It has solely been a bit of underneath two years since TikTok Store made its foray into Southeast Asia, however its fast development may give Shopee and Lazada a run for his or her cash.

Whereas primarily generally known as a social media platform for brief movies, TikTok started dipping its toes into e-commerce in late 2021. By 2022, TikTok Store refocused its efforts on Southeast Asia, increasing to 6 international locations within the area — Singapore, Malaysia, Indonesia, the Philippines, Vietnam, and Thailand.

On TikTok Store, manufacturers and influencers can hyperlink merchandise to purchase in movies or broadcast reside to promote merchandise obtainable to buy throughout the app.

The platform additionally ramped up its e-commerce efforts reminiscent of together with new options, incentives for retailers, in addition to partnerships with e-commerce enablers and logistics companions. Its efforts have actually paid off — in 2022, TikTok Store’s GMV within the area skyrocketed greater than 4 occasions to US$4.4 billion.

Social commerce is on the rise

Social commerce, an e-commerce method that enables companies to promote merchandise on to shoppers throughout the app, has modified the purchasing habits of shoppers.

In line with a report by McKinsey, shoppers in Southeast Asia are purchasing for merchandise on-line throughout extra diversified channels, together with social commerce platforms reminiscent of TikTok Store, Fb Market, and Instagram Store.

The recognition of social commerce within the area has been accelerated by excessive charges of cellular web penetration. This mobile-first technology spends a lot time on social media and will increase engagement.

On a broader scale, a 2022 examine by TikTok and Boston Consulting Group revealed that social commerce may uncover US$1 trillion in market worth for manufacturers within the Asia Pacific area by 2025, up from US$500 billion in 2022.

Nonetheless, even amongst social commerce gamers reminiscent of Fb Market and Instagram Store, TikTok Store stands out from the remainder.

For starters, TikTok Store’s algorithm-driven content material discovery system ensures that movies with potential gross sales worth are uncovered to the correct target market, which in flip will increase the possibilities of conversions.

The platform additionally leverages on its well-liked video-sharing operate to get a grip on web shoppers. Retailers can tout their wares immediately by their TikTok accounts, with merchandise beneficial to customers by way of livestreams and a showcase part on sellers’ profile pages.

Moreover, whereas Gen Z makes up nearly all of TikTok customers, different demographics are additionally more and more turning into customers of the platform. A 2023 Statista report reveals that Gen Zs make up 33.32 per cent of TikTok’s consumer base in Singapore, adopted by millennials (28.65 per cent). In the meantime, near a fifth (18.19 per cent) of TikTok customers in Singapore are over the age of 32.

TikTok’s perk as a brief video app additionally helps it to come back throughout as much less aggressive on the subject of showcasing merchandise customers can buy. A examine by Nielsen in 2021 confirmed that customers discover TikTok content material to be extra genuine, real, unfiltered and trendsetting than different platforms.

On the identical time, when wanting particularly at promoting content material, customers nonetheless related phrases reminiscent of genuine and real, whereas including sincere, actual, distinctive and enjoyable. Greater than half (52 per cent) of TikTok’s world customers — excluding america — say they seek for merchandise or store on the platform.

How does TikTok Store fare in opposition to Shopee and Lazada?

Whereas the social media e-commerce mannequin has been vastly profitable in Asia, TikTok Store has been failing to realize full traction with western shoppers and content material creators.

Specifically, its reside purchasing characteristic which permits customers to purchase merchandise from sellers throughout a reside broadcast, seems to be failing to resonate with western shoppers regardless of its large recognition in Asia.

