bodnarchuk

Part I – Introduction

The Vancouver-based Eldorado Gold Corporation (NYSE:EGO) announced the third quarter of 2023 preliminary gold production late on October 1, 2023.

Also, Eldorado Gold published its October presentation, which you can access by clicking here.

Note: This article updates my July 31, 2023, article. I have followed EGO on Seeking Alpha since January 2015.

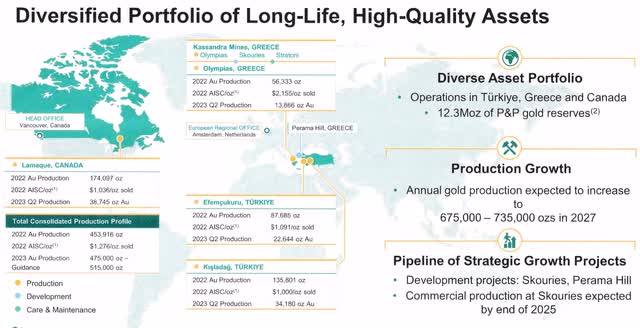

EGO Map Assets Presentation (EGO October Presentation)

1 – 3Q23 Production Snapshot and 2023 Guidance

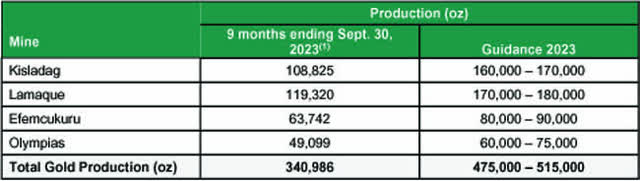

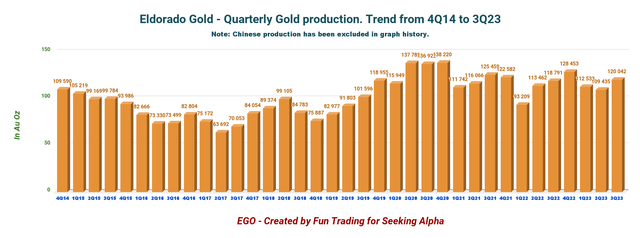

Eldorado Gold Corporation delivered another decent gold production this quarter. Gold production came in at 120,042 Oz, up 1.1% from 118,791 ounces produced in 3Q22 and up 9.7% from the preceding quarter. The company indicated that it was on track to meet 2023 Guidance.

EGO 2023 Guidance (EGO Press Release)

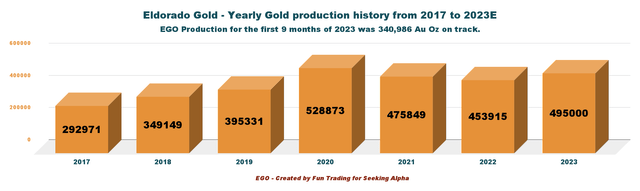

Gold production peaked in 2020 and is gradually increasing now after a slight decline in 2021-2022.

EGO Yearly Production History with 2023 Outlook (Mid-Point) (Fun Trading)

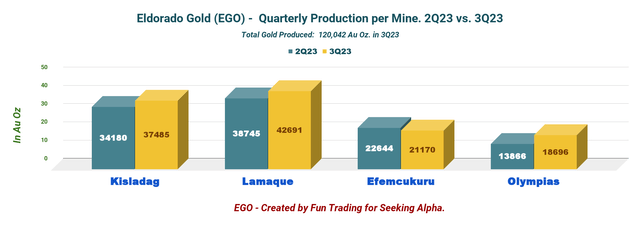

Lamaque production increased significantly; Kisladag and Olympias performed well, while Efemcukuru registered a slightly lower production sequentially, as shown below. Overall, a very decent production 3Q23.

