Beginning With January 2024, the Grab-powered electronic financial institution GXBank began presenting its extremely first physical card, the GX Card.

A debit card that’s connected to the GX Account, the GX Card can be made use of anywhere that takes Mastercard or MyDebit cards, and is likewise sustained by the MEPS Shared Atm Machine Network (SAN).

Like any type of common credit scores or debit card, it is determined by a special string of 16 numerical figures. The GX Card will certainly have a five-year legitimacy duration upon card issuance, indicating if you obtain it this year, it’ll end time in 2029.

In regards to capability, the GX Card looks quite typical as for cards go. So, what remains in it for individuals to register for it? Well, having actually been utilizing it for a great week, below’s my testimonial of the card, from making an application for it to using it in real-world usage situations.

Easy application with great advantages

Requesting the GX Card is as very easy as making a GXBank account and touching on a little card symbol once you established your account. Provided, it’s still being presented now, so not everybody will certainly reach appreciate this card right now.

When it comes to qualification, candidates have to:

Be Malaysian people with a legitimate MyKad and living in Malaysia.

Be matured 18 and above.

Have an energetic GX Account.

If you satisfy those requirements, obtaining your card is seriously very easy. I right away was admitted to the online card, though I just obtained the physical card regarding a week after that.

Convenience of use apart, several of the fantastic advantages of the GX Card consist of the truth that there’s no minimal account equilibrium needed to preserve thecard So if you fail to remember to cover up your GX Account, there’s definitely no concern.

In addition to that, GX Card is providing individuals 1% cashback on purchases without cap from currently up until November 5, 2024. Some sorts of purchases are not qualified for the cashback, however, consisting of:

Cash money withdrawals.

E-wallet top-up purchases.

Insurance policy or Takaful purchases.

Repayments made to charity bodies.

Federal government purchases.

Gambling-related purchases.

Repayments made to quasi-cash sellers (crypto, foreign exchange, and so on).

Gap purchases.

Constant Jaya Grocer buyers will certainly more than happy to find out that GX Card uses 1.5 x GrabRewards Information if you make use of the card at the supermarket. Simply bear in mind that you need to blink the Jaya Grocer participant barcode in Grab application at the cashier prior to you pay, or you will not obtain any type of factors.

Unfortunately, this perk is not comprehensive of on the internet Jaya Grocer orders.

One more fantastic perk is that there are practically no financial institution charges now. That consists of no brand-new card (or perhaps substitute) issuance charges or yearly card charges.

Utilizing it at any type of atm machine through the MEPS SAN is likewise cost-free. There will certainly be a RM1 MEPS cost published on the client’s account, however it’ll be forgoed right away. There are likewise no charges for abroad cash money withdrawals making use of Atm machines through Mastercard.

Simply bear in mind that the forgo is readied to last up until completion of this year (December 31, 2024).

No concerns for customer support

So, after making an application for my GX Card, I started waiting on my mail. Serious, I examined my mail box everyday. It was intended to get here on January 25, however taking into consideration that it was Thaipusam, I provided it a little bit even more time.

If you’re asking yourself why I could not simply begin making use of the “virtual card”, well, it just helps on the internet purchases. It does not work as an NFC card like I incorrectly thought it would certainly. And also, GXBank hasn’t permitted individuals to include the card to their on the internet budgets such as Samsung Pay, Google Pay, or Apple Budget right now.

When the card really did not get here by Friday evening, I made a decision to fire the customer support a message on the GXBank application. It was 10:30 PM so I was happily shocked when I contacted a human depictive right away.

Raaj, the customer support agent, notified me that there were some hold-ups in sending the card, which I must get it the adhering to week. Lo and look at, come Monday, I obtained an unique little shipment in my mail box.

Placing it to the examination

In regards to the construct of the card, I would certainly state it’s somewhat thinner contrasted to my various other cards. While this does suggest it has a flimsier feeling to it, it might be a plus for those that such as to maintain their budgets slim.

That apart, the card has a holographic luster to it that makes me really feel extremely trendy when utilizing it. It’s likewise upright instead of straight, which I discovered one-of-a-kind. (Generally, every single time I utilize it, I half-expect to obtain a praise from the cashier. No good luck thus far.)

As soon as you get the physical card, you just need to trigger it in the application.

