covid 1Q19 ranges. The corporate has additionally been prudent with prices and that resulted in adj. EPS of $3.99, a determine that outpaced the Road’s $3.25 forecast.

Not solely tech shares have been outperforming the market this 12 months. That show has helped the inventory ship year-to-date beneficial properties of 32%. But, in accordance with Raymond James analyst Savanthi Syth, there’s extra to return.

The analyst charges Copa shares a Sturdy Purchase whereas her $155 worth goal implies upside of 40% over the approaching months. (To look at Syth’s monitor report, click on right here)

Explaining her bullish stance, the 5-star analyst wrote, “We imagine the relative attractiveness of Copa’s geographically advantageous and defensible hub has improved. As such, whereas the inflection in aggressive capability towards a decrease gasoline backdrop is prone to stress yields, Copa’s value initiatives coupled with an total enticing aggressive setup (additional supported by world provide constraints) ought to assist robust margins.”

Total, that is one other inventory that will get the Road’s full assist. With a unanimous 8 Buys, the inventory boasts a Sturdy Purchase consensus ranking. Ought to the $148.63 common worth goal be met, a 12 months from now, buyers will probably be pocketing returns of ~35%. (See CPA Holdings inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather essential to do your personal evaluation earlier than making any funding.