EGO Quarterly Production 2Q23 versus 3Q23 (Fun Trading)

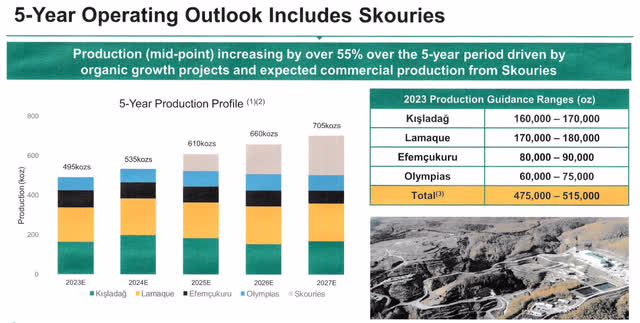

One crucial component we need to analyze is the Skouries feasibility study after securing the financing. The company released an impressive 5-Year Production outlook including Skouries kicking in in 2025.

EGO 5-Year Outlook (EGO Presentation)

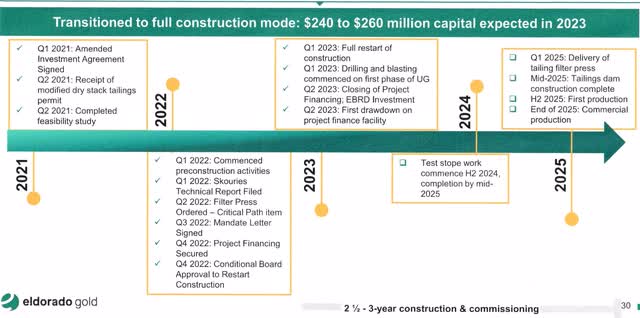

The full construction activities commenced in the second quarter of 2023, and the company remains on budget and on track for first gold production in mid-2025 with commercial production expected at the end of 2025.

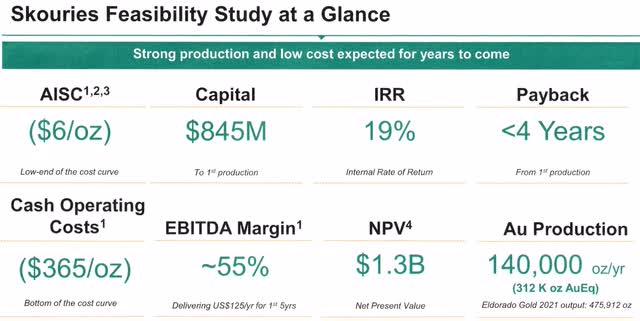

EGO Skouries Feasibility Study at a Glance (EGO Presentation October)

Progress Project Highlights as at August 30, 2023

Overall project progress was 33%; forecast to be 48% complete by year-end; Detailed engineering was 55% complete; forecast to be 90% complete by year-end; Procurement was 68% complete; forecast to be 90% complete by year-end; Personnel onsite increased to 400 with 900 expected by year-end; and personnel off-site is at 200 and the remaining engineering has transferred from Fluor to Greek firms.

Possible issue: Due to inflationary pressures and despite management confidence, I believe the Capital cost of $845 million will be slightly higher.

EGO Skouries Schedule (EGO Presentation)

The Skouries mine will produce gold and copper with 140K Au Oz and 67 M pounds of copper annually, with an estimated free cash flow per year of $217 million for the first five years.

2 – Investment Thesis

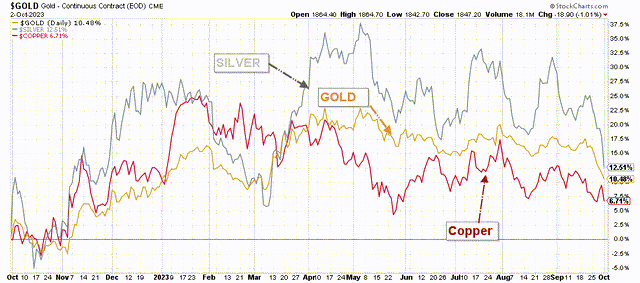

The investment thesis continues to be a challenging exercise, but the situation is getting better despite the recent weakness that the gold industry is experiencing.

