Earlier in July, we did a deep dive into the startup scene in Singapore, the place we interviewed 4 specialists on whether or not the nation lacks succesful founders.

Whereas we’ve decided this was not the case, one among our readers identified that solely male voices have been represented in the article. As such, we’ve reached out to 2 women lively in the startup house in Singapore, both as enterprise capitalists or startup founders.

Nicely, it simply so occurred that our specialists, Yuying Deng, CEO and founding father of Esevel, and Anna Vanessa Haotanto, founding father of Zora Well being, have expertise in each sectors; listed here are their insights.

“A capable founder is a generalist.”

Following the earlier article, Yuying and Anna agree that past tangible metrics like income and consumer progress, being versatile in numerous areas and adapting to totally different approaches when wanted are two key traits of “capable” founders.

Anna added {that a} succesful founder should additionally create a robust firm tradition, construct and lead a crew, and maintain the firm’s imaginative and prescient through tough instances. “To me, you need to always remember your values and vision and not waver when times get difficult.”

However one would possibly surprise, what does it actually imply to be versatile? To Yuying, it’s to grasp a paradox of qualities that “seem like opposites”.

She emphasised the want for entrepreneurs to pay attention, take suggestions critically, and take accountability for his or her errors. “The best entrepreneurs know they don’t have all the answers and are open to learning from others.”

Navigating the valley of loss of life

Qualities apart, we have to acknowledge that the present financial atmosphere has not made it simple for startups in Singapore to develop.

As a consequence of inflation, many firms have turn into extra conservative when managing their funds. Some select to rent fewer staff, offshore operations to “less expensive” places in the Southeast Asian area, or go totally distant.

Yuying highlighted that funding has “dried up” in comparison with the increase of 2021 and earlier years, inevitably growing the strain on startups to search out their market slot in a shorter timeframe, which may be extremely demanding.

“Companies that raised funds at high valuations in 2021 or before are now struggling to generate the revenue needed to justify those valuations. This puts them in a tough spot as they try to scale and grow in a more cautious market,” added Yuying.

On the different hand, Anna believes that whereas funding is offered, the actual problem lies in securing “the right type” of capital.

She defined that buyers have turn into more and more cautious, which ends up in extra stringent due diligence processes and better expectations for startups to exhibit traction and scalability.

“Finding and retaining top talent is a persistent challenge, especially in a competitive market like Singapore. Entrepreneurs often struggle to attract skilled professionals who are both affordable and aligned with the startup’s vision,” Anna elaborated.

Gender equality in the entrepreneurship scene

Other than defining the traits of a succesful founder, we’re additionally curious whether or not gender performs an element in rising their enterprise (spoiler alert: it does).

Due to social media, extra ladies have come ahead to “dismantle gender inequality and the structures that uphold it”. Whereas ladies have been in a position to entry alternatives with their male counterparts, there’s nonetheless rather more to be achieved.

Each specialists agreed that there’s a funding hole for women-run enterprises. In keeping with Yuying, female founders obtain lower than 3 per cent of enterprise capital funding that male entrepreneurs sometimes safe.

She added that on prime of the societal strain for ladies to be enterprise leaders and first caregivers, many ladies internalise the similar burden, resulting in feeling burnt out—an expertise that males won’t have in the similar vein.

In her earlier interview with Vulcan Publish, Anna shared that it took her 158 pitches to achieve her goal fundraising objective, the place she introduced up the prevalence of gender points.

