Vladdeep

Herbalife Ltd. (NYSE:HLF) has been a disputed and controversial alternative for traders over the a long time, with the sale of dietary merchandise made by multi-level advertising and marketing [MLM] methods.

Multi-level advertising and marketing, often known as direct advertising and marketing or community advertising and marketing, is the method of promoting merchandise on to shoppers utilizing impartial gross sales representatives. The first attraction to new recruits contains guarantees of wealth and independence, whereas with the ability to work out of your own home. Usually, unlawful pyramid schemes are current in MLM innovations, the place the unique builders get wealthy, whereas the latest gross sales associates are left with substantial “start-up” charges/losses and no actual earnings.

Firm Homepage – July twenty first, 2023

My job on this article just isn’t to judge the enterprise mannequin, however level out after almost 43 years in enterprise (publicly buying and selling since 1986), with tens of billions in income generated over that span, the HLF inventory possession story is maybe as low cost now because it has ever been on underlying fundamentals. As well as, a monster borrowed and sold-short place might be trapped if gross sales and earnings reverse into a large uptrend going into 2024, like now projected by Wall Avenue analysts.

The upside argument is best working outcomes will encourage new traders to purchase the inventory, whereas shorts begin to expertise heavy losses on their bearish commerce concept. The additional quantity of purchase orders, as brief sellers reverse course and buy shares to shut positions, might serve to create an uncommon imbalance in share provide/demand. If aggressive patrons outnumber sellers by 2 to 1, or 3 to 1 each day for weeks on finish, the value might leap +50% to +100% in a traditional “brief squeeze” situation.

Extremely-Low Valuation

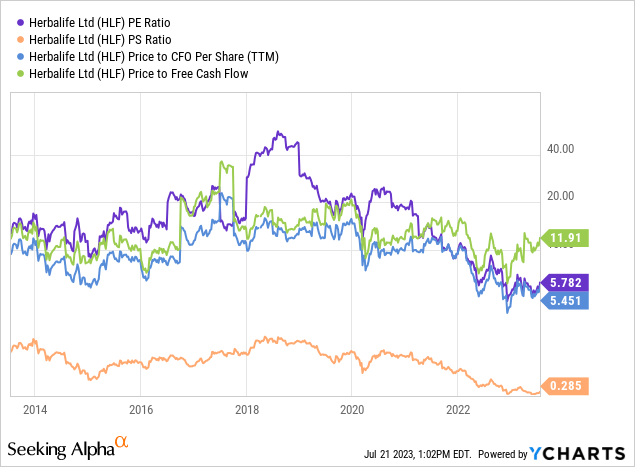

The core bullish story is discovered within the present valuation of the inventory vs. what the enterprise is producing for homeowners. On value to trailing earnings (5.8x), gross sales (0.28x), and money circulate (5.5x), HLF is successfully buying and selling round its 10-year low presently. Moreover, regardless of a “free” money circulate a number of of 11.9x stacking up as comparatively common over the newest decade of historical past, the projected pickup in earnings (and elimination of momentary headwinds) ought to produce a quantity nicely below 10x subsequent yr.

YCharts – Herbalife, Worth to Fundamental Elementary Valuations, 10 Years

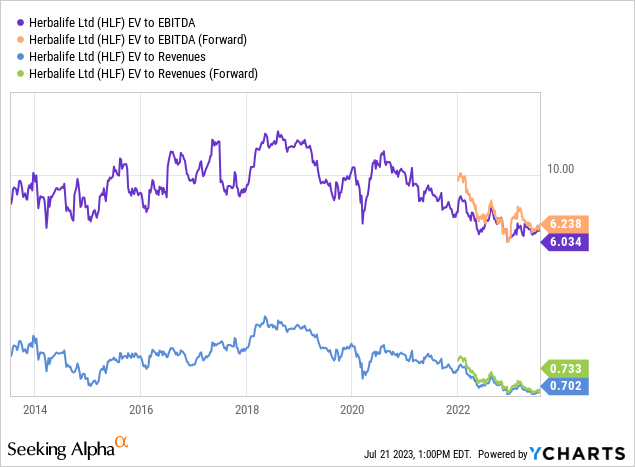

Much more spectacular is the enterprise valuation on primary money EBITDA and revenues. After we add complete debt and subtract money holdings to the fairness market capitalization, a comparatively full image of working outcomes on zeroed-out debt, theoretical web acquisition value for a single purchaser is created.