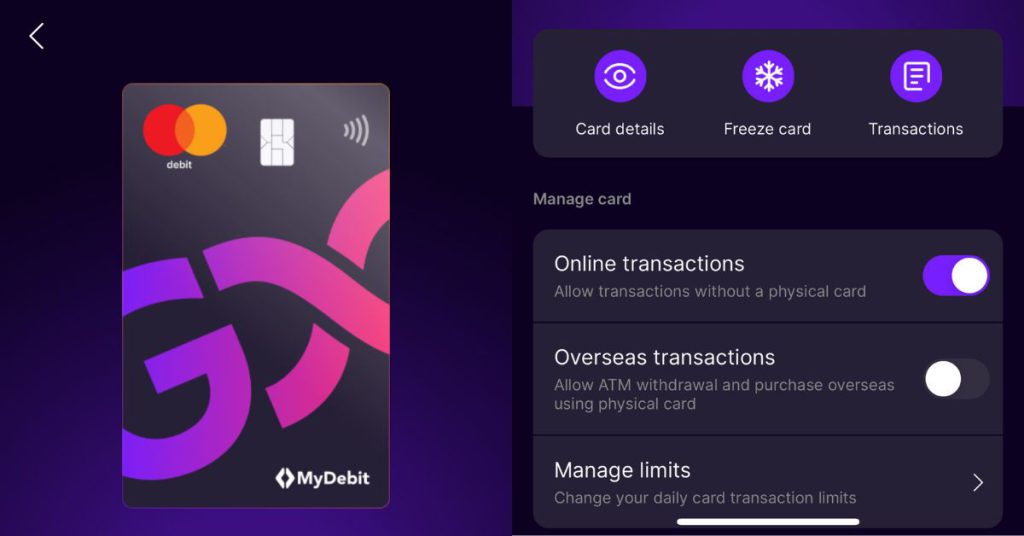

For card upkeep, the GXBank application has everything covered in a really user-friendly way. In the application’s card web page, you can check out card information, freeze or thaw your card, make it possible for or disable on the internet purchases, make it possible for or disable abroad purchases, alter your card PIN or limitation, or completely terminate your card.

Utilizing it for the first time, you will certainly need to input your PIN, however succeeding purchases can be done through Paywave.

I have actually utilized it for rather the variety of acquisitions so far. For one, I such as exactly how it enables me to budget plan my costs considering that it’s connected to my GX Account, which does not have that much cash therein.

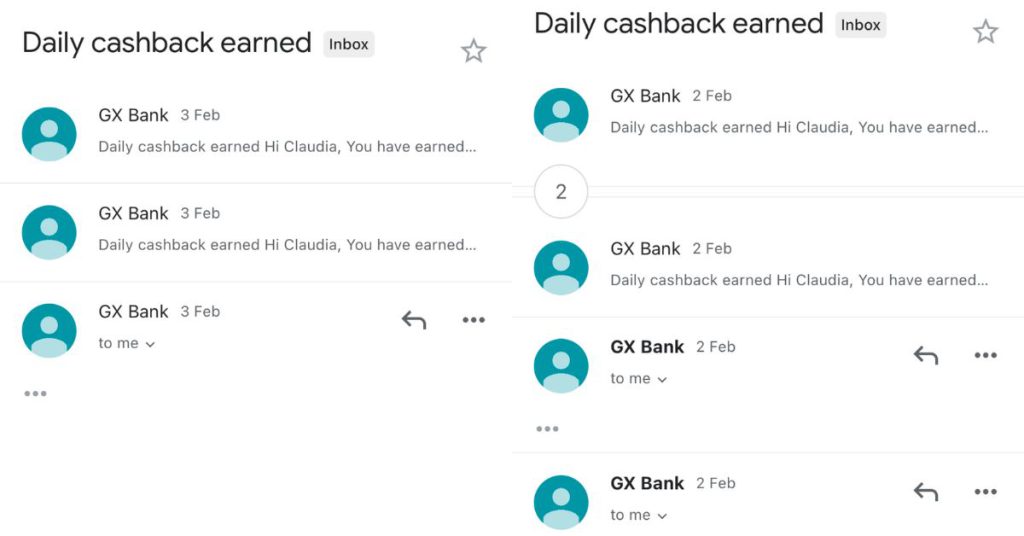

The cashback does appear to take a little time to be transferred. Inspecting the information once more, I found out that the cashback will certainly be attributed to your account by the end of the following day from the uploading day of the purchase.

When my cashback was attributed, the financial institution sent me not one, not 2, not also 3, however 6 entire notices and e-mails (definition I obtained 12 pings entirely on my phone) for a RM0.40 cashback. Not 6 RM0.40 cashbacks, however one.

For a minute I was really stressed it was embeded a loophole and I would certainly be obtaining notices from GXBank permanently.

This is actually puzzling, and the only solution I have is that probably the cashback associates to 6 overall purchases. I’m actually wishing this obtains dealt with quickly.

In various other information, I likewise discovered that the 1% cashback worth will certainly be determined and rounded to the local 2 decimal factors, so maintain that in mind.

The cashback quantity likewise requires to be a minimum of RM0.01 to be qualified to be attributed to your GX Account. All that implies is the repayment requires to be a minimum of RM1.

Waiting on higher access

Once, I was an individual that spoke highly of making use of cash money just. However as the moments altered, so have I. Not just am I typically cashless, I’m really cardless as well.

Sometimes, all I carry me when I pursue lunch is simply my phone. Besides, much of the areas I check out take QR settlements. And if I require to utilize my card, I currently have it on my Apple Budget.

So, as high as I have actually taken pleasure in the GX Card and the uniqueness of having a brand-new physical card to contribute to my budget, I am quite expecting even more advancements with GXBank.

Regardless, however, I do assume it deserves making an application for the card, as there’s actually absolutely nothing to shed. And also, isn’t it a great concept to obtain the card while the advantages last?

Find out more regarding GXBank below.

Check out various other posts we have actually covered electronic financial below.

![[Review] GX Card, Grab-powered GXBank’s first debit card [Review] GX Card, Grab-powered GXBank’s first debit card](https://thehollywoodpremiere.com/wp-content/uploads/2024/02/Review-GX-Card-Grab-powered-GXBanks-first-debit-card-750x375.jpg)