If you happen to’re trying to financial institution social media tips, you’re in the fitting place.

As a marketer in monetary companies, navigating financial institution and credit score union social media accounts might be difficult. Balancing compliance rules with artistic content material advertising isn’t any small feat. And the whole lot will get even trickier if you’re managing a number of social media channels.

Luckily, we’ve obtained some useful tips to make your job simpler. Whether or not you’re in search of new methods to interact prospects on Instagram, construct model consciousness on TikTok, or simply making an attempt to determine what tactic will work greatest on Twitter, these 9 tips will enable you to get began.

#1 Social Media Software for Monetary Companies

Develop your consumer base with the device that makes it simple to promote, interact, measure, and win — all whereas staying compliant.

Ebook a Demo

Why do banks want to be on social media? What can social media for banks do for you? Why must you hassle with a financial institution advertising technique? These are questions with 1,000,000 solutions, however we’ll begin with a number of.

Social media is among the many most used assets for gathering monetary data in sure generations

In accordance to the FINRA Basis, 48% of Gen Z and 42% of millennials report utilizing social media to collect investing and monetary data.

(*9*)

Supply: FINRA Basis

Whereas it isn’t essentially the most trusted useful resource (that one belongs to dad and mom and household), many individuals flip to social media to uncover academic content material.

Gen Z makes use of social media as a method to get monetary recommendation

Technology Z is 5 instances extra possible to get monetary recommendation on social media than folks 41 and over. Gen Z’s affinity for finfluencers isn’t a shock. Monetary influencers fluent in TikTok understand how to ship content material that speaks to this technology.

Your financial institution social media advertising technique can take inspiration from their work, creating bite-sized movies specializing in recommendation or technique.

Keep in mind, Gen Z is used to getting data rapidly and instantly. Reserving a name with a monetary advisor won’t be the most effective technique to get them to interact.

Your rivals are on-line

9 out of 10 banks state that social media is necessary, and 88% report being very or considerably lively on their accounts.

If you happen to’re not lively on-line, know that your rivals are. They usually’re scooping up all of your potential social media followers, telling them why their financial institution is best than yours.

On-line FOMO is a giant think about Gen Z funding motivation

Keep in mind when cryptocurrency blew up, and other people had been creating wealth hand over fist? I do, and I bear in mind feeling a whole lot of remorse for not having invested in it early on.

That form of FOMO drives Gen Z to make investments. The truth is, 50% of Gen Z traders report investing solely due to FOMO. For individuals who have, the funding was possible crypto (57%), particular person shares (32%), or meme shares (28%).

We’re not saying it is best to entice folks to spend money on dangerous companies like cryptocurrencies. However there’s energy in exhibiting a bunch of individuals all doing or getting enthusiastic about the identical factor.

Digital advert spending for the monetary sector was $33 billion in 2023

In 2023, the monetary sector’s digital advert spend confirmed an upward trajectory. It’s becoming a member of the retail and CPG sectors in surpassing $30 billion in annual spend. In accordance to eMarketer, it should see $36.95 billion in 2025.

Whenever you create your digital technique, don’t simply rely solely on natural social posts. Think about paid promoting efforts like the professionals do.

Social media and banking business haven’t all the time been essentially the most synonymous of phrases. However increasingly more monetary establishments are realizing the advantages of platforms like TikTok, Fb, and Instagram.

And the extra your financial institution’s on-line, the extra you’re going to understand there are guidelines to this. Sure, some are concrete, authorized guidelines, however others are extra free social media tips for banks than arduous and quick guidelines.

Listed here are a number of tips to enable you to kick off your social media technique.

1. Begin with a social media audit

To get a full-picture thought of what you’re working with, do a social media audit. It’s useful no matter what you are promoting measurement, whether or not you’re a giant world conglomerate, a small mom-and-pop group or something in between.

If you happen to’re a smaller enterprise, you may want a greater image of what’s working and what’s not.

If you happen to’re a world monetary group, you will have a number of accounts unfold throughout social media platforms.

Both method, a social media audit will provide you with perception into what your model’s up to on social media.

World insurance coverage large MAPFRE, for instance, performed a social media audit and found over 80 official accounts unfold throughout totally different platforms.

By consolidating these accounts into one platform utilizing Hootsuite, they gained a clearer view of their social media exercise and considerably boosted their on-line presence.

The outcomes had been spectacular:

2M+ followers on social networks

31% enhance in on-line interactions

200M+ feedback obtained per 12 months

2. Select the fitting platforms

Fb is utilized by 95% of the banks surveyed by the American Banker’s Affiliation with LinkedIn coming in at an in depth second, utilized by 75% of surveyed banks. Since Fb and LinkedIn are well-liked decisions, there may very well be a niche available in the market on platforms like TikTok (utilized by solely 7% of banks).

Selecting the best platform depends upon who you’re making an attempt to attain.