YCharts – Herbalife, Enterprise Valuations on EBITDA & Gross sales, 10 Years

EV to EBITDA round 6x and gross sales close to 0.70x in the summertime of 2023 is actually the least costly setup for brand spanking new Herbalife patrons in current reminiscence. In case you wish to “store” firm valuations, and are waiting for an improved enterprise outlook, there’s loads to be upbeat about.

Quick Curiosity Logic and Positioning

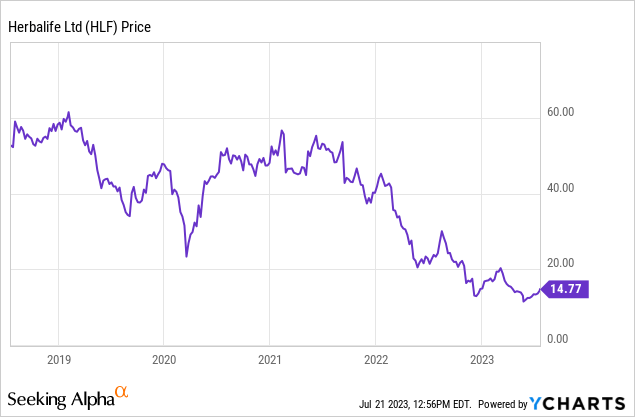

The curious a part of the Herbalife funding proposition is traders are taking a really adverse view of the corporate right this moment, all due to PAST occasions. The #1 cause to shrink back from proudly owning HLF is share efficiency has sucked for years (pardon my French). Under is a 5-year graph of weekly value modifications.

YCharts – Herbalife, Weekly Worth Adjustments over 10 Years

Had you bought a stake at $60 in early 2019, you wouldn’t be pleased with shares sitting at $15 (a -75% value loss) 4 years later (receiving no money dividends over this era).

Then, a dip in operations has occurred because the pandemic has light. Throughout 2020-21 a sturdy climb in shopper/distributor gross sales and earnings occurred as a consequence of surprising work-from-home demand.

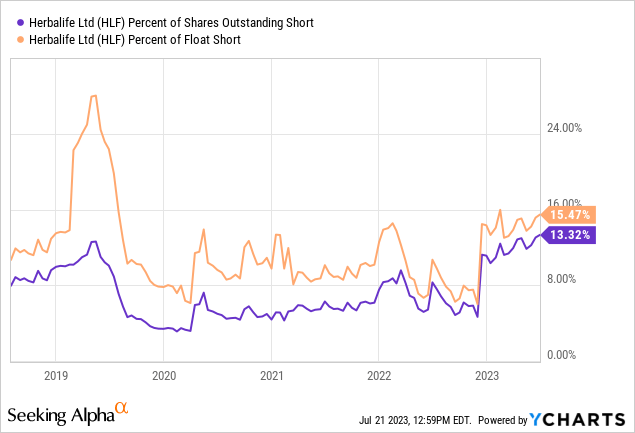

Quick sellers have confidently jumped on each concepts in 2023 and greater than DOUBLED their bets towards the corporate’s inventory vs. late 2022. With 15% of share float and 13% of excellent share counts now pre-sold on borrowed inventory from others, shorts are confidently sitting on solely negligible beneficial properties general, measured from the December spike in positioning. I’m guestimating (having performed brief squeezes extensively since 2006), HLF’s value could be $5 to $10 increased absent the numerous and skewed impact of this additional promoting within the open market.

YCharts – Herbalife, Month-to-month Quick Positioning, 5 Years

I’d additionally level out that complete firm gross sales have solely risen about 10% over the previous decade. This seems to be a enterprise fading into the sundown, one other stable cause to think about promoting or shorting the inventory.

However wait! Administration has aggressively used almost all free money circulate through the years to purchase again shares, as an alternative of investing capital into rising the enterprise by plant & gear spending and acquisitions. While you correctly account for the higher than 50% discount in excellent shares over the earlier 10 years, income progress has really averaged a stronger than +7% annual improve “per” share, which has outperformed many brand-name blue chips on Wall Avenue.