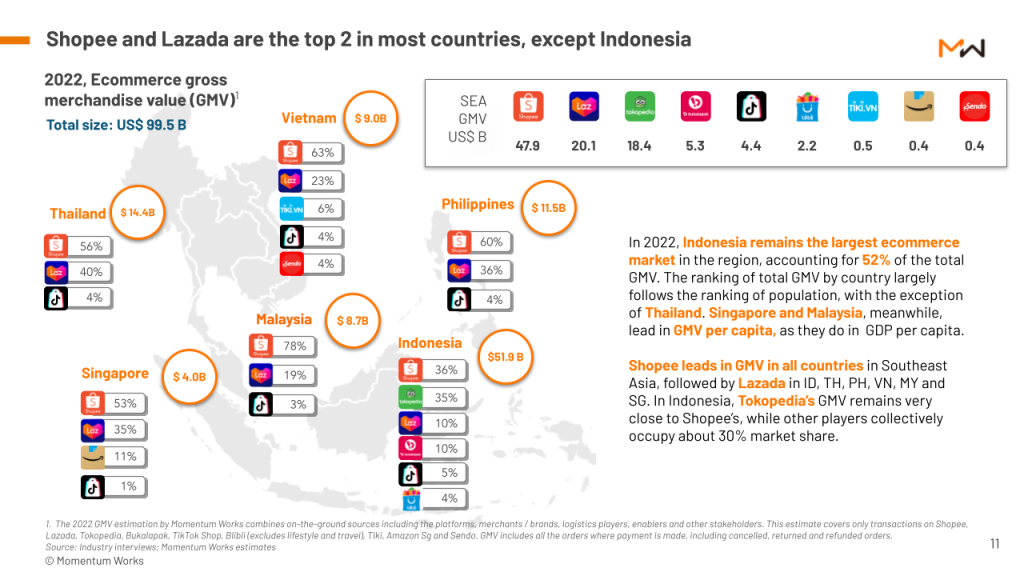

Moreover, TikTok Store’s fast development has but to go neck and neck with its rivals. In line with a 2023 report by Momentum Works, e-commerce GMV within the area was US$99.5 billion; of which TikTok Store solely accounted for US$4.4 billion. As compared, rivals Shopee and Lazada noticed a GMV of US$47.9 billion and US$20.1 billion respectively.

TikTok Store has additionally but to realize majority market share in any Southeast Asian nation — it accounted for just one and three per cent of e-commerce GMV in Singapore and Malaysia respectively. The platform’s highest market share was clocked in Indonesia, albeit solely 5 per cent.

As compared, Shopee and Lazada noticed a GMV of 53 per cent and 35 per cent in Singapore respectively. In Malaysia, Shopee dominated the market, making up for 78 per cent of e-commerce GMV, adopted by Lazada which accounted for 19 per cent.

Regardless of its present shortcomings, TikTok Store continues to be a possible menace to rivals like Shopee and Lazada, no less than within the Southeast Asia market.

Though the platform solely took up a small market share within the area, it was capable of develop its estimated Southeast Asian GMV from US$600 million in 2021, the 12 months of its launch, to US$4.4 billion in 2022 — the quickest development fee amongst rival e-commerce platforms.

As compared, Shopee’s GMV a 12 months after its launch within the area was US$1.8 billion, whereas Lazada’s was solely US$384 million. Regardless of proudly owning the second-largest mart share within the area, Lazada can also be starting to see a decline as its estimated GMV fell from US$21 billion in 2021 to US$20.1 billion final 12 months, in line with Momentum Works’ report.

Moreover, a survey carried out by on-line retail insights firm Dice Asia revealed that buyers spending on TikTok Store are decreasing their spending on Shopee (51 per cent), Lazada (45 per cent) and offline (38 per cent).

Moreover, e-commerce platforms reminiscent of Shopee and Lazada cost extra on fee, transaction and repair charges. As such, retailers should mark up their merchandise to cowl the charges — this makes merchandise on TikTok Store come off as comparatively cheaper than different platforms.

What’s subsequent for TikTok?

With over 250 million customers in Southeast Asia, TikTok is in a fairly undisputable place to steer the social commerce market.

On the identical time, as e-commerce continues to be a driving pressure for the platform, it’s now trying to introduce Mission S. As a part of the undertaking, TikTok will introduce a devoted part known as Fashionable Beat, which can provide objects which have confirmed well-liked on movies, reminiscent of instruments to extract ear wax or brush off pet hair from clothes.

Nonetheless, it will function much like Amazon Fundamentals, the place TikTok’s mum or dad firm ByteDance sells its personal model of those trending merchandise. By means of the launch of Fashionable Beat, TikTok hopes to compete with established giants reminiscent of Shein and Amazon.

Featured picture credit score: Shutterstock / World Trademark Evaluate / Lazada

Additionally learn: The quickest flop in historical past? Information reveals that Threads’ recognition crashed in only one week