For instance, TikTok is beloved by Gen Z, preferring bite-sized monetary movies over reserving an appointment with an advisor.

For this technology, cellphone calls are an additional little bit of effort that they don’t have time for. Construct trust by assembly them with content material they need to eat.

3. Use it to construct trust along with your viewers

Gen Z traders are massive on constructing trust. A FINRA Basis report states that Gen Z tends to trust sources that give clear explanations with related data. (Who doesn’t love that?)

Gen Z additionally likes commentators who share their very own private monetary efficiency. Nonetheless, they’re very skeptical about finfluencers who strive to promote them one thing.

The takeaway for banks is that in case you associate with a finfluencer, or have your personal social media spokespeople on workers, don’t be afraid of moving into private tales. Additionally, don’t strive to educate and promote in the identical breath. Nobody actually needs a gross sales pitch once they’re gathering data.

One other tactic you should use to construct trust is thru user-generated content material (UGC). Securian Monetary‘s #LifeBalanceRemix social media marketing campaign, for instance, centered UGC and achieved severe outcomes.

Supply: idjhamm on Instagram

Utilizing a combination of social listening, UGC, and social engagement, the marketing campaign noticed:

2.5M impressions on Twitter and Instagram

1,000+ members contributing content material

$35,000+ return on funding

4. Be up in your compliance and threat administration guidelines

The place you use will dictate which compliance and threat administration guidelines you want to comply with. Extremely regulated industries like finance can face severe dangers if compliance isn’t correctly managed on social media.

A safety breach, whether or not from unauthorized social media exercise or cyber assaults, may end up in main monetary and reputational harm.

For instance, monetary know-how service supplier SIX (working in Switzerland) manages companies for 130 banks. With such a giant community, the corporate is extremely vulnerable to cyber threats, particularly throughout social media platforms that require fixed vigilance.

Supply: sixgroup on Instagram

To fight this, SIX applied automated cyber safety measures (powered partly by Hootsuite) to monitor and handle threats, resembling unauthorized profiles or malicious content material.

The outcomes communicate for themselves:

30-40 automated alerts generated per thirty days

1-2 non-compliant content material takedowns a month made potential

< 24 hour content material takedown time achieved

And talking of compliance: We’ve already talked about FINRA a number of instances, so listed here are some tips to keep compliant with them and tips on staying compliant with the SEC on social media.

5. Educate your inside crew in your compliance and technique

Embrace a section in your social media technique devoted to educating your inside crew in your business’s rules and your personal social media tips.

In case your crew members perceive what compliance seems to be like, they are going to be far much less possible to by accident submit one thing that will get you in bother.

Hootsuite can even make this simpler. Amplify, our worker advocacy platform, permits content material admins to push a gentle stream of pre-approved, curated content material that your workers can share on their social accounts.

Amplify’s a good way to prolong your group’s attain whereas decreasing threat with on-brand, compliant content material. We use it ourselves, and we’ve additionally launched an academic element into the technique.

After implementing Amplify, we noticed spectacular outcomes:

250% YOY enhance in sourced income

80% Amplify sign-up charge—up 9% YOY

4.1M employer model impressions in Q1 attributed to worker posts through Amplify

6. Have a social media governance coverage in place

A social media governance coverage lays out the principles of engagement for all workers. This is usually a doc outlining the entire ‘needs to know’ in your content material creators.

Your coverage ought to align along with your tips for e mail, textual content, and all different communications with shoppers and the general public. General, it should enable you to function inside your business’s rules.

Since social media administration is a part of the corporate’s general safety and compliance insurance policies, the chief data officer and chief threat officer could also be concerned in creating your social media governance coverage.

Hootsuite may even associate with you to ship customized social media governance coaching in your workers.

7. Use social media as one piece of your larger advertising technique

Buyers in youthful generations (aged 18-34) aren’t solely counting on social media for monetary recommendation. They use it along with different sources to collect data.

Supply: vancitycu on Instagram

So, making a community of digital data (like linking your social posts again to your weblog and out of your weblog to vetted sources) will enable you to construct a dependable popularity. This may be so simple as including a CTA like “click the link in our bio.”

8. Humanize your model with people-forward content material

Individuals content material on a monetary model’s social media web page sometimes does rather well. Financial institution advertising executives polled in an ABA report unanimously agreed that audiences admire studying in regards to the financial institution’s folks.

You may enhance your social media engagement by posting in regards to the folks inside your organization. Share worker tales, your consumer’s experiences and testimonials, and behind-the-scenes updates.

You’ll give off the impression that you simply care in regards to the individuals who work inside your group, which is necessary in an business typically seen as impersonal.

Supply: holidayheroesfoundation on Instagram

Your efforts to humanize your model will repay. For instance, Armanino LLP, a high 20 CPA and consulting agency, used Hootsuite Amplify to empower workers as model ambassadors.

