Ronald Martinez

You’re probably familiar with AT&T (NYSE:T) and its stock at this point.

Countless digital ink has been spilled on the massive telecom company over the last few years, especially in light of the company’s recent breakup with Warner Bros. Discovery (WBD) and all of the surrounding drama.

You’re probably also familiar with the company’s dividend, which was the star of much debate on Seeking Alpha and elsewhere when it was cut in 2022 for the first time in 29 years.

From the outside, the company looks like a mess as shareholders have had to endure controversy after controversy in a period of heightened volatility for the company.

However, focus on these noisemakers and you’ll miss the facts; the company is a well-run, deleveraged, simplified business with strong cash flow – something that was only cemented in our mind further as a result of the company’s recent Q3 earnings.

That said, we think there may be an even better way to generate income off of the stock going forward.

Today, we’re covering A.) the recent earnings report, B.) the company’s future prospects, and C.) why selling puts on AT&T might be the best way to play the stock for income-focused investors.

Sound good? Let’s dive in.

Q3 Earnings

AT&T came out of the gate swinging in their recent earnings report.

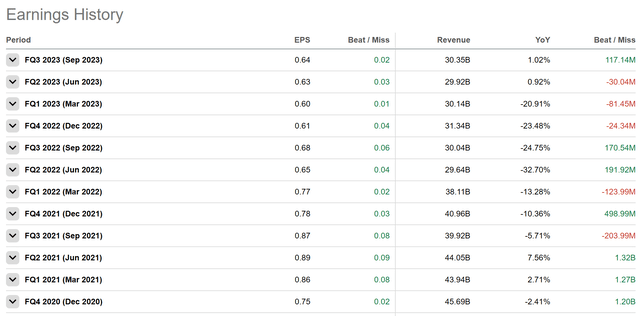

The company reported EPS of 0.64 cents per share, which topped estimates and was the highest profit reported over the last year:

Seeking Alpha

AT&T also reported more than $30.3 billion in revenue in Q3, which was a beat as well.

While year-over-year revenue growth was less than spectacular at 1%, the two recent quarters of positive top line growth firmly put to bed the notion that AT&T’s results will be volatile over the long term.

In other words, as evidenced by these results and the stabilizing financials, AT&T is back to ‘business as usual’ with their core communications business.

For some context, FY 2019 was the year of peak AT&T ‘gluttony’. In that year, the company produced $181 billion in revenue, $27 billion in operating income, and carried ~$150 billion of long-term debt on its balance sheet.

Over the last twelve months, AT&T has produced $122 billion in revenue, with $31 billion in operating income while carrying ~$126 billion in long term debt.

This is significant progress on the debt front and the margin front.

But how did the titanic company manage to turn the boat so quickly?

In short, all of the aforementioned drama. Cutting the bloated media arm and loading it with debt improved margins and deleveraged the company in one fell swoop. Cutting the dividend has also allowed management increased flexibility when it comes to making strategic investments.

Additionally, a renewed focus on the company’s core cash cow business has helped reduce drag across the board.

AT&T’s Prospects

Before the spinoff, AT&T was an octopus of a company, with tentacles out in every direction. The parent company was home to a communications division, a media division, a tech division, and more.

Following the breakup, the company’s sole focus is its core communications business, which has been the profit driver from the beginning. This can be seen from WBD’s gross & operating margins, which are less impressive and likely reduced pre-breakup AT&T margins.

In effect, AT&T’s business has now been reduced to the following few verticals:

The Communications segment provides services to businesses and consumers located in the U.S. and businesses globally. Our business strategies reflect bundled product offerings that cut across product lines and utilize shared assets. This segment contains the following business units:

Mobility provides nationwide wireless service and equipment. Business Wireline provides advanced ethernet-based fiber services, IP Voice and managed professional services, as well as traditional voice and data services and related equipment to business customers. Consumer Wireline provides broadband services, including fiber connections that provide our multi-gig services to residential customers in select locations. Consumer Wireline also provides legacy telephony voice communication services.

