Monty Rakusen

Thesis

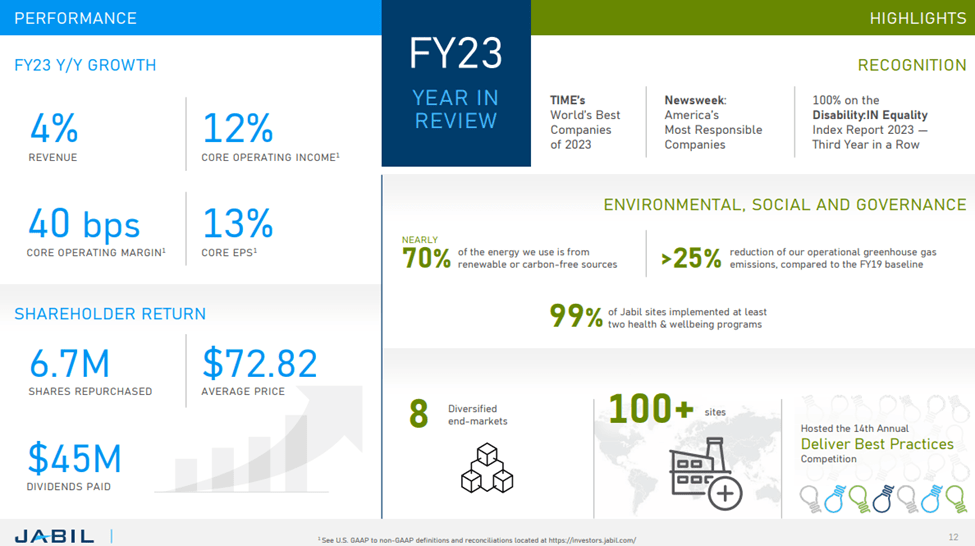

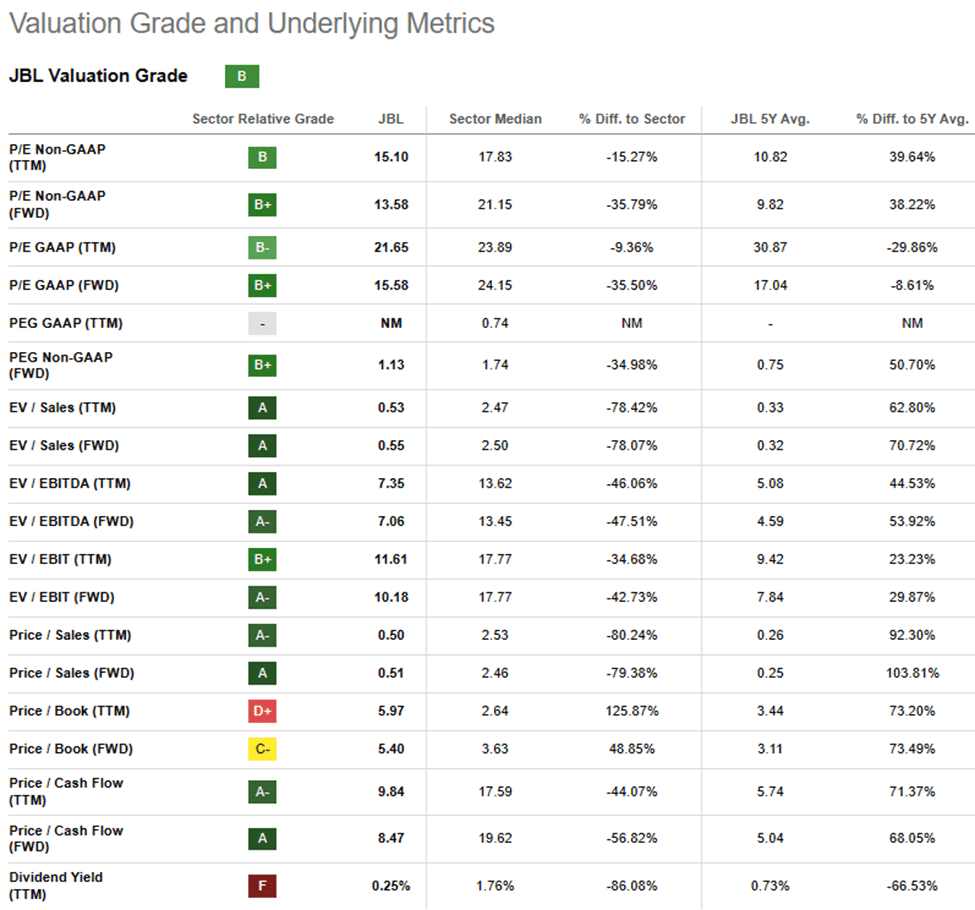

Jabil Inc. (NYSE:JBL) has been making significant gains in market share and consistently expanding its revenue and profit margins. This success can be attributed to key partnerships with companies like Tesla in the electric vehicle sector, Johnson & Johnson in healthcare, and Amazon Web Services in cloud computing. Additionally, the company’s involvement in the renewable energy sector is also proving to be robust. The company is expected to engage in substantial share buybacks as it generates more cash flow. Moreover, JBL is trading at a price-to-earnings ratio of around 13 times forward PE, which is significantly below the sector median.

F4Q23 Review and Outlook

Jabil finished its fiscal year strongly in the fourth quarter of 2023, surpassing earnings expectations and achieving revenue levels within the middle of its guidance range. The company also exceeded gross margin projections. However, the main focus was on the long-term guidance provided by Jabil, which outlines the expected margins and earnings trajectory. This guidance is of particular interest because of the recent decision to sell the Mobility business to BYD.

Jabil’s long-term guidance exceeded investor expectations, indicating a promising future for the company’s earnings potential. The guidance was conservative regarding revenue expectations, taking into account limited macroeconomic recovery in certain markets. For the fiscal year 2024, the margin outlook was positive, driven by a shift towards higher-growth and higher-margin segments such as Industrial & Semi-Cap, Auto & Transportation, Healthcare & Packaging, and 5G Wireless & Cloud. These segments are expected to contribute significantly to Jabil’s revenue, offsetting the revenue decline from the Mobility business sale. Notably, this positive outlook comes as Jabil reduces its customer concentration risk with Apple, historically responsible for around 20% of its revenue.

I believe JBL’s quickened transition to the consignment model for its cloud business could boost margins as it starts shipment of AI server racks to Amazon. More robust growth lies ahead for its automotive, renewable energy, and healthcare businesses due to secular trends such as EV adoption, the energy transition, and medical outsourcing.

