Can Insurance Processing Become More Social?

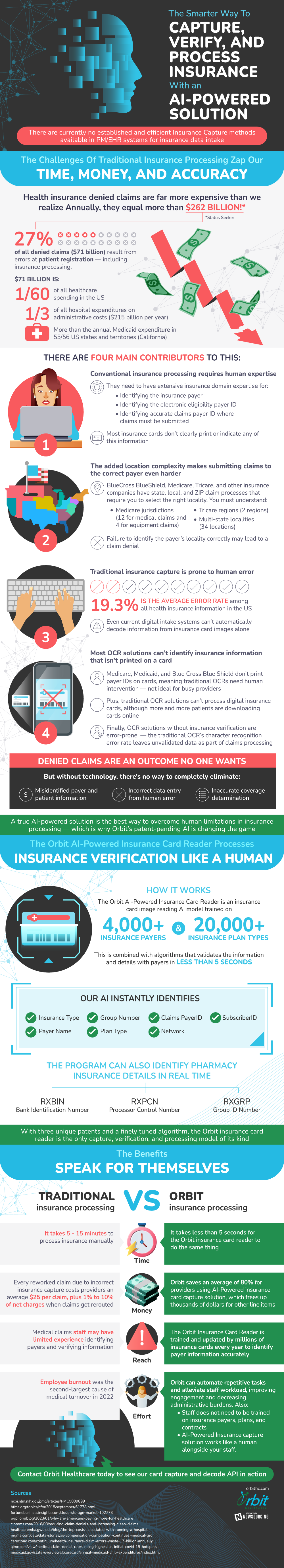

There are presently no ideal approaches for insurance information consumption. In a sector so essential to our culture, the approaches for processing are obsoleted and unreliable. Not just that, however the procedures mishandle and mistake vulnerable, setting you back insurer over $260 billion jointly annually.

There are several factors to these issues, a lot of which originate from human treatment. Many present options for insurance processing can not recognize any kind of insurance info that is not published on a card. When modern technology can no more help, people are required to action in and finish the task. Some insurer, like Medicare, Medicaid, and Blue Cross Blue Guard, do not publish payer IDs on cards. This is not excellent for active service providers, and calls for also additional human treatment. When people become an important component of this procedure, the possibility and chance of mistake escalates. Amongst all medical insurance info in the USA, the ordinary mistake price is 19.3%. These concerns in mix with area intricacy of each insurance company makes it progressively hard to effectively catch and refine insurance.

Due to these disadvantages, professionals are servicing a more up-to-date and reliable option to insurance card processing utilizing expert system This modern technology can be educated to recognize countless insurance payers and 10s of countless strategy kinds. Not just can AI recognize greater than the present options, however it can do it at a much faster rate and with more precision than in the past. The advantages to embracing this arising modern technology are clear, leading several market leaders to begin to make the button.

Resource: OrbitHC

Resource: OrbitHC

![It was all going well until… | Squid Game 2 | Netflix [ENG SUB] It was all going well until… | Squid Game 2 | Netflix [ENG SUB]](https://thehollywoodpremiere.com/wp-content/uploads/2025/01/It-was-all-going-well-until-Squid-Game-2-120x86.jpg)