On the whole, AT&T now looks like a leaner, hungrier Verizon (VZ).

Here’s how the companies currently compare following their recent respective Q3 results:

TTM Verizon AT&T Revenue (in billions) $134 $121.7

Operating Profit

$30.4 $31

Operating Margin

22.7% 25.4%

Long Term Debt

$134.4 $126.7

Long Term Debt / Op Profit

4.42x 4.08x Click to enlarge

It’s tough to argue that AT&T doesn’t look better on every front. Plus, it’s clear that AT&T is a real competitor in the space. Their physical service footprint is well established, and the company should be able to continue to churn in operating profits quarter after quarter.

Oh, and one other thing; AT&T is attractively priced.

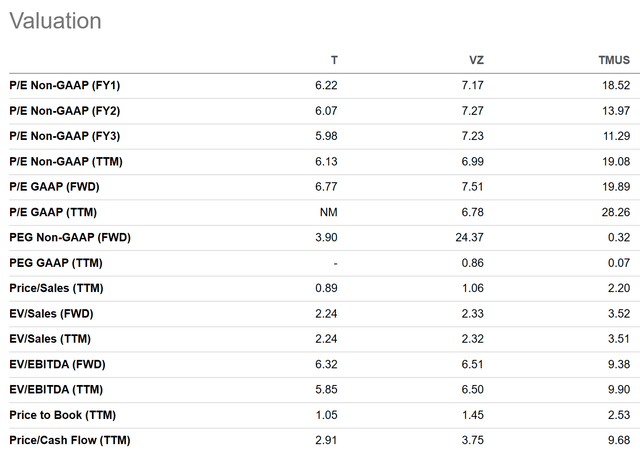

When compared with Verizon, despite the better operational results we’ve covered, AT&T is actually priced more competitively. The same goes for T-Mobile (TMUS), the only other real competitor in the communications business.

On nearly every metric, AT&T is the most attractively priced stock of the three:

Seeking Alpha

On top line sales, book, and cash flow, AT&T takes the cake when compared to its peers.

Additionally, AT&T compares favorably vs. the average S&P constituent on P/E and EBITDA multiples.

All in all, AT&T’s renewed operating focus, improved financial performance and relatively attractive valuation appear to put the company, and its stock, in a great light. We think the prospects are good for investors looking to get involved at this point in time.

The Trade

However, despite the attractive valuation and favorable operational results, the best way to take advantage of AT&T’s simplified business and potential future success may not be to simply buy the stock.

While buying the stock does lock in a ~7% dividend that will be strongly backed by the company’s cash flows, saturation of AT&T’s end market makes us think that share prices may struggle to appreciate significantly in the coming months and years.

This leaves us with an intriguing solution for juicing higher returns out of AT&T – selling put options.

When you sell a put option on a given stock, you’re agreeing to purchase stock at a given price (called the ‘Strike Price’) over a given time frame until the option expires.

In return for committing to potentially buying a given stock at a given price, the put seller receives a cash premium to keep, similar to insurance.

Then, one of two things happens.

In one scenario, the stock trades above the strike price by the expiration date of the option, in which case the put seller gets to keep the premium generated as profit.

In the second scenario, the stock dips below the strike price, and the put seller needs to buy shares at the strike price in order to satisfy the option. This will likely mean an unrealized loss in the short term. However, the put seller will still get to keep the premium generated.

Thus, selling put options either leads to income and a return of your cash used to collateralize the position, or income and a stock purchase of the same value in the underlying company.

Given that we like AT&T’s prospects as we’ve laid out, presently we like the $14 strike, December 15th put options:

Expiry & Strike (TradingView)

These options are trading at $21 per contract, which represents a 1.52% return over the next 47 days. If AT&T trades above $14 per share by December 15th, then you get your cash back and get to keep the premium. If AT&T trades under $14 per share by expiration then you get to buy stock at $14 and keep the premium. A win-win!