This boosted the agency’s attain and popularity with:

14,707 web site clicks from worker posts

19.2M folks reached with worker content material (+638% year-over-year)

$232,375 in potential advert worth created via worker advocacy

9. Interact along with your viewers

The gorgeous factor about social media is that it’s a two-way avenue. Individuals are reaching out to you who need to interact, to have a dialog.

Good customer support isn’t nearly fielding complaints, both. Being open and receptive to speaking along with your viewers humanizes your establishment and helps construct buyer loyalty.

Supply: Vancity on Threads

Reply to tweets and threads, interact with feedback on Instagram, TikTok, and LinkedIn, and make certain to message again on Messenger.

Social Tendencies Report for Monetary Companies

Get a glimpse into the way forward for monetary companies on social media and construct a method you possibly can financial institution on.

Get the report

Social media and banking: how to measure success

Success isn’t nearly likes and follows. Monetary establishments want to strategy social media with a strategic mindset, targeted on the fitting metrics and utilizing the most effective instruments to observe, analyze, and adapt.

Setting your social media targets will provide you with perception into what you want to search for to decide your success.

Use the fitting device

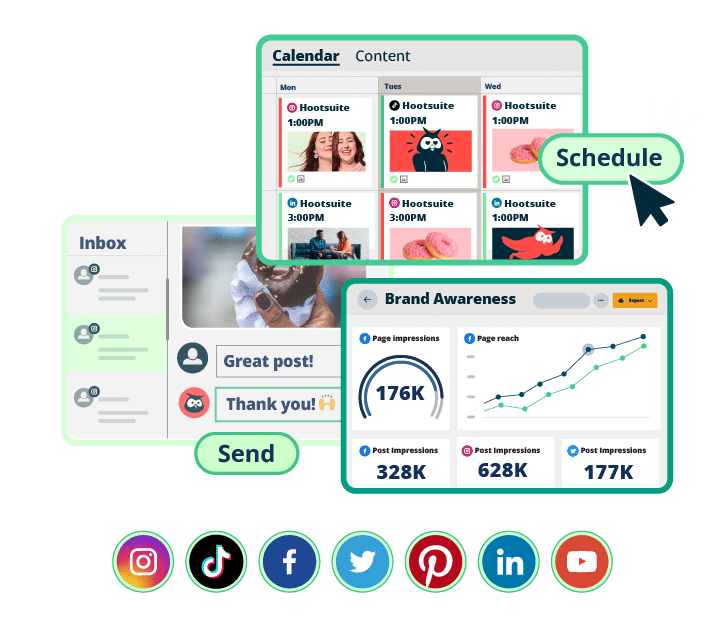

The appropriate device can take your social technique from fundamental to bossy. Not to brag (however to brag a little bit), Hootsuite’s all-in-one resolution helps credit score unions, banks, and different monetary establishments measure and handle each facet of their social media presence.

You may get assist with scheduling, reporting, and creating compliance content material for credit score unions and banks, or no matter else your coronary heart wishes.

Hootsuite Analytics will provide you with an general view of what’s working and what’s not in your technique, however there are different options the monetary sector loves:

Scheduling: Plan posts throughout a number of platforms to keep constant. You may attain your viewers at optimum instances utilizing our Finest Time to Publish device, even throughout totally different time zones.

Benchmarking: Evaluate your efficiency towards rivals and business requirements to see the place you stand. You are able to do this utilizing Hootsuite Analytics or try our full information to social media benchmarks for monetary companies (it’s up to date quarterly!).

Social listening: Monitor what individuals are saying about your model, rivals, and business tendencies in actual time. This helps you keep proactive in managing your popularity and addressing issues earlier than they escalate.

Group administration: Hootsuite permits you to handle buyer inquiries and responses from one dashboard, serving to you with constant communication.

Compliance and threat administration: Hootsuite’s monitoring instruments be certain that your content material stays compliant with monetary rules whereas defending your model from cyber threats.

Monitor the fitting metrics

To gauge the effectiveness of your social media efforts, deal with key efficiency indicators (KPIs) that align with what you are promoting targets.

Listed here are a number of well-liked metrics you may want to contemplate:

Evaluation outcomes and adapt your technique

The social methods that work are those which might be repeatedly reviewed and tailored. Check out your metrics utilizing Hootsuite Analytics to see what’s working and what’s not, and modify your price range and technique accordingly.

If a selected kind of content material performs higher, lean into that. If engagement drops, reassess your strategy. Your information goes to be the most effective indicator of what’s working and what’s not, letting you modify your technique for the most effective outcomes and greatest use of your social media price range.

Hootsuite makes social advertising simple for monetary service professionals. Handle all of your networks, drive income, present customer support, mitigate threat, and keep compliant — all from one easy-to-use dashboard. See the platform in motion.

Get extra leads, interact prospects and keep compliant with Hootsuite, the #1 social media device for monetary companies.