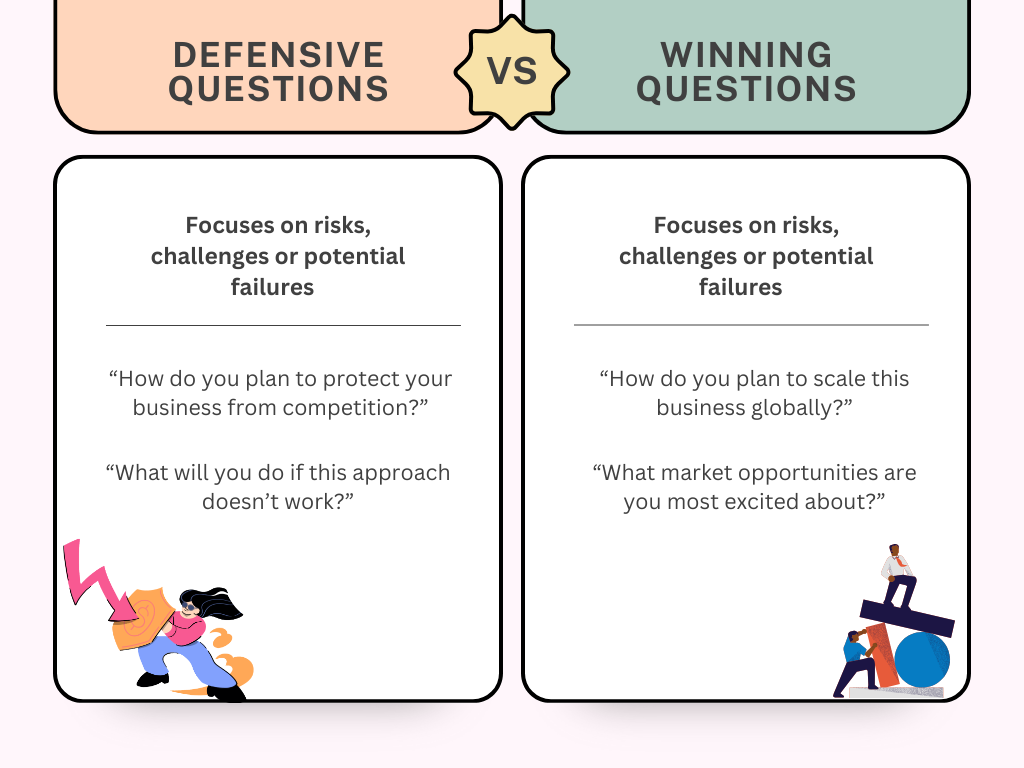

In keeping with a research carried out by Harvard Enterprise Evaluate, ladies are extra ceaselessly requested defensive questions throughout pitches, interviews, and public boards, whereas males are requested extra profitable questions.

In essence, defensive questions implicitly assume their enterprise is extra susceptible and require them to justify or defend their technique and decisions whereas profitable questions assume the enterprise will probably be profitable and encourage the founder to focus on their imaginative and prescient and ambition.

The research additionally confirmed that the sort of questions requested additionally has an impression on the quantity of funding raised, with these being requested defensive questions solely with the ability to elevate a mean of US$2.3 million in mixture funds—seven instances lower than the US$16.8 million common raised by these requested profitable questions.

This disparity signifies that ladies should work more durable to shift the narrative from a defensive stance and pivot the responses to stress strengths and alternatives.

I feel many ladies attain some extent the place they realise they must be 5 instances nearly as good to get the similar recognition as their male counterparts. However the excellent news is that almost all ladies are ten instances nearly as good, if not higher.

So slightly than getting caught on the inequalities, I’ve discovered it extra empowering to maintain pushing ahead, staying targeted on what I can change, and proving what I’m able to.

Yuying Deng, CEO and co-founder of Essevel

That stated, Anna shortly clarified that the challenges she encountered throughout the fundraising course of weren’t gender-focused. As a substitute, there was a lack of know-how and training about the particular points her firm aimed to handle: ladies’s well being.

[Fertility and women’s health] will not be simple or widespread matters, which typically led to misunderstandings or underestimations of the market alternative. The key was to teach potential buyers about the significance and impression of ladies’s well being, notably in areas like fertility, the place the want is critical however usually ignored.

I imagine that growing consciousness and understanding of those crucial points is important for driving not solely funding but in addition broader assist and recognition of the worth that firms like Zora Well being deliver to the market.

