aluxum

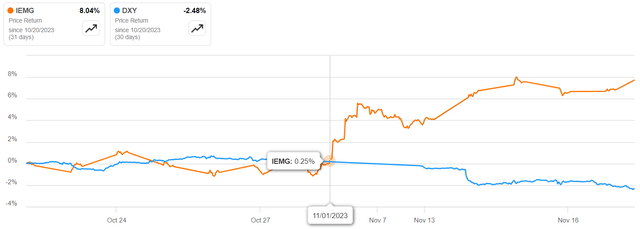

The meeting between Biden and Xi Jinping in San Francisco some five days ago may have quelled some of the fears in investors’ minds pertaining to geopolitical concerns over China, which is also good for EM (emerging markets) in general given the East Asian country’s position as the world’s second-largest economy. However, the iShares Core MSCI Emerging Markets ETF’s (NYSEARCA:IEMG) latest upside can be traced back to earlier, or November 1, and coincided with the U.S. dollar index starting to see a downtrend as illustrated in the chart below.

Comparison of price performances, IEMG, and Dollar Index (Seeking Alpha)

Now, dollar strength mostly depends on the monetary policy practiced by the U.S. Federal Reserve and there is no shortage of uncertainty with two armed conflicts underway in Eastern Europe and the Middle East. Against such a backdrop, this thesis aims to assess whether IEMG’s upside could be sustained going into 2024 by considering its holdings as well as macroeconomic conditions.

I start with King Dollar.

How a Weak Dollar Can Help IEMG

First, November 1 also marked Federal Chairman Powell’s press conference following the FOMC or Federal Open Market Committee meeting where it was decided to keep interest rates on hold. Noteworthily, this was the second consecutive meeting where rates were not raised, following a string of 11 rate hikes since March 2022. Subsequently, the Consumer Price Index, or CPI data for October was lower than what was initially expected by economists.

This indicates a slowing U.S. inflation at least for now, and in case the trend continues, the chances of the Federal Reserve raising interest rates this year would not only be reduced but, conversely, this also increases the likelihood of a rate cut. Hence, the market is pricing four 25-basis point cuts by the end of 2024 which would reduce support for the dollar.

Now, given the dominant position of the greenback in international trade, dollar strength has significant macroeconomic implications in the rest of the world. Thus, according to the Bank of International Settlements, the dollar is involved in nearly 90% of forex transactions as of August this month. Thus, for many countries, especially those that have large amounts of imports all billed in dollars, a higher-valued greenback makes the fight against inflation harder. The reason is that the price of goods after getting converted from dollars to the local currency becomes dearer, in turn increasing CPI. Furthermore, compared to developed markets like Europe, Japan, and Australia, these inflationary pressures can be particularly strong in emerging economies, because the share of their imports that are invoiced in dollars is normally larger.

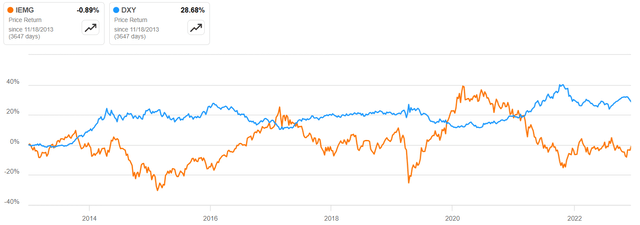

For investors, the inverse relationship between the dollar index and the share price of the emerging market fund is illustrated in the chart below.

Comparing price performances of IEMG and Dollar Index over the long term (Seeking Alpha)

Thus, the greenback is well below its September 2022 peak of $114.1. Subsequently, after offering some resistance at the $105 to $107 range in October this year, the index is now at the $103 level, last time reached in June 2022 when the Fed was aggressively tightening monetary policy.

Noteworthily, the above charts also show that the greenback still needs to fall a lot further, by around 10-15% based on historical performance, for EFMG (in orange) to deliver a meaningful upside. In addition, the ETF could benefit from a warm-up in relationships with China.

Geopolitics and IEMG’s Holdings

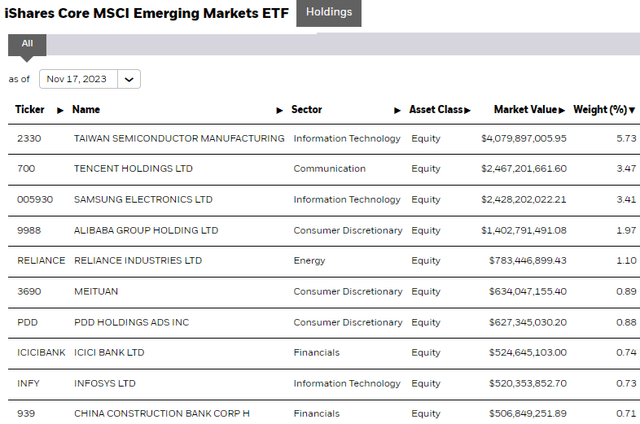

First, when investing in East Asian EM, the tensions that have been going on between the U.S. and China are at the top of every investor’s mind, especially when considering that IEMG’s topmost holding is Taiwan Semiconductor Manufacturing Company (TSM) as shown in the table below. By itself, it was responsible for the manufacturing of most (over 60%) of the world’s semiconductors in 2022. Additionally, most of its clients for the advanced chips where TSMC dominates production with over 90% of global output are American companies like NVIDIA (NVDA), Advanced Micro Devices (AMD), and QUALCOMM (QCOM).

www.ishares.com

These are the semiconductors that make possible the very underlying infrastructure for AI, and, for this matter, any dialogue between the United States and China reduces the likelihood of a war because of Taiwan constituting a black swan event in the future.

