When that payday attacks your account in the end or even beginning of the month, there is actually a short lived instant of delight for several functioning grownups.

Yet in Malaysia, a part of that joy is actually prearranged for the future as a result of the Staff Members Provident Fund (EPF).

Created in 1991 due to the Malaysian federal government, the EPF resembles a monetary safeguard, guaranteeing that a cut of your revenues goes in the direction of your retired life fund.

Yet there is actually been actually a latest rebuilding in the EPF plan, leaving behind several damaging their scalps. Permit’s break what you require to understand about EPF Account 3.

What is actually modifying?

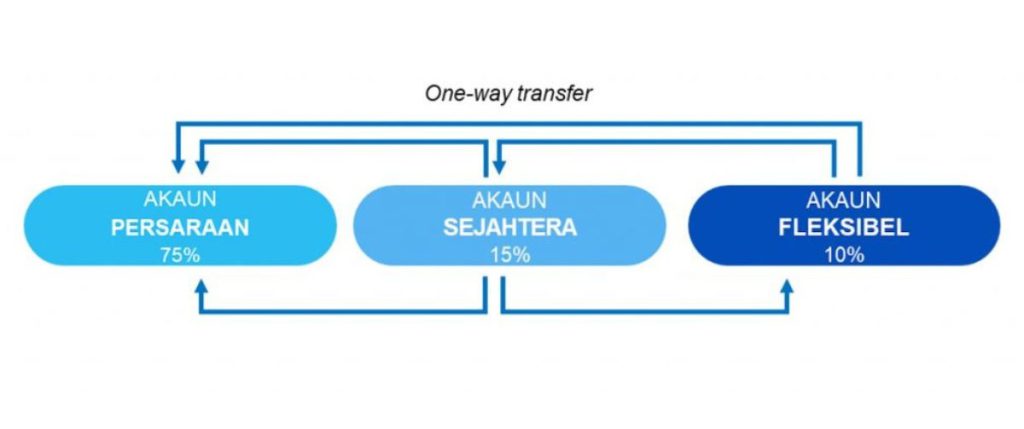

Therefore, what is actually all the difficulty concerning? Properly, prepare your own self for a three-account device. Leave to the aged two-account arrangement; it is actually currently 3 make up much better economic preparing. Listed below is actually the itemization:

Akaun Persaraan (Account 1): Builds Up savings that will definitely act as earnings during the course of retired life.

Akaun Sejahtera (Account 2): Satisfies the a variety of requirements throughout lifestyle phases to improve total lifestyle in retired life.

Akaun Fleksibel (Account 3): Deals convenience for quick economic criteria. Funds within this account could be removed any time depending on to participants’ requirements.

To keep quality, our company’ll keep the authentic mathematical tags for these profiles. Furthermore, all EPF payments will definitely be actually partitioned right into 3 parts based upon these portions:

75% will definitely enter into Account 1.

15% will definitely enter into Account 2.

10% will enter into Account 3

Why the modification?

EPF’s makeover provides certainly not simply to include heft to your retired life savings however likewise to straighten along with the a variety of phases of your lifestyle. Listed below’s what it targets to perform:

Improve the funds in your pension to offer more significant safety and security forever after job.

Straighten small, tool, as well as long-term criteria along with participants’ life process as well as life-span.

Create EPF Plans that think about the progressing job fads work schedule, group changes, as well as participants’ found as well as potential requirements.

Outfit temporary economic requirements that might have an effect on participants’ wellness during the course of retired life..

What will accompany the funds in my present EPF profiles?

On the whole, there will definitely be actually no changes to all of them. This suggests that all the present savings in your Account 1 as well as Account 2 will definitely stay unblemished, while the brand-new Account 3 will definitely start along with RM0.

Will the brand-new EPF account effect the reward cost?

Depending On to KWSP, the reward cost for EPF 2023 positions at 5.5% for traditional savings as well as 5.4% for Shariah-compliantsavings

Feel confident, the present plan regulating reward fees continues to be unmodified in spite of the rebuilding. The rewards for Account 3 will definitely coincide when it comes to Account 1 as well as 2.

Nonetheless, it costs keeping in mind that the even more a factor withdraws, the reduced the reward cost.

On the other hand, always keeping Account 3 unblemished, also after going with the single transmission, will definitely make certain the factor’s reward cost continues to be unaltered.

When performs it pitch in?

Sign your schedules for May 11, 2024. That is actually when EPF 3 enter the band. Yet, it is actually certainly not simply for natives; non-Malaysians under 55 are actually in on the activity as well. The yesterday of the single transmission treatment performs August 31, 2024.

Acquired a round figure? Listed below is actually the package.

EPF is actually allowing a single transmission coming from Account 2 to Account 3 in between May 11 as well as August 31, 2024.

Nonetheless, it is necessary to keep in mind that you can not take out any sort of volume that you as if. The drawback volume rests upon your present harmony in Account 2.

If the harmony in Account 2 is actually RM3,000 or even greater, one-third of the harmony will definitely be actually relocated to Account 3, as well as one more one-sixth will definitely be actually assigned to Account 1. Nevertheless, if the harmony in Account 2 is actually lower than RM3,000, the method differs somewhat:

For harmonies of RM1,000 as well as under in Account 2: All savings will definitely be actually movedto Account 3

For harmonies over RM1,000 however still listed below RM3,000 in Account 2: RM1,000 will definitely be actually moved to Account 3, while the rest will definitely keep in Account 2.

Just How to help make transmissions

You may make an application for this single transmission by means of these possibilities:

Online: You may administer by means of the KWSP i-Akaun application..

Personally: You may likewise perform it by means of Smorgasbord Terminals in any way EPF limbs countrywide.

Transactions possibilities as well as policies

Acquired some funds you yearn for to shuffle around? Listed below is actually just how you may do thus.

Coming From Account 3 (Fleksibel): You may relocate funds to Account 2 or even Account 1.

Coming From Account 2 (Sejahtera): Funds may jump to Account 1 or even be actually utilized to start yourAccount 3

Coming From Account 1 (Persaraan): Moving loan out is actually certainly not allowed.

Nonetheless, the moment you have actually moved loan coming from Account 3 to Account 2 or even Account 1, you can not turn around the transmission. Furthermore, you have to directly check out an EPF division to provide your transmission request.

Choice to pull out

If you are actually miserable along with the brand-new three-account layout as well as dream to stick to the present two-account arrangement, sadly, there is actually no possibility to do this.

EPF will definitely present the brand-new account framework this May for all participants under 55 years of ages without offering an opt-out selection.

All the same, if you possess the opportunity of leaving your EPF funds unblemished up until retired life, that would certainly still be actually the best advantageous selection, as well as these architectural changes should not impact you or even your savings.

You may discover more concerning EPF Account 3 below.

Check out various other write-ups our company have actually covered EPF below.

Included Picture Credit Report: Vulcan Blog Post