Anna Vanessa Haotanto, co-founder of Zora Well being

Granting extra entry to assets

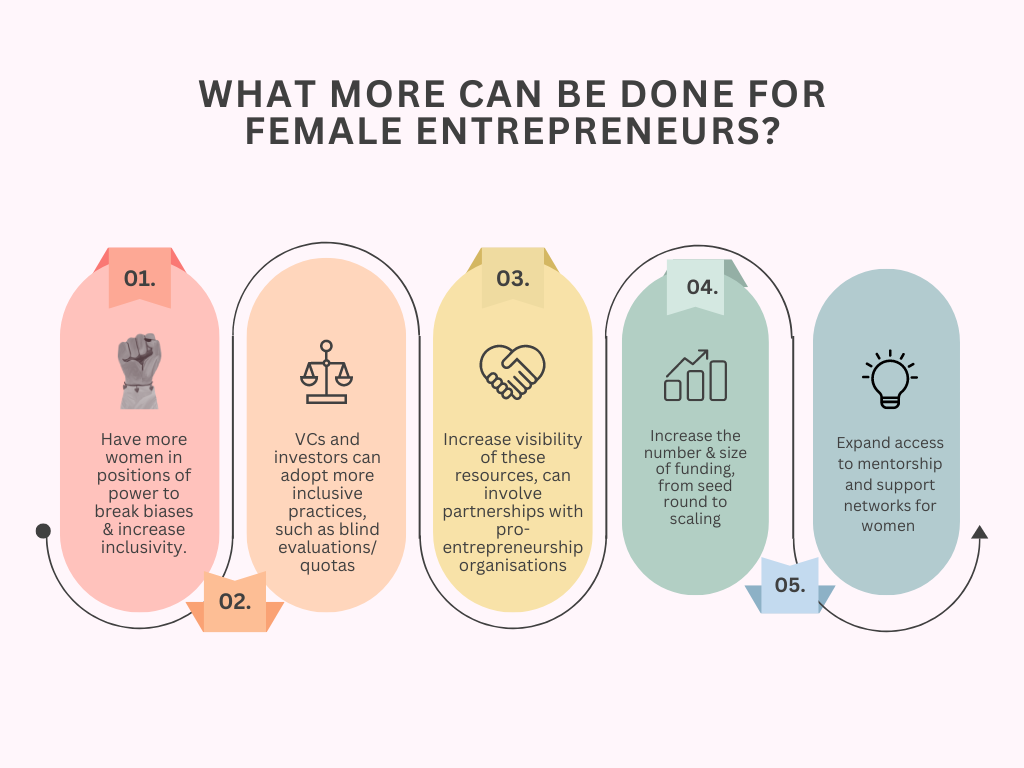

Whereas there was a rise in funding for female entrepreneurs, each Yuying and Anna imagine that there’s room for enchancment.

Yuying defined that whereas it’s a nice concept in follow, she has not seen many who’ve acquired these monetary assets. “This suggests that while the intention is there, the accessibility of these funds might be lacking.”

It is usually very important to create extra funding alternatives and be certain that it could attain female entrepreneurs who may benefit from them. On prime of that, giving them entry to networks, mentorship, and coaching will help them leverage these funds successfully.

Yuying added that that is greater than only a ladies’s difficulty—by overlooking female entrepreneurs’ contributions, we’re ignoring the potential of half of the world’s inhabitants.

“Imagine the innovations, businesses, and solutions we’re missing out on by not fully supporting women in their entrepreneurial journeys,” she added.

Past closing the gender hole, Anna believes that every one entrepreneurs, no matter gender, are assessed on the power of their concepts, execution, and the impression they will create.

In the end, the definition of functionality stays the similar throughout each genders. Nonetheless, the variety of hurdles they face is totally different.

We’re not saying that one has it worse than the different—as an alternative, we have to acknowledge that granting accessibility to assets to these in want will help enhance the progress of our native startups.

ANEXT Financial institution, a Singapore-based digital financial institution regulated by MAS, empowers startups with simple and accessible financing to gasoline their enterprise progress and growth.

Learn extra tales about Singaporean startups right here.

Featured Picture Credit: Yuying Deng by way of LinkedIn, Zora Well being

![It was all going well until… | Squid Game 2 | Netflix [ENG SUB] It was all going well until… | Squid Game 2 | Netflix [ENG SUB]](https://thehollywoodpremiere.com/wp-content/uploads/2025/01/It-was-all-going-well-until-Squid-Game-2-120x86.jpg)