In this connection, U.S. memory chip maker Micron’s (MU) could be allowed to grow its business in China, after being earlier subject to a partial ban based on security grounds. Still, to be realistic, relations remain tense and the meeting between the two heads of state constitutes only a fragile detente as sanctions relating to the export of sophisticated chips to China have been reinforced only last month. Moreover, there is no guarantee that things will not worsen in case a new administration controls the White House following next year’s presidential elections.

Still, this top-level meeting held on American soil creates avenues for clearer communication channels, which in turn can lead to more visibility especially when it comes to planning capital expenditure. This visibility factor has become key as previous export restrictions relating to AI chips by the U.S. Department of Commerce have started to hurt, with one example being Alibaba (BABA).

The Risks

First, this Chinese company which is classified as a consumer discretionary stock since it sells products through its online portal also has a sprawling cloud business. As such, as seen by its five-year price performance, it has still not recovered since the 2020-2021 crackdown by Chinese regulators on the tech sector. Also, its second-quarter results not only missed analysts’ expectations but it also scrapped the previously announced spin-off of its cloud computing business, an action that was not well digested by the market as the stock lost over 10% of its market value.

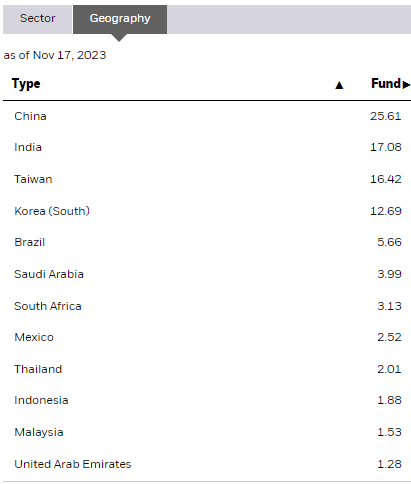

Now, the main reason provided for not creating a standalone cloud unit was attributed to U.S. chip sanctions which implies that others like Baidu (BIDU) and Tencent (OTCPK:TCEHY) which depend on Nvidia’s advanced chips to upgrade their AI applications could also suffer. Worst, China which constitutes 25.6% of IEMG’s assets (as shown below) also faces economic problems caused by problems in the property sector becoming contagious to other sectors of the economy such as banks.

www.ishares.com

In response, the government provided stimulus through $137 billion worth of sovereign bond sales at the beginning of October, but, according to a recent update by Bloomberg, economic activity remains weak. Thus, while the YoY growth in industrial production for this year is likely to see a surge compared to 2022 when Covid-related lockdown measures severely impacted factory workers’ mobility, economists see the slowdown seen from September to be persisting due to lower consumer demand and business confidence.

Looking beyond China, according to the International Monetary Fund, global growth is expected to slow further by 2.9% in 2024 relative to 3% this year. Stronger growth is also expected in other large emerging markets, with one of these being India which constitutes 17.08% of IEMG. However, the downward revision in China could offset India’s relatively brighter outlook. Worst, with the IMF also downgrading its outlook for the Euro-area, the only major developed market expected to grow strongly remains the United States. In these conditions, demand prospects for imports from emerging economies are not likely to see any meaningful uptake.

The Upside is not Likely to be Sustained

Therefore, unfavorable macros are not conducive to IEMG’s upside being sustained, unless the dollar continues to depreciate. However, this cannot be taken for granted given that core inflation is well above the Fed’s 2% target. Moreover, at a price-to-earnings of 11.07x, IEMG is not an opportunistic buy. The reason is that it is available only at a discount of 8% relative to the iShares Core MSCI International Developed Markets ETF (IDEV), with a P/S of 11.95x. Still, this discount can easily be offset in case the Fed’s narrative changes to “higher for much longer” signifying no rate cut next year and supporting the dollar. In this respect, research data shows that just a 10% appreciation in the dollar’s value can decrease economic output by 1.9% in emerging markets over the longer term compared to three times less in developed economies.

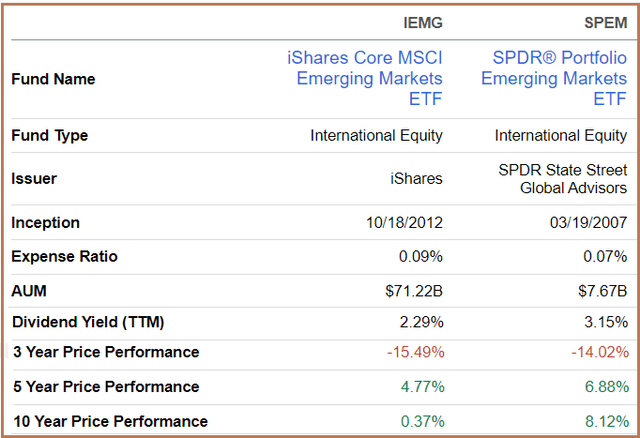

Now, for those who have the stomach for risk and want to invest in EM, another option is to opt for the SPDR Portfolio Emerging Markets ETF (SPEM) which comes at a lower expense ratio as shown below. On top, it offers a better dividend yield in case dollar-related reasons delay a rally in EM stocks.

Comparison of key metrics (Seeking Alpha)

In conclusion, it is a combination of factors including macros, China’s exposure, and dollar strength which are responsible for IEMG’s price performance. Another important factor is investor sentiment which benefits when there are talks between the leaders of the world’s top two economies. Now, these are certainly positive in the current context of geopolitical tensions, but, it is important that these are pursued in the longer term with concrete objectives as to how chip-related restrictions are removed. Otherwise, it is unlikely for China to see the same AI-led momentum for its tech stocks as seen by their American counterparts listed on the Nasdaq stock exchange.