Company Presentation

Mobility Business Sale to BYD

Jabil’s decision to sell its mobility business to BYD Electronic has the potential to enhance its portfolio and financial flexibility in the coming years. This move would substantially decrease its exposure to the consumer electronics sector, which is subject to economic cycles, and instead provide additional capital to support the growth of its high-margin businesses with longer product lifecycles. These businesses include automotive, renewable energy, and healthcare products. Furthermore, the shift to a consignment model for its cloud business is expected to boost profit margins, although it may impact revenue. The funds generated from the sale of the mobility business could also accelerate Jabil’s share repurchase program, as the company has recently increased its authorization for share buybacks to $2.5 billion.

Supply Chain Challenges Prompting Strategic Shifts in Production

In light of recent significant challenges in the supply chain resulting in shortages and increased logistics costs, companies are showing a growing interest in relocating their production facilities closer to their end customers. EMS ((Electronic Manufacturing Services)) companies are taking steps to shift their property, plant, and equipment away from China and towards locations like the United States, Eastern Europe, and Mexico. Jabil’s strong global presence positions it favorably to attract customers seeking to diversify its manufacturing operations. The increasing complexity of product designs is driving higher demand for outsourcing as companies aim to reduce their fixed manufacturing costs.

Jabil is also actively involved in value-added projects and is tapping into growing markets with longer product lifecycles, such as electric vehicles and healthcare. Additionally, the company is making strategic technology investments in areas like AI ((Artificial Intelligence)), ML ((Machine Learning)), and robotics, which are contributing to the expansion of profit margins and the generation of free cash flow.

