Jesse Grant

Intro

On November 16, Sonos (NASDAQ:SONO) released its earnings. The business showed tenacity in expanding its clientele. The business also revealed a new buyback initiative. As a result, following the earnings, the stock rose 16%.

Investment Thesis

We launched a buy rating on Sonos back in May. Our initial claim was that Sonos is a fantastic brand with a devoted following of customers. The difficult consumer environment that businesses are currently facing will pass. The cycle will end with the company growing again.

Many investors are running away from the consumer discretionary sector due to the fear of potential recession. But we think these investors will miss the enormous upside this pessimistic sentiment is offering. We know the economy has been rough lately, but Sonos has actually grown its customer base and registered product per household over the past year. Consumers clearly love their products. Even with high inflation and concerns about a recession, the company has found ways to thrive. This tells us their products are solid.

So while the markets have been volatile, this is a good time to invest in Sonos. Trying to time exactly when to buy stocks is tricky anyway. We mainly focus on the big-picture strength of the Sonos brand.

Financial Review

Its revenues declined by 3.5% in Q4 FY2023, after increasing by 0.4% in Q3. But compared to Q3, when it shrank by 130 basis points, its gross margin increased by 270 basis points in Q4. This assisted in reducing its loss and bringing it back into positive cash flow and EBITDA territory.

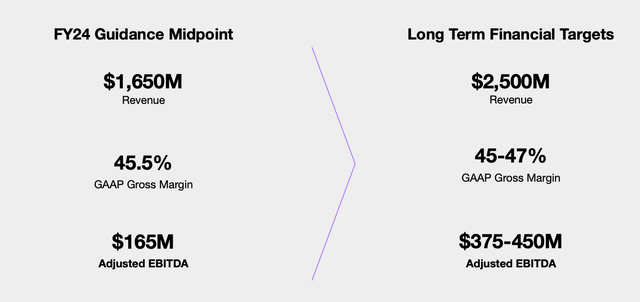

The management projected flat top-line growth in FY2024. It anticipated a challenging market in H1 FY2024, but it also anticipated an acceleration of the company’s top-line growth in H2 FY2024 due to new product launches. Furthermore, the business projected a higher gross margin and EBITDA for FY 2024 even though a flat revenue growth.

SONO

Stock Buyback

Sonos has been committed to creating shareholder value through stock buyback. Just this year, the company spent $100 million to repurchase shares. And they just announced plans for another $200 million stock buyback program. That’s a significant size compared to Sonos’ total market cap of $1.7 billion.

The good news is, Sonos can clearly afford it. They have zero debt and $220 million of cash sitting in the bank. On top of that, Sonos generated $50 million in free cash flow this past fiscal year. So we are confident they are capable of executing the full $200 million buyback plan.

Customer Growth

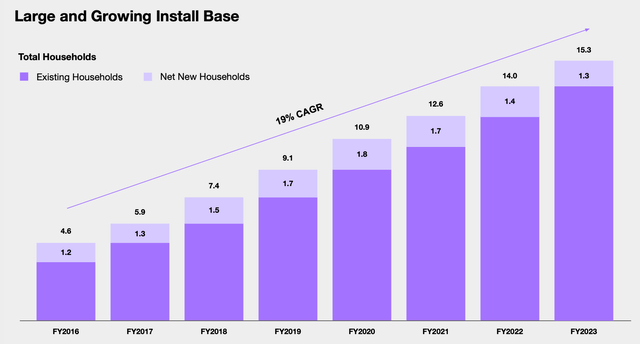

In addition, Sonos did admit they’re facing more competition in the market these days. But even so, they still grew their customer base by 9% this past year. The average number of Sonos products per household keeps increasing – that’s a good sign in our book. It shows their strategy of working with all the music platforms and focusing on wireless is paying dividends. It draws customers in and gets them hooked on building out whole-home systems. That seamless connectivity is a real edge for Sonos and helps keep people locked into their ecosystem.

Total households increased 9% to 15.3 million in Fiscal 2023

Existing households accounted for 44% of new product registrations in Fiscal 2023

Average number of registered products per household of 3.05 in Fiscal 2023 vs 2.98 last year

SONO

Brand Strength & Operational Focus

In the last fiscal year, Sonos also cut their inventory levels by 24%. Management says wholesale inventories are now at a healthy level. That provides a solid foundation as Sonos looks to restart growth.