This 1.52% return annualizes to an 11%, which is considerably higher than the current dividend, hence our thinking in the first place.

Risks

While our trade idea does have some upsides to it – namely, the higher income – there are some risks to consider as well.

First, if the stock goes to zero, then you still may be forced to buy stock at $14, even if shares are worthless. This is the same risk profile as buying and holding the shares outright, but it’s important to consider nonetheless.

Additionally, AT&T as an underlying stock has some risks to consider.

First, macro conditions right now are choppy, which could lead to significant volatility in AT&T’s share price, as an extension of the market as a whole. While AT&T’s communications services are largely inelastic, there’s some sensitivity to business spend as institutional clients look to optimize / cut their cash outflows.

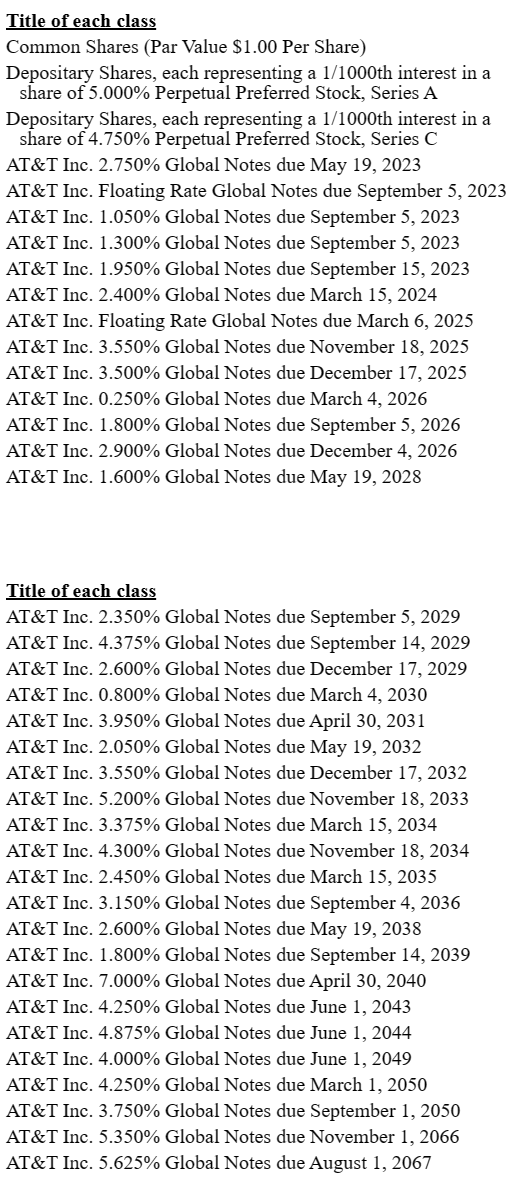

Second, AT&T has a large debt pile which will only get more expensive over time. Sure, the company’s current maturity profile and rate ladder is relatively cheap:

10Q

However, as the company refinances this debt over time or invests into new Capex, its highly possible that interest expenses will grow.

This could hamper equity returns or worsen overall margins, which could lead to a lower multiple and thus a stock price that stays lower for longer.

Net net, despite these risks, the conservative profile of the trade we’ve suggested could ameliorate some of the concern, all while providing even higher potential income for investors.

This seems like a win-win, and the best way to play the stock.

Summary

Overall, we like AT&T’s prospects as a leaner, more focused company on better financial footing. The stock is trading at a great valuation, and the company’s earnings aren’t that sensitive to potential economic shocks. We rate AT&T a “Buy”.

Because of these aspects, the stock should also serve as a great platform for selling put options. This strategy further reduces risk by lowering potential cost basis in the name if assigned and provides better cash distributions vs. the dividend or the risk-free rate in treasuries.

As we expect most investors in AT&T are here for the dividend, this could be a win-win strategy that is able to produce even more from the stock than a simple buy-and-hold strategy, especially given the risks we’ve outlined. Good luck out there!