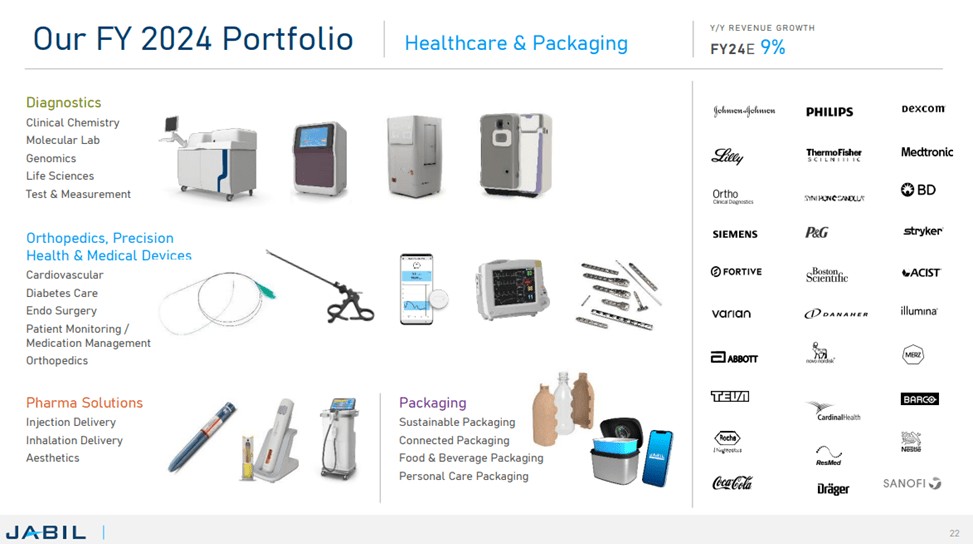

Healthcare Division Remains a Key Driver of Revenue and Growth

Jabil’s healthcare division is likely to remain its largest revenue contributor and a consistent source of growth for its diversified manufacturing services segment. The company’s strong relationships with key clients like Johnson & Johnson imply a steady flow of outsourcing orders for medical devices in the years ahead. The increasing demand for connected healthcare, particularly in areas such as continuous glucose monitoring and sensors, offers further growth potential.

As Jabil’s customer base expands, the healthcare division could present broader opportunities in areas like diagnostics and pharmacy-related products, such as auto-injectors for diabetes. Jabil’s healthcare-related revenue may experience double-digit growth in the next 2-3 years due to increased outsourcing demand from key customers and heightened public health awareness following the pandemic. With sustained revenue growth and above-average profit margins, Jabil’s healthcare business is positioned to be a significant driver of long-term growth. Jabil’s efforts to expand its production capacity in the higher-margin healthcare sector can enhance its profitability. Collaborations with partners like Johnson & Johnson, E3D (auto-injector), and Elvie (women’s health) may grant Jabil access to a broader range of medical devices and open up new business opportunities as clients shift their focus from manufacturing to product enhancement and platform development. The utilization of Jabil’s Caribbean manufacturing facilities can further improve economies of scale and reduce costs in this business.

Company Presentation

Valuation

JBL is currently trading at a forward PE of 13x at a discount to the sector median of 21x. While ongoing global inflation could continue to add pressure to Jabil’s consumer electronics exposure, the rising contribution of margin-accretive businesses like healthcare and 5G/cloud should help grow earnings while offering a potential tailwind to its valuation over time.

The stock has significant upside potential here given its current valuation multiple and I believe the multiple can re-rate higher for several reasons. Firstly, Jabil is undergoing a shift in its business mix towards higher-growth and higher-margin sectors such as Industrial & Semi-Cap, Auto & Transportation, Healthcare & Packaging, and 5G Wireless & Cloud. Secondly, the company has announced the divestiture of its Mobility business, which is cyclical and has lower margins. This move not only reduces the risk associated with customer concentration (e.g., Apple accounting for 20% of revenue) but also provides funds for a significant share buyback program. These factors collectively pave the way for robust earnings growth and create a scenario where investors are likely to assign a higher valuation to Jabil’s shares. Although I currently do not have a specific target price on the stock, I believe the company’s growth, margin expansion and disciplined capital allocation justify a re-rating of JBL stock. Hence, I remain optimistic on the prospects of the company and assign a buy rating to the stock.

Seeking Alpha

Investment Risks

Jabil heavily relies on its top five customers for more than 40% of its total revenue. This means that the company faces significant financial risks if these key customers merge, reduce their purchases, or end their business relationships with Jabil. Furthermore, the demand from end customers can be volatile tied closely to specific product lifecycles, and production schedules are often short-term. In terms of competition, there is intense rivalry in certain market segments due to low barriers to entry and minimal switching costs. Some competitors in the industry have substantial scale and wield significant influence over supply chains, with notable examples being Hon Hai and Flex.

Conclusion

Jabil’s sale of its mobility business to BYD Electronic is set to bolster its portfolio and financial flexibility by reducing exposure to cyclical consumer electronics. This move will provide capital to support high-margin businesses in automotive, renewable energy, and healthcare. Moreover, JBL’s diversified business model is benefiting from trends favoring outsourcing, gaining market share, reshoring plans, and sustained growth in sectors such as electric vehicles, digital healthcare, energy, and AI-driven cloud data centers. As a result, I anticipate that JBL will outperform the market over the coming few years, which is why I assign a buy rating to the stock.