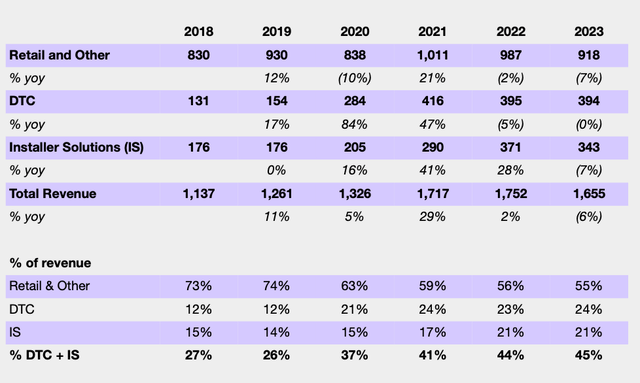

In addition, over the last few years, the company has reduced its reliance on the wholesale channel. It raised its DTC percentage to 24% while decreasing the proportion of wholesale revenue from 73% to 55%. This meant that the company continued to increase its brand awareness, which should lead to higher margins in the future.

SONO

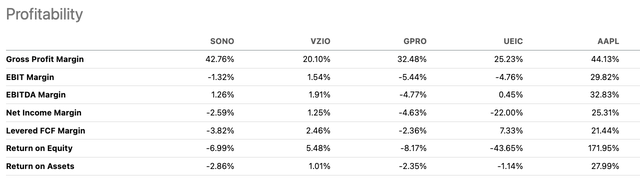

The way we see it, Sonos has built itself a pretty strong brand name. You can tell when you look at their gross margins of 42.7%. That’s comparable with Apple (NYSE:AAPL), which is impressive.

Seeking Alpha

The company incurred operating loss because it is still in the early stages, so they’re investing in marketing and new product development. The good news is that the management is ready to start focusing more on profitable growth going forward. They cut 7% of staff this year in 2023 to help get costs in line.

Our take is this should help improve profitability in FY2024. The brand strength is there for Sonos. They just need to find the right balance between investing for the future and delivering on the bottom line. We’ll be keeping an eye on the impact of this year’s layoffs when the next earnings come out.

Valuation

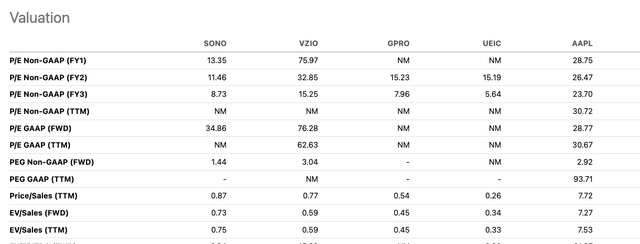

Based on current valuation metrics, Sonos does not appear expensive compared to industry peers. The stock trades at 13.35x forward P/E ratio and 0.87x P/S ratio.

We believe Sonos has the potential to establish a leading position in the speaker sector over the long term. The company’s strong brand, high customer loyalty, and connected home audio platform give it competitive advantages in our view.

Even amid a challenging consumer environment, Sonos has continued growing its customer base while making progress on shifting to a more direct sales model. This gives us confidence in Sonos’ upside potential from today’s valuation.

Seeking Alpha

Risk

The Sonos management team has expressed a cautious view of the consumer environment in FY2024. As a result, we believe there could still be volatility ahead for Sonos stock.

If the company fails to maintain positive free cash flow in upcoming quarters, there is a risk that the stock could be re-priced lower on a book value basis. The shares have declined 25% over the past year. However, we do not think the market is currently pricing Sonos at a distressed valuation level.

This points to potential significant downside risk if operations deteriorate. However, we do not see this as a highly probable scenario currently since Sonos did manage to grow its customer base in fiscal 2023 amid challenges.

Seeking Alpha

Conclusion

While Sonos management believes the consumer environment will remain challenging in FY2024, the company has shown an ability to maintain strong 42% gross margins, well above most peers. This demonstrates the loyalty of Sonos’ customer base and the strength of its brand. More importantly, amid difficult conditions in FY2023, Sonos grew its customer households and increased product registrations per home. This indicates the company still has room to expand its user base and drive higher engagement.

We have noticed many investors panicking and fleeing consumer discretionary stocks because of fears of a potential recession. However, in our view, the current challenges make consumer discretionary stocks like Sonos more attractively valued. Despite macro uncertainty, Sonos continues demonstrating that its platform resonates with consumers.

While risks exist around consumer spending, we believe Sonos’ strong brand, recurring revenue model, and ability to expand its base even in difficult times provide confidence. In addition, we do not view the stock as overvalued trading at 13.35x forward P/E.

Recent results reinforce our bullish thesis on Sonos. We maintain our buy rating as we see the company’s growth story intact despite economic turbulence. The current negativity appears overdone and offers an opportunity in a top name at a reasonable valuation based on our analysis.