The market turned bearish after learning that the Fed may be inclined to raise further interest rates due to an increased inflationary pressure triggered by higher oil prices trading now above $90 a barrel.

Gold, silver and other metals have tumbled since September and gold miners suffered a severe correction in the process. Gold spot closed a little over $1,820 per ounce yesterday shading over $100 per ounce in two weeks.

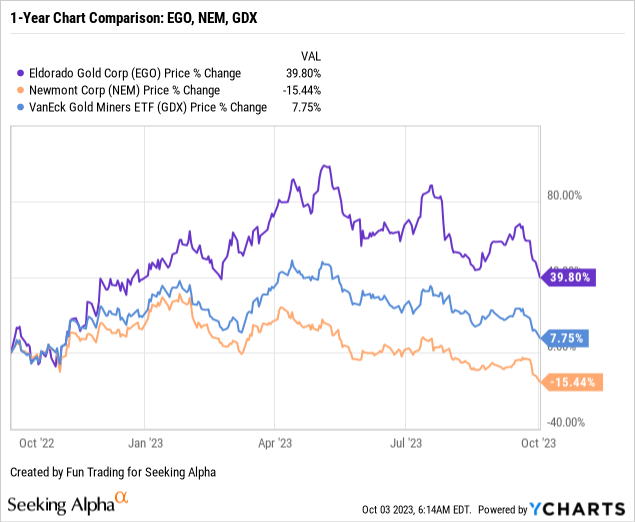

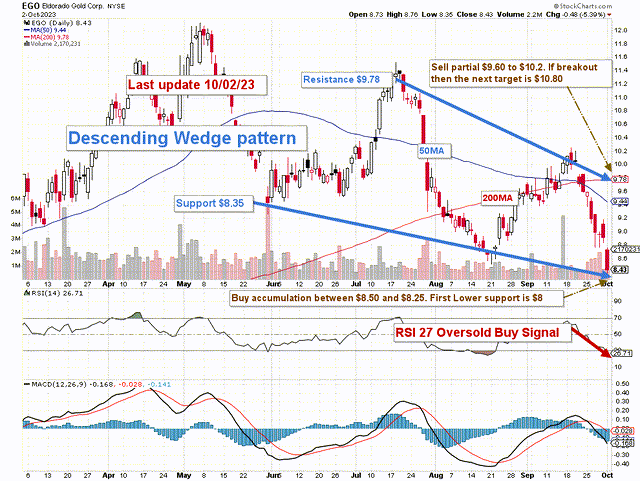

EGO 1-Year Chart History (Fun Trading StockCharts)

However, I firmly believe this period of weakness will not last long and I see gold prices turning around in 4Q23.

Thus, it is an excellent time to take advantage of the low stock price and start a gradually long-term accumulation of any weakness. It must be incremented by short-term trading using the LIFO method to make this process beneficial. The solution is to trade EGO short-term LIFO using at least 50% of your entire position while keeping a core long-term for a much higher target.

3 – Stock Performance

The stock has outperformed the VanEck Vectors Gold Miners ETF (GDX) and Newmont Corp. (NEM) and is now up 40% on a one-year basis.

Part II – Gold Production Details For 3Q23

On October 2, 2023, the company announced the initial gold production for the third quarter of 2023.

EGO Quarterly Production History (Fun Trading)

The third quarter of 2023 production came in at 120,042 Oz, up 1.1% from 118,791 ounces produced in 3Q22 and up 9.7% delivered the preceding quarter.