This monetary engineering effort can be retaining stress on brief sellers as obtainable provide to brief is consistently shrinking, whereas future outcomes are “leveraged” for remaining longs with out using added debt. Any sizable uptick in operations ought to improve the value of shares reasonably quickly is my pondering.

Technical Momentum Reversing to Upside?

If the brief squeeze setup is prepared for ignition, we’d like some proof relating to a reversal in promoting stress. To be sincere, a number of hints of hassle for the brief place have appeared on the charts since Might.

First, many trading-health indicators bottomed on the December skid in value, which you’ll be able to evaluation on the 18-month chart under. The Accumulation/Distribution Line and On Steadiness Quantity indicators reached new lows on the similar time (circled in inexperienced). Nonetheless, the share quote low in Might was “not confirmed” by the 2 momentum creations, and most others I watch carefully.

Second, the 20-day Chaikin Cash Circulation calculation has turned fairly bullish for the reason that finish of June. A CMF swing from cash outflows to inflows occurred throughout July of final yr and January of this yr, simply earlier than value jumped 30% and 20% respectively. We might, at a minimal, expertise one other rebound to $16 or $17, as a retest of the 200-day transferring common. My pondering is an actual turnaround in operations might simply assist breaking nicely above the 200-day MA to as excessive as the following overhead value resistance stage from February close to $20.

StockCharts.com – Herbalife, 18 Months of Worth & Quantity Adjustments, Writer Reference Factors

Last Ideas

One potential brief squeeze catalyst might be the Q2 earnings report, scheduled for launch on August 2nd. If outcomes impress or steerage is raised, the shorts might be caught in an every-man-for-himself rush to the exits.

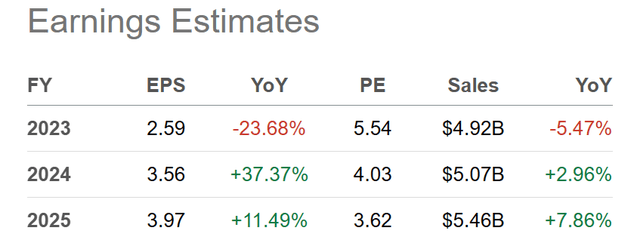

Under is a desk of the turnaround forecast in earnings projected for 2024-25 by Wall Avenue analyst consensus. Sure, Herbalife might be priced at a super-low ahead P/E of simply 4x right this moment!

Searching for Alpha Desk – Analyst Estimates for 2023-25, Made July twentieth, 2023

The primary danger for the corporate is a recession with increased rates of interest might undercut earnings era. Herbalife held over $2.4 billion in debt (down from $2.8 billion in 2021) ending Q1 in March vs. an fairness market capitalization of $1.5 billion at $15 per share. To date, complete curiosity expense has stayed round $140 million the final three years (vs. after-tax earnings of $250 million over the trailing 12 months). However, a weaker economic system with decrease gross sales and enterprise profitability might result in bond score downgrades alongside increased bills finally. The vast majority of its debt will seemingly must be refinanced at higher borrowing expense between 2024-26.

How excessive can Herbalife go? That is a good query. I do not see any cause why it can not commerce again to its 52-week excessive of $30, given an actual flip for the higher in working profitability. Such would put the valuation story nearer to 10-year regular ranges, whereas a P/E of 8x “ahead” estimates would nonetheless be a distance from costly vs. S&P 500 estimated P/Es within the 15x to 17x vary for 2024. Keep in mind, a $30 value from $15 right this moment would equate with a achieve of +100% for good patrons (or fortunate ones relying in your standpoint).

As a best-case situation for merchants, an exaggerated brief squeeze spike on really optimistic working information over the following quarter or two might permit value to overshoot $30 on the upside. Do not say it can not occur. This safety has a historical past of untamed swings over the a long time.

Thanks for studying. Please take into account this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is beneficial earlier than making any commerce.

![It was all going well until… | Squid Game 2 | Netflix [ENG SUB] It was all going well until… | Squid Game 2 | Netflix [ENG SUB]](https://thehollywoodpremiere.com/wp-content/uploads/2025/01/It-was-all-going-well-until-Squid-Game-2-120x86.jpg)