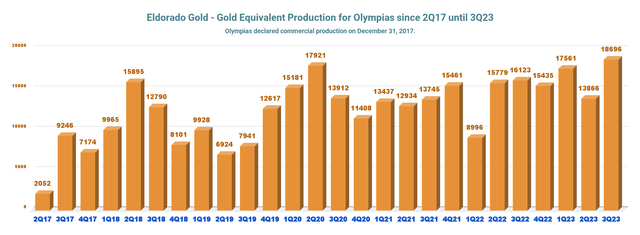

1 – Olympias Mine

Production came in at 18,696 ounces compared to 16,123 ounces produced in 3Q22 and 13,866 ounces in 2Q23. It was a record as you can see below:

EGO Olympias Quarterly Production (Fun Trading)

The company said that “Olympias benefited from transformation initiatives completed early in the quarter including emulsion blasting and increased underground ventilation. Productivity continues to ramp up with development into the larger stopes within the Flats zone which is expected to result in steady production into the fourth quarter.”

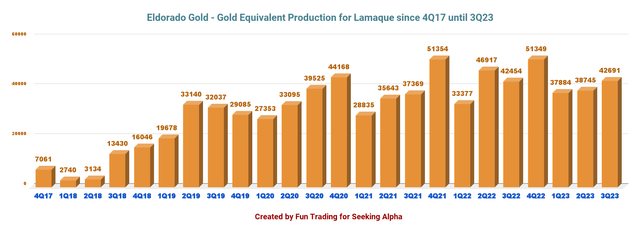

2 – Lamaque Mine

At Lamaque, third-quarter production increased 0.5% over the third quarter 2022. Production was impacted by slower than expected development in the underground from suspended shifts in the second quarter due to the wildfires in the region.

Production came in at 42,691 ounces, up from 42,454 ounces in 3Q22 and 38,745 ounces in 2Q23.

EGO Lamaque Quarterly Production (Fun Trading)

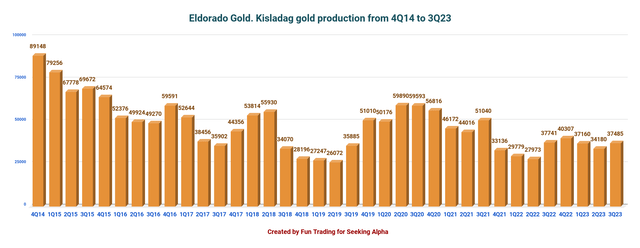

3 – Kisladag Mine

Third-quarter gold production at Kisladag decreased by 0.7% to 37,485 ounces over the third quarter 2022 and was up from 34,180 ounces produced in 2Q23. The increased production was due to the successful commissioning of the agglomeration drum that was added to the crushing circuit in the second quarter and tonnes placed on the heap leach pad have continued to increase as a result of the higher-capacity grasshopper conveyors and radial stacker.

EGO Kisladag Production History (Fun Trading)

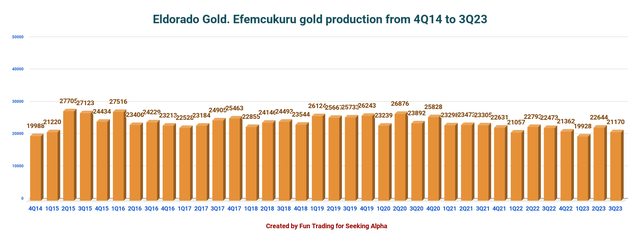

4 – Efemcukuru Mine

At Efemcukuru, gold production, throughput, and average gold grade were in line with the plan for the third quarter 2023. Production was 21,170 ounces in 3Q23.

EGO Efemcukuru Production History (Fun Trading)

Technical Analysis And Commentary

EGO TA Chart (Fun Trading StockCharts)

EGO forms a descending wedge pattern with resistance at $9.78 and support at $8.35.

The Falling Wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. This price action forms a cone that slopes down as the reaction highs and reaction lows converge.

I suggest selling about 50% between $9.60 and $10.20 (trading LIFO), with possible higher resistance at $10.80. Conversely, I recommend accumulating on any weakness between $8.50 and $8.25 with possible lower support at $